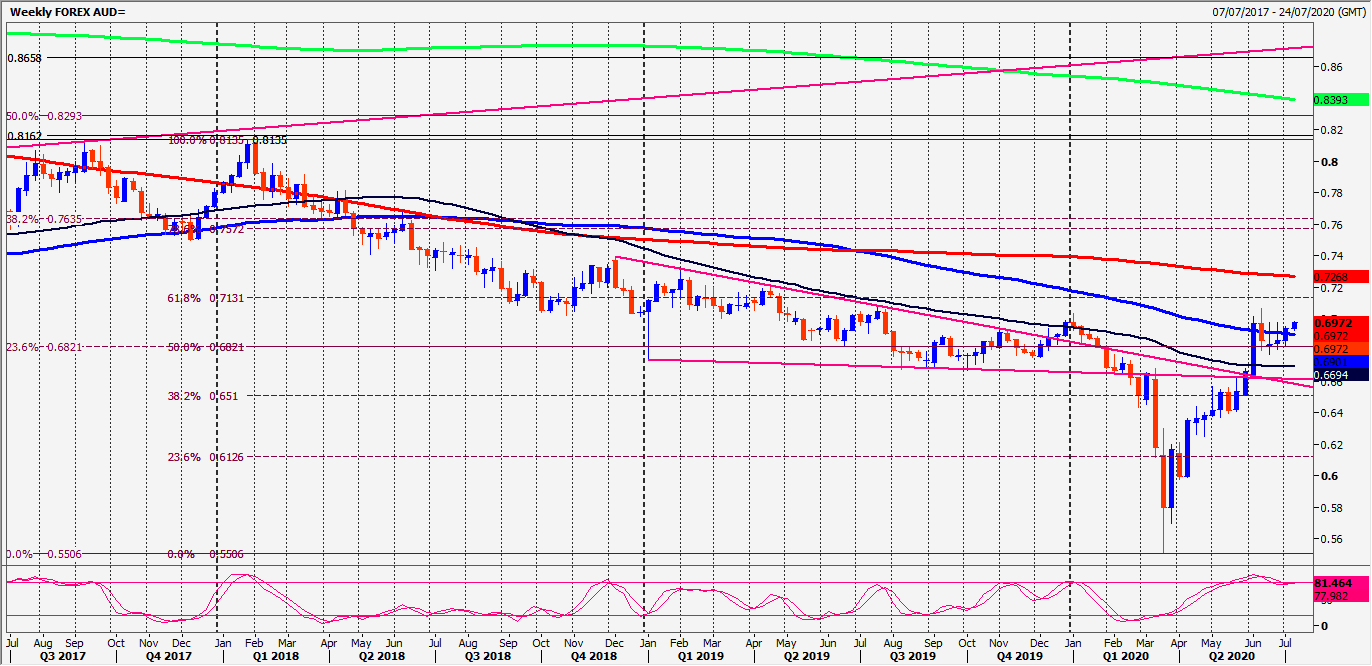

AUD/USD: Selling opportunity at 0.6970

AUD/USD _ NZD/USD

AUDUSD now using 6885/95 as strong support to top exactly at the next target of 6950/60.

NZDUSD shorts at the selling opportunity at 6525/35 offered up to 30 pips profit more on Friday.

Daily Analysis

AUDUSD holding first support at 6905/6895 targets 6950, then a selling opportunity at 6970/80 today, with stops above 6990. A break higher is a buy signal targeting 7010, 7030, 7040 & perhaps as far as the June high at 7060.

Longs at support at 6905/6895 need stops below 6885 for a test of 2 week trend line support at 6850/40. A break lower meets a buying opportunity at 6810/00, with stops below 6775.

NZDUSD shorts at the selling opportunity at 6525/35 worked perfectly with a 25-35 pip profit offered. Shorts need stops above 6550. A break higher retests the June recovery high at 6579/83. A weekly close above is another buy signal.

Shorts at 6525/35 target 6505/00, 6485, perhaps as far as first support at 6460/50. Try longs with stops below 6435. A break lower targets 6390/80, with minor support at 6365/55.

Trends

Weekly outlook is positive.

Daily outlook is neutral.

Short Term outlook is neutral.

Author

Jason Sen

DayTradeIdeas.co.uk