AUD/USD Price Forecast: Next support emerges at 0.6450

- AUD/USD lost further ground and approached the 0.6500 support.

- The US Dollar gathered extra upside impulse on the back of trade progress.

- Investors’ attention now shifts to the Australian inflation data due later in the week.

The Australian Dollar (AUD) has started the week on the back foot, in line with the rest of its risk-linked peers, after AUD/USD clocked losses for the third consecutive day, this time coming at shouting distance from the 0.6500 region, always on the back of the continuation of the buying pressure on the US Dollar (USD).

Mixed signals from the economy

July brought more evidence of a two-speed Australian economy. Preliminary PMI figures painted a surprisingly upbeat picture: the S&P Global Manufacturing and Services PMIs rose to 51.6 and 53.8 respectively, pointing to expanding activity in both sectors.

But the labour market data told a less reassuring story. Only 2K jobs were added in June, while unemployment nudged higher to 4.3% and the participation rate ticked up to 67.1%. Meanwhile, inflation expectations eased to 4.7%, down from 5.0% a month earlier—a modest win for the Reserve Bank of Australia (RBA).

RBA holds fire—for now

The RBA caught markets off guard earlier this month by keeping its cash rate steady at 3.85%. The decision wasn’t unanimous, but incoming Governor Michele Bullock framed the debate as one of “timing rather than direction”—a hint that the board is open to easing if the next inflation print plays nice.

Subsequent meeting Minutes reinforced that tilt. Board members appeared increasingly confident that underlying inflation is cooling, laying the groundwork for “some additional reduction in interest rates over time.” Money markets are now placing long odds on an August rate cut, with around 75 basis points of easing priced in over the next year.

China’s two-speed recovery keeps the Aussie guessing

Australia’s biggest trading partner is showing signs of life, but the recovery lacks balance. China’s Q2 GDP rose a solid 5.2% YoY, and industrial output is humming near 7%. But consumer spending remains tepid, with retail sales stuck below 5% as households continue to save rather than spend.

Beijing’s central bank appears content to sit on its hands for now. The People’s Bank of China (PboC) left both the one- and five-year Loan Prime Rates (LPR) unchanged at 3.00% and 3.50% respectively, opting for stability over stimulus.

Diverging central bank paths widen the yield gap risk

While both the Federal Reserve (Fed) and the RBA are in wait-and-see mode, their outlooks are drifting apart. In the US, sticky inflation and the threat of fresh tariffs are fuelling speculation that the Fed may still have more work to do.

Any signs of renewed price pressure in the US—or Australia—could quickly widen the yield gap and put fresh pressure on the Aussie.

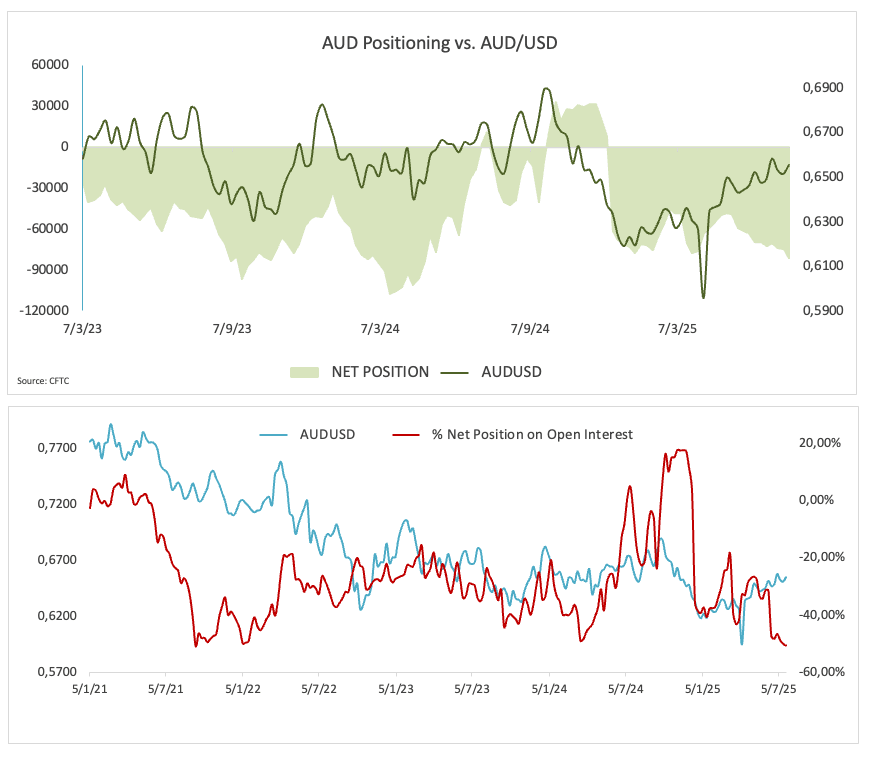

Speculators pull back

“Fast‑money” traders have turned even more cautious on the Aussie, boosting their net short positions to about 81.2K contracts—their most bearish stance since April 2024. Meanwhile, total open interest has swelled to roughly 161.4K contracts, marking a multi‑week high.

