AUD/USD Price Forecast: Next on the downside aligns the 2024 low

- AUD/USD faced some renewed downside pressure, breaking below 0.6500.

- The US Dollar regained balance and rose sharply, helped by yields and Trump.

- Retail Sales in Australia surprised to the upside in October.

The US Dollar (USD) rebounded sharply, erasing Friday’s losses and reclaiming the upper 106.00s in a strong start to the week for the US Dollar Index (DXY). The Dollar’s upward momentum was driven by market reactions to President-elect Donald Trump’s announcement of sweeping tariffs targeting the BRICS alliance. Renewed political concerns in France also played a role in the Dollar’s bounce.

In contrast, the Australian Dollar (AUD) resumed its downtrend, reversing three consecutive days of gains. It broke decisively below the 0.6500 support level, edging closer to the 0.6440 zone and nearing the November low around 0.6430.

The Greenback’s renewed strength weighed heavily on the Aussie, compounded by the persistent weakness in the Chinese Yuan. The Yuan’s struggles were attributed to US tariff threats and mixed domestic business activity data from China.

Adding to the AUD’s decline was the uneven performance across the commodity complex. Copper prices dropped to multi-day lows, while iron ore prices recorded another uptick. This divergence occurred despite lingering doubts over the effectiveness of China’s stimulus measures, a key driver of Australia’s export-dependent economy.

RBA: Cautious and Steady

The Reserve Bank of Australia (RBA) has stayed the course, keeping rates at 4.35% earlier in November. While it remains laser-focused on controlling inflation, concerns about sluggish economic growth are clearly shaping its careful stance. Governor Michele Bullock reiterated the need for tight monetary policy until inflation shows sustained, meaningful progress.

Back to Oz, Australia’s inflation picture remains mixed. The RBA’s Monthly CPI Indicator held steady at 2.1% in October, but policymakers were quick to caution that one solid quarter doesn’t define a trend. As a result, rate cuts appear to be off the table for now.

AUD/USD: Risks and Opportunities Ahead

Looking ahead, the AUD/USD could catch a tailwind if the Federal Reserve (Fed) pivots toward rate cuts. But the path isn’t without obstacles. Inflationary pressures from US policy moves and the USD’s resilience may cap the Aussie’s potential upside.

Adding to the uncertainty is China’s ongoing economic slowdown, which continues to cast a shadow over Australia’s growth outlook. Despite this, Australia’s domestic labour market delivered a modest win in October, with unemployment holding at 4.1% and 16K new jobs added.

Market chatter suggests the RBA will take a cautious approach, with a potential rate cut pencilled in for Q2 2025—conditional on inflation cooling off at a steady pace. Policymakers have stressed the need for clear and sustained progress before making any moves to ease policy.

Key Events to Watch

Eyes are now on the Current Account data, the final Judo Bank Services PMI and the Ai Group Industry Index, all due on Tuesday, ahead of crucial GDP data on Wednesday, Balance of Trade results on Thursday, and Home Loans figures on Friday.

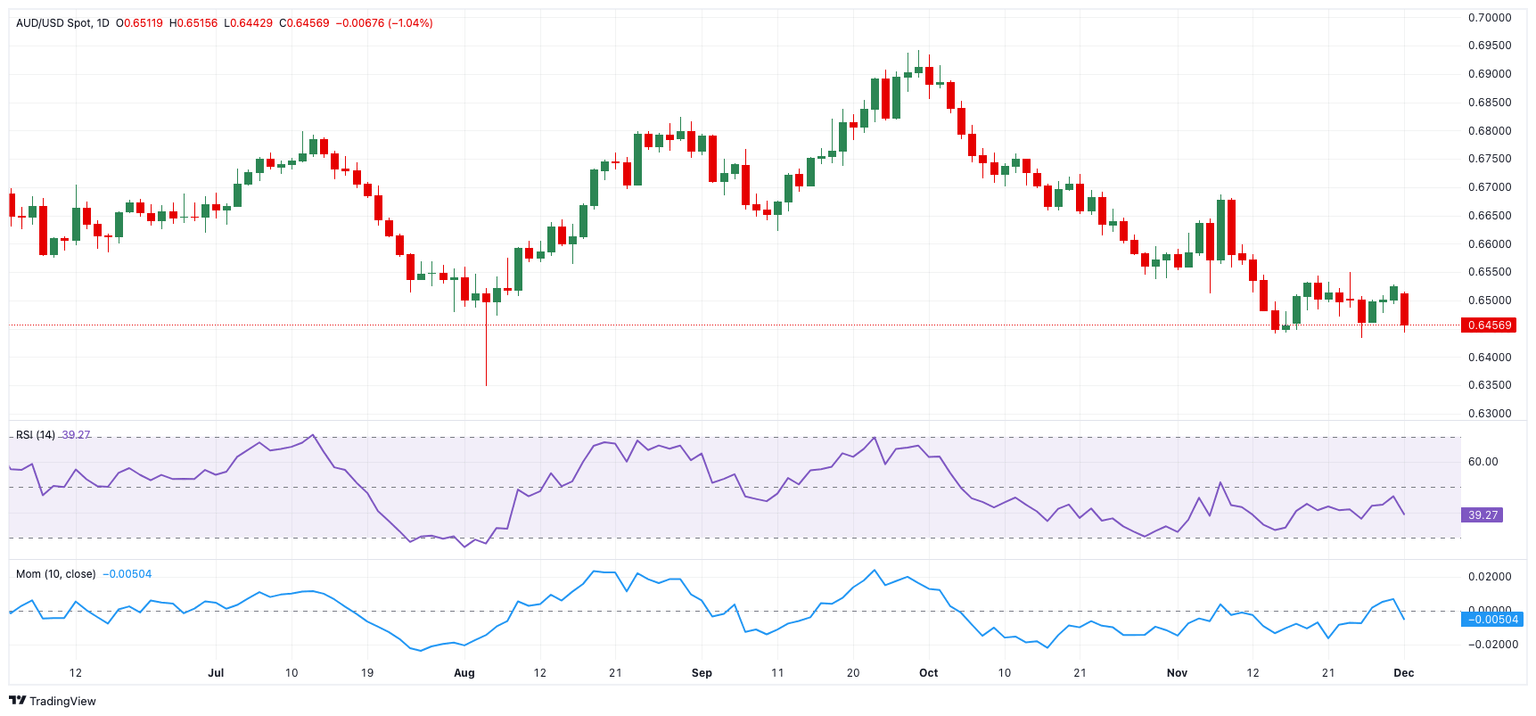

AUD/USD daily chart

AUD/USD Technical Outlook

Should bulls regain momentum, the pair could face resistance at the weekly high of 0.6549 (November 25), followed by the key 200-day SMA at 0.6626. A further push could see the AUD/USD testing November’s peak at 0.6687 (November 7).

On the downside, initial support lies at the November low of 0.6433 (hit on November 26), followed by a more significant level—the 2024 low of 0.6347, marked on August 5. These levels could act as cushions if the pair faces renewed selling pressure.

The four-hour chart paints a pessimistic picture, suggesting that the downward bias has regained traction. For now, immediate resistance is seen at 0.6549, followed by the 200-SMA at 0.6566—a level closely watched by traders for signs of a breakout. On the downside, initial contention comes at 0.6442, prior to 0.6433.

Momentum indicators are adding to the negative sentiment, with the Relative Strength Index (RSI) tumbling to around 35, despite the Average Directional Index (ADX) pointing to a weak trend below 15.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.