AUD/USD Price Forecast: No change to the consolidative mood

- AUD/USD reversed Tuesday’s downtick and retested the key 0.6500 zone.

- The US Dollar weakened on the back of poor data releases and trade jitters.

- Australian GDP figures came in on the soft side in the first quarter.

The Australian Dollar (AUD) regained the smile on Wednesday amid a weaker US Dollar (USD). In fact, AUD/USD picked up pace, left behind the previous decline and managed to revisit the resistance zone around 0.6500.

Central banks back in the spotlight

The FX galaxy continues to hang on central bank signals for clues on rate directions.

Against that, the Federal Reserve (Fed) held steady at its May meeting, with Chair Jerome Powell reiterating a cautious, data-driven approach. Softer inflation readings for April along with discouraging data from domestic fundamentals as of late, have nudged market expectations towards a rate cut by September.

Down Under, the Reserve Bank of Australia (RBA) took a dovish turn at its May event, lowering its OCR by 25 basis points to 3.85%, broadly in line with investors’ expectations.

The bank suggested a slow and gradual easing path, with the cash rate seen falling to 3.2% at some point in 2027, inflation predicted to decline to 2.6%, and its 2025 growth forecast to ease to 2.1%.

Still around the RBA, the latest Minutes emphasised the need to preserve policy predictability amid heightened uncertainty. On that note, central bank argued that a larger rate cut could be on the table if household consumption weakens further or wage growth falters alongside a softening labour market. Additionally, policymakers warned of potential need for more aggressive moves if global policy shocks spill over unexpectedly.

Markets are now pricing in nearly 80% odds of another 25 basis points cut as soon as in July, and close to 100 basis points of easing in 2026.

China clouds the horizon

China, Australia’s largest trading partner, continues to send mixed economic signals. In fact, while Q1 industrial output surprised to the upside, weak retail sales and subdued investment underscore lingering vulnerabilities.

Furthermore, the People’s Bank of China (PboC) trimmed its 1-Year and 5-Year Loan Prime Rate (LPR) to 3.00% and 3.50%, respectively.

Adding to the scenario, May’s Caixin Manufacturing PMI dropped to 48.3, undermining market confidence and hopes of a robust recovery.

Bearish sentiment building

Sentiment towards the Aussie remained bearish overall. According to the latest CFTC data, net shorts increased to nearly 61.2K contracts, the highest level since early April, while open interest climbed, signalling a bearish tilt across broader markets.

Key technical levels

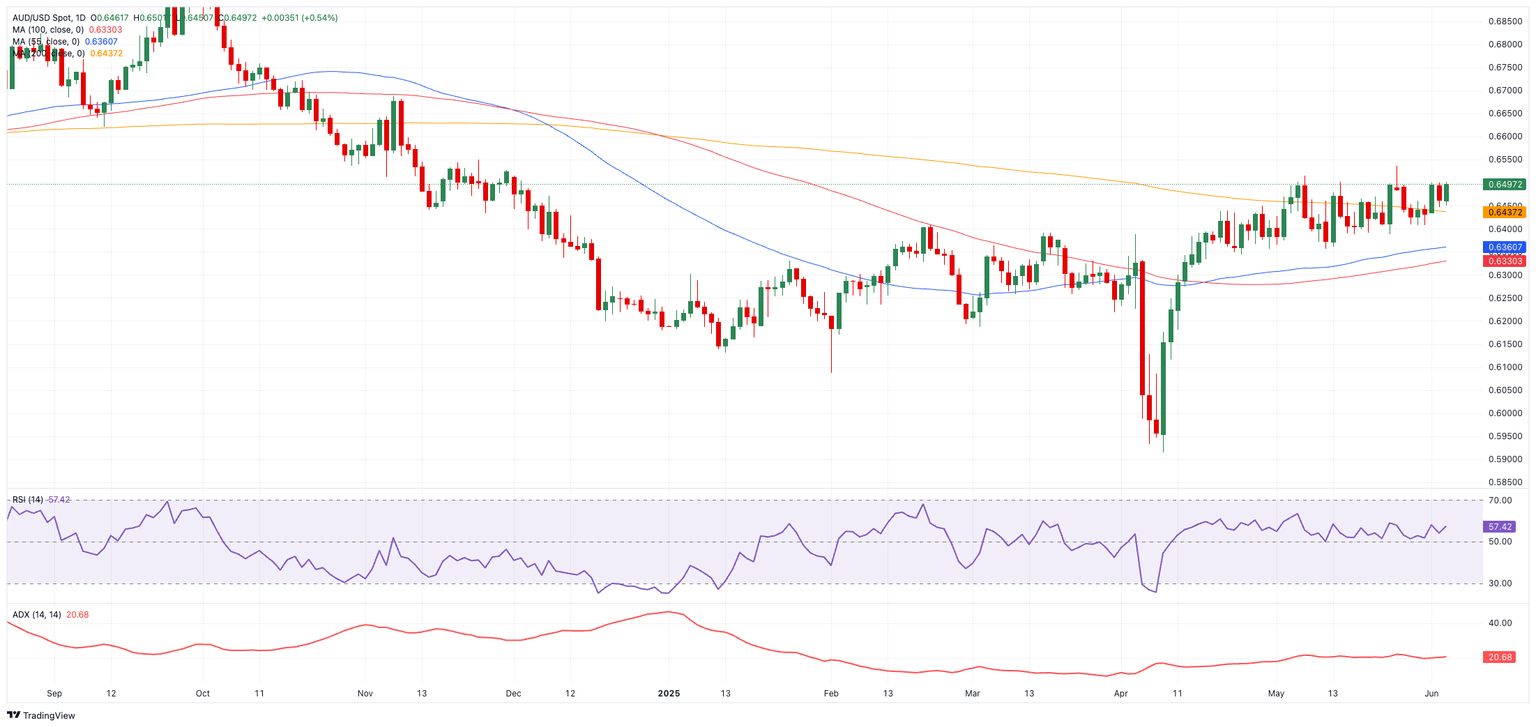

If AUD/USD breaks above its 2025 high of 0.6537 (May 26), it could next target the November 2024 peak at 0.6687, and possibly the 2024 high of 0.6942.

On the downside, initial support sits at 0.6356 (May 12), reinforced by the 55-day simple moving average (SMA) at 0.6359. Below that, the transitory 100-day SMA at 0.6328 comes into play, with the psychological 0.6000 mark and the 2025 bottom of 0.5913 (9 April) further out.

Momentum indicators remain mildly constructive. The Average Directional Index (ADX) hovers near 22, suggesting a decent strength of the trend. Meanwhile, the Relative Strength Index (RSI) has rebounded to around 58, still pointing to short-term upside potential.

AUD/USD daily chart

What’s ahead

Trade balance figures follow on 5 June, with Private House Approvals and Building Permits rounding out the week on 6 June.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.