Chart check: resistance and range-bound reality

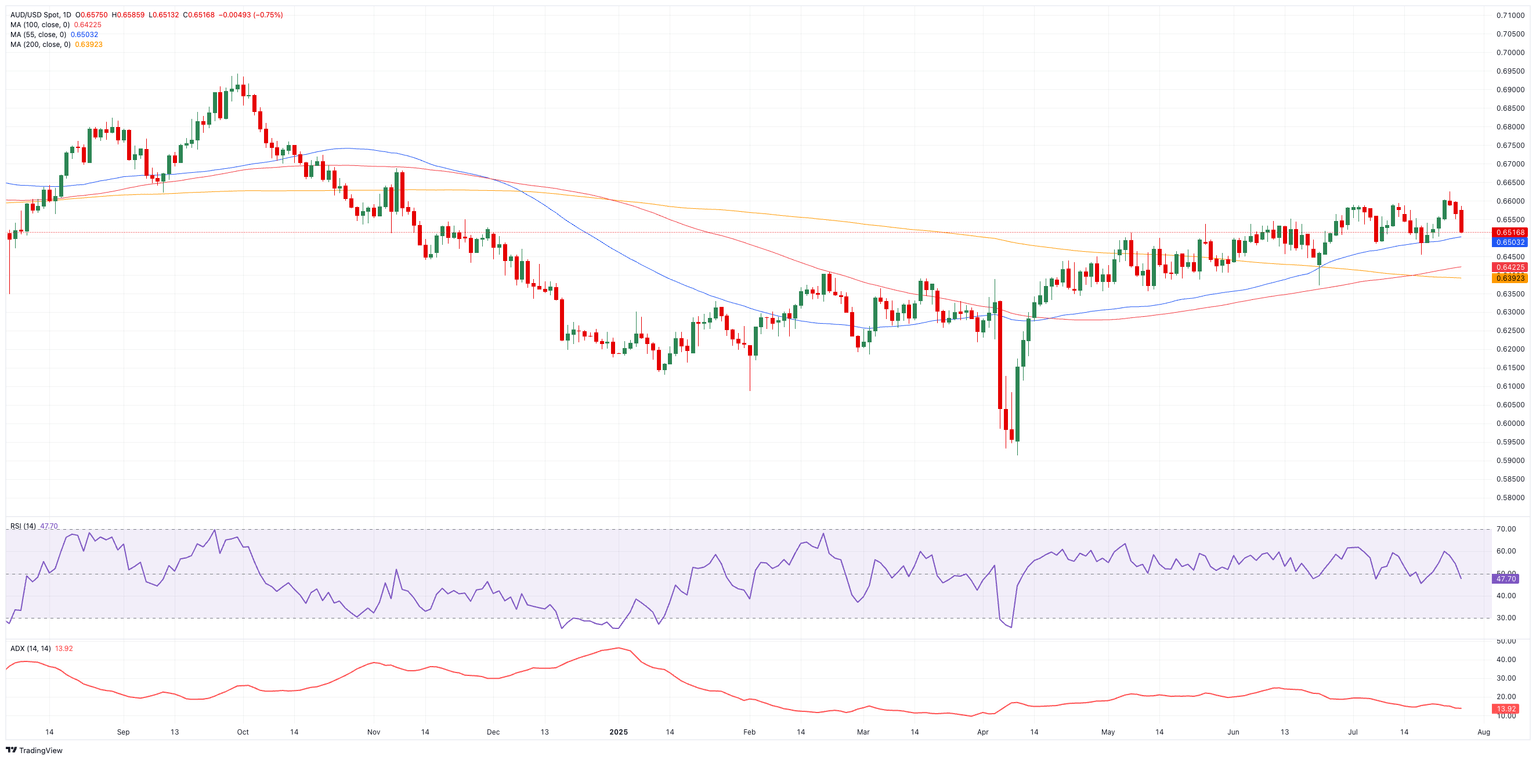

The Aussie faces immediate resistance at its 2025 peak at 0.6625 (July 24), followed by the November 2024 high of 0.6687 (November 7), and the psychological barrier at 0.7000.

On the downside, watch the interim 55-day simple moving average (SMA) at 0.6501, seconded by the July base at 0.6454 (July 17), with stronger support near the 200-day line at 0.6395.

Momentum indicators are sending mixed signals. The Relative Strength Index (RSI) dropped below 48, back to bearish territory, but the Average Directional Index (ADX) near 14 suggests that the current trend lacks conviction.

AUD/USD daily chart

What’s next?

In the absence of a surprise from Beijing or a fresh flare-up in US inflation, the Australian dollar appears stable for the time being. Given the RBA's patience and the lacklustre performance of China's rebound, traders will be actively searching for the next macro catalyst, such as a CPI shock or a geopolitical headline, that could potentially disrupt the range.

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.