AUD/USD: Strong resistance at 7555/65

AUD/USD, NZD/USD, AUD/JPY

AUDUSD beat 7400/20 for a medium term buy signal targeting 7495/99 & 7530/35 then within just 9 pips of our profit-taking target of 7555/65. Then yesterday we collapsed from the resistance, leaving a bearish engulfing candle for a sell signal.

HOWEVER!! Longs at good support at 7475/55 worked perfectly with a low for the day here.

NZDUSD longs did very well as we hit my targets of 7015/20, 7075/80, 7135/40, the September high at 7165/70 & next target of 7210 (missed by just 2 pips). HOWEVER!! Yesterday we wrote: could well have seen a high for the very strong rally now.

What a call! Even though there was no sell signal the pair crashed, leaving a bearish engulfing candle for a sell signal. AND LONGS AT FIRST SUPPORT AT 7140/30 ARE WORKING!!

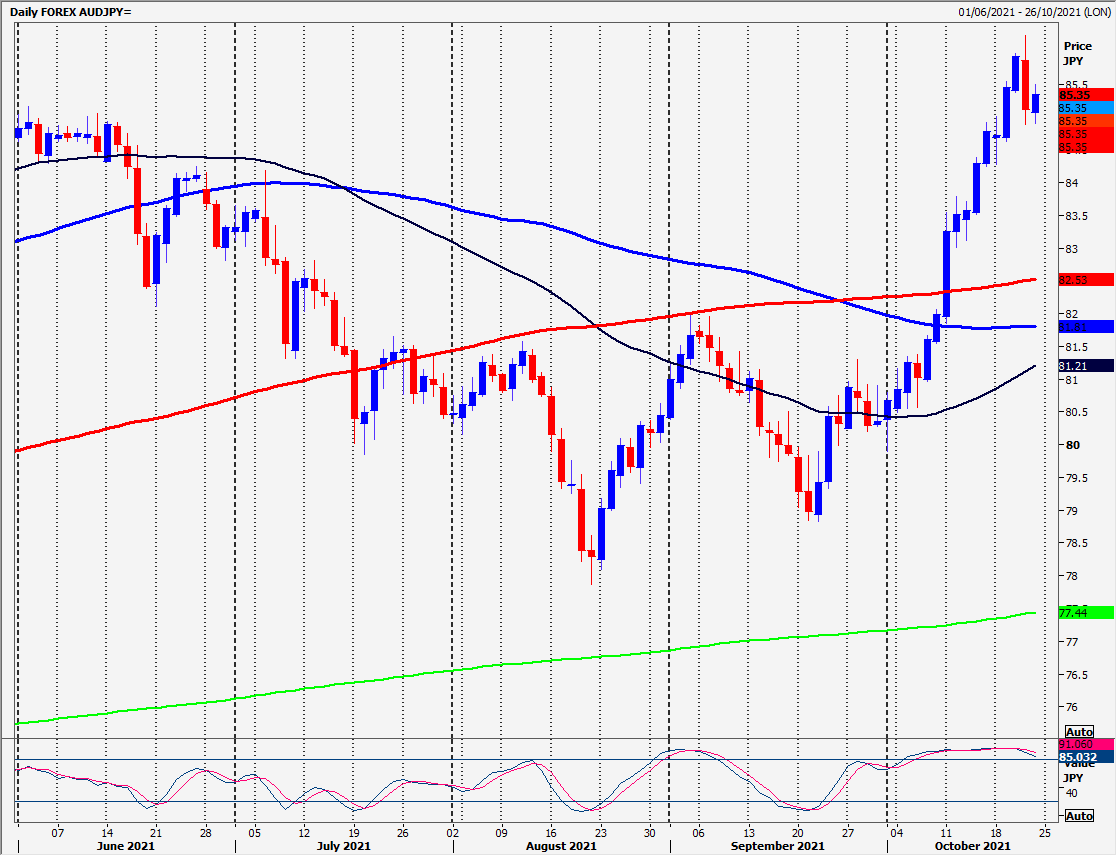

AUDJPY beat 8570/80 with shorts stopped above 8600. We wrote: However unfortunately it does look like we have seen a high for the rally at yesterday’s high of 8624…likely to see profit-taking now in severely overbought conditions.

Another perfect call!!! The pair headed significantly lower leaving a bearish engulfing candle for a sell signal.

Daily analysis

AUDUSD held a fraction below the 7555/65 target for profit taking on longs & triggered sell signal yesterday with the bearish engulfing candle. Longs at good support at 7475/55 targets 7490/7500. Gains are likely to be limited now. However a break above 7510 allows a recovery to 7530/35. Strong resistance at 7555/65 should be a big challenge. It is unlikely we will reach this far but if we do, try shorts with stops above 7580. A weekly close above here is a buy signal targeting very strong resistance at 7630/50.

Longs at 7475/55 are working. Stops below 7440. A break lower is a sell signal targeting 7410/7390, perhaps as far as 7360/50.

NZDUSD headed lower exactly as predicted to first support at 7140/30 & THIS WAS THE LOW FOR THE DAY!! Longs are working as we target 7180/90 for profit taking. Gains are likely to be limited now. If we retest 7200/7220, try shorts with stops above 7240. BUT be ready to sell again at very strong resistance at 7255/75. Stop above 7300.

Longs at first support at 7140/30 must stops below 7110. A break lower is a sell signal targeting 7090/80, perhaps as far as 7040/30.

AUDJPY hit profit taking exactly as predicted & IN FACT MADE A LOW FOR THE DAY EXACTLY AT SUPPORT AT 8510/8490. Longs need stops below 8475. A break lower is a sell signal targeting 8440/20. A break below 8410 is the next sell signal targeting 8370 & 8340.

Our longs at 8510/8490 target 8540/50. Gains are likely to be limited but we could reach as far as 8580 for profit taking. I would sell at 8620/40 with stops above 8670. A weekly close above here however is a buy signal for next week.

Chart

Author

Jason Sen

DayTradeIdeas.co.uk