AUD/USD Price Forecast: Further gains target 0.6400

- AUD/USD added to Friday’s uptick and rose to the 0.6370 zone.

- The US Dollar faced strong selling pressure, weakening to four-day lows.

- Next on the upside for the pair emerges the YTD peak past 0.6400.

The Australian Dollar (AUD) extended Friday’s recovery and motivated AUD/USD to revisit the upper-0.6300s, or three-week tops, in a promising start to the new trading week.

The pair’s extra gains unfolded alongside the US Dollar’s (USD) ongoing sell-off, with the US Dollar Index (DXY) trading at shouting distance from its multi-month lows near the 103.30 zone amid persistent tariff worries, recession fears, and declining US yields.

Trade tensions under the spotlight

Washington’s unpredictable trade policies have kept markets on high alert, as investors brace for potential countermeasures from US trading partners. The prospect of an escalating trade war remains a major risk factor and is expected to maintain the risk-linked galaxy under pressure.

Australia, heavily reliant on commodity exports to China, is closely monitoring US tariffs on Chinese imports. Any slowdown in China—Australia’s biggest trade partner—could quickly weigh on the Aussie Dollar.

Central banks and inflation: The unfolding narrative

Fears of trade-driven inflation potentially forcing the Federal Reserve (Fed) into extended tightening are clashing with growing concerns about a US economic slowdown. However, softer-than-expected US Consumer Price Index (CPI) data for February seemed to have bolstered that idea that the Fed might resume its easing cycle in the short-term horizon.

Meanwhile, the Reserve Bank of Australia (RBA) cut its benchmark rate by 25 basis points in February to 4.10%. Governor Michele Bullock emphasised that inflation data would guide future decisions, though Deputy Governor Andrew Hauser cautioned against assuming a series of rate cuts is on the horizon. Still, market chatter suggests up to 75 basis points of additional easing could be possible if trade tensions intensify.

Later, Minutes from the latest RBA meeting showed policymakers debated leaving rates unchanged vs. a modest cut. They ultimately opted for the latter but stressed this doesn’t guarantee a full easing cycle. Officials also underscored that Australia’s rate peak remains relatively low by global standards and highlighted the domestic labour market’s resilience.

AUD/USD technical outlook

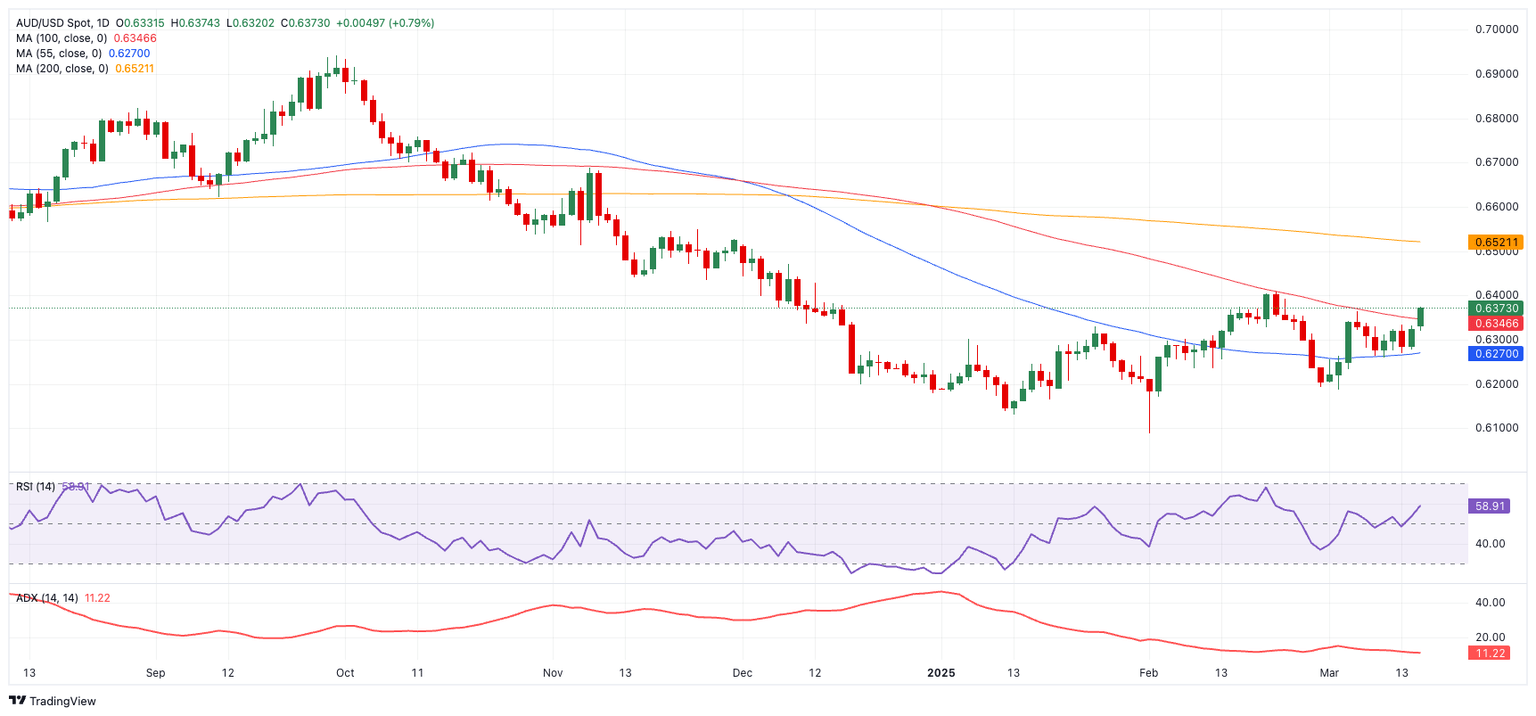

A push above the 2025 peak at 0.6408 (from February 21), might open the door to the 200-day Simple Moving Average (SMA) at 0.6523, prior to the November 2024 high of 0.6687 (November 7).

On the downside, immediate support emerges at the March low of 0.6186 (March 4). A sharper decline could see the pair testing the 2025 trough at 0.6087, with the psychologically significant 0.6000 handle in play.

Momentum indicators paint a mixed picture. The Relative Strength Index (RSI) around 59 suggests a growing upward bias, yet the Average Directional Index (ADX) hovering near 11 points to an overall weak trend.

Key data releases ahead

All eyes will be on Australia’s labour market report, due March 20. This data drop could provide valuable insights into the RBA’s next policy steps and set the tone for AUD/USD in the near term.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.