AUD/USD Price Forecast: Outlook expected to shift to bullish above 0.6470

- AUD/USD regained impulse and revisited the 0.6400 neighbourhood on Thursday.

- The US Dollar faced renewed downside pressure on tariff uncertainty.

- Australia’s inflation figures will grab all the attention next week.

The Australian Dollar (AUD) picked up renewed upside traction on Thursday, with AUD/USD briefly testing levels just above the key 0.6400 hurdle following two consecutive days of losses. The modest recovery came in response to a softer US Dollar (USD), as scepticism around the real progress in the US-China trade conflict weighed on market participants.

Given Australia’s heavy trade reliance on China, the Aussie remains particularly sensitive to shifts in the geopolitical trade landscape.

Central banks hold fire

Both the Federal Reserve (Fed) and Reserve Bank of Australia (RBA) are signalling caution. The Fed left interest rates unchanged at 4.25%–4.50% in March, with Chair Jerome Powell reaffirming the importance of anchoring inflation expectations—even in the face of rising tariff risks. Powell later stressed that future rate moves will remain data driven.

The RBA also kept its policy rate steady at 4.10% this month, with Governor Michele Bullock citing persistent inflationary pressures and tight labour market conditions. Market pricing suggests a roughly 70% probability of a rate cut at the central bank’s May meeting.

Positioning hints at cautious optimism

Recent CFTC data shows a reduction in net short positions on the Aussie, which fell to a five-week low of approximately 59K contracts through April 15. The move, accompanied by a drop in open interest, hints that some speculative traders may be paring back bearish bets.

Technical picture

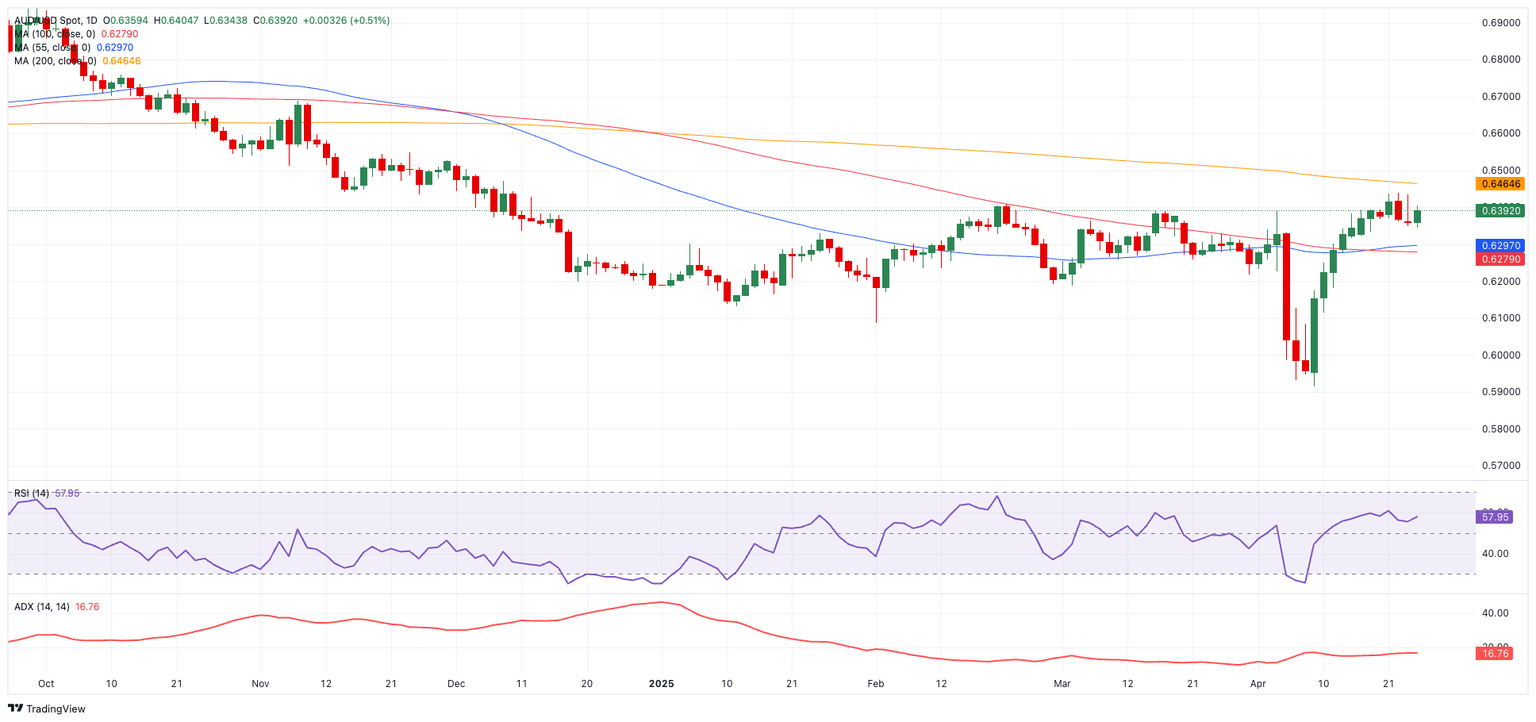

Technically, AUD/USD remains capped below its 200-day simple moving average (SMA), now around 0.6470.

A break above that level would bring the 2025 peak of 0.6439 (April 22) into focus, followed by the November 2024 high at 0.6687. In addition, a sustainable breakout of that critical region is expected to shift the pair’s near-term outlook to a more constructive one, allowing for extra gains.

On the downside, a failure to defend the provisional 55-day and 100-day SMAs at 0.6295 and 0.6282, respectively, would expose a move to the 2025 bottom of 0.5913, prior to the pandemic-era trough at 0.5506.

Momentum indicators offer mixed signals. The Relative Strength Index (RSI), hovering near 58, suggests room for further upside, while a subdued Average Directional Index (ADX) near 17 indicates the current uptrend may lack conviction.

AUD/USD daily chart

Outlook: Choppy waters ahead

With tariff headlines and incoming data continuing to drive sentiment, AUD/USD remains highly sensitive to policy cues from both Washington and Beijing. Until clarity emerges, traders should brace for continued volatility.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.