AUD/USD Price Forecast: Further gains retarget the 0.6400 region

- AUD/USD rose further and surpassed the 0.6200 barrier on Thursday.

- The US Dollar tumbled to fresh lows on increasing trade war concerns.

- The White House said tariffs on China rose to a staggering 145%.

The Australian Dollar (AUD) added to Wednesday’s upbeat tone and motivated AUD/USD to reclaim the region above the key barrier at 0.6200 the figure on Thursday.

The strong advance in the pair came on the back of the steep retracement in the US Dollar (USD) as US-China trade tensions continued to escalate.

A global trade war brews

President Trump’s latest tariff salvo, ranging from 10% to 50%, has triggered forceful reprisals and heightened fears of a full-blown trade war—one that could slow global growth, drive up consumer prices, and complicate monetary policies across the board.

Australia, with close economic ties to China and a heavy commodities export profile, found itself particularly vulnerable. Just last week, China retaliated with its own set of tariffs, sending AUD/USD to multi-year troughs.

Tensions ratcheted up further on Thursday after Trump’s 145% tariffs on Chinese goods were announced.

Fed: Stuck between rock and a hard place

In the US, the Federal Reserve (Fed) finds itself balancing inflationary risks from climbing tariffs against signs of a softening economy. In March, it held rates at 4.25–4.50%, adopting a cautious “wait-and-see” stance. Fed Chair Jerome Powell acknowledged the potential for greater-than-expected impacts on inflation and growth, hinting that upcoming trade headlines could guide the Fed’s next steps.

RBA holds steady

On the other side of the globe, the Reserve Bank of Australia (RBA) kept its Official Cash Rate (OCR) at 4.10%—no surprise there—while striking a note of caution on both the upside and downside risks for the economy.

Governor Michele Bullock reaffirmed the challenge of hauling inflation back into the 2–3% sweet spot. Traders took the RBA’s slightly dovish shift to heart, as the odds of a 25-basis-point cut at the May 20 meeting dipped from 80% to 70%.

It is worth noting that the RBA will publish the Minutes from its latest meeting on April 15, which should shed further light regarding the Board’s discussions around the decision.

Bearish vibes linger

Looking at the broader picture, the sentiment toward the Aussie remains far from rosy. The latest CFTC figures show net short positions hovering near multi-month highs (around 76K contracts). Persistent worries over tariffs and broader global uncertainty continue to weigh on the currency’s outlook.

Technical snapshot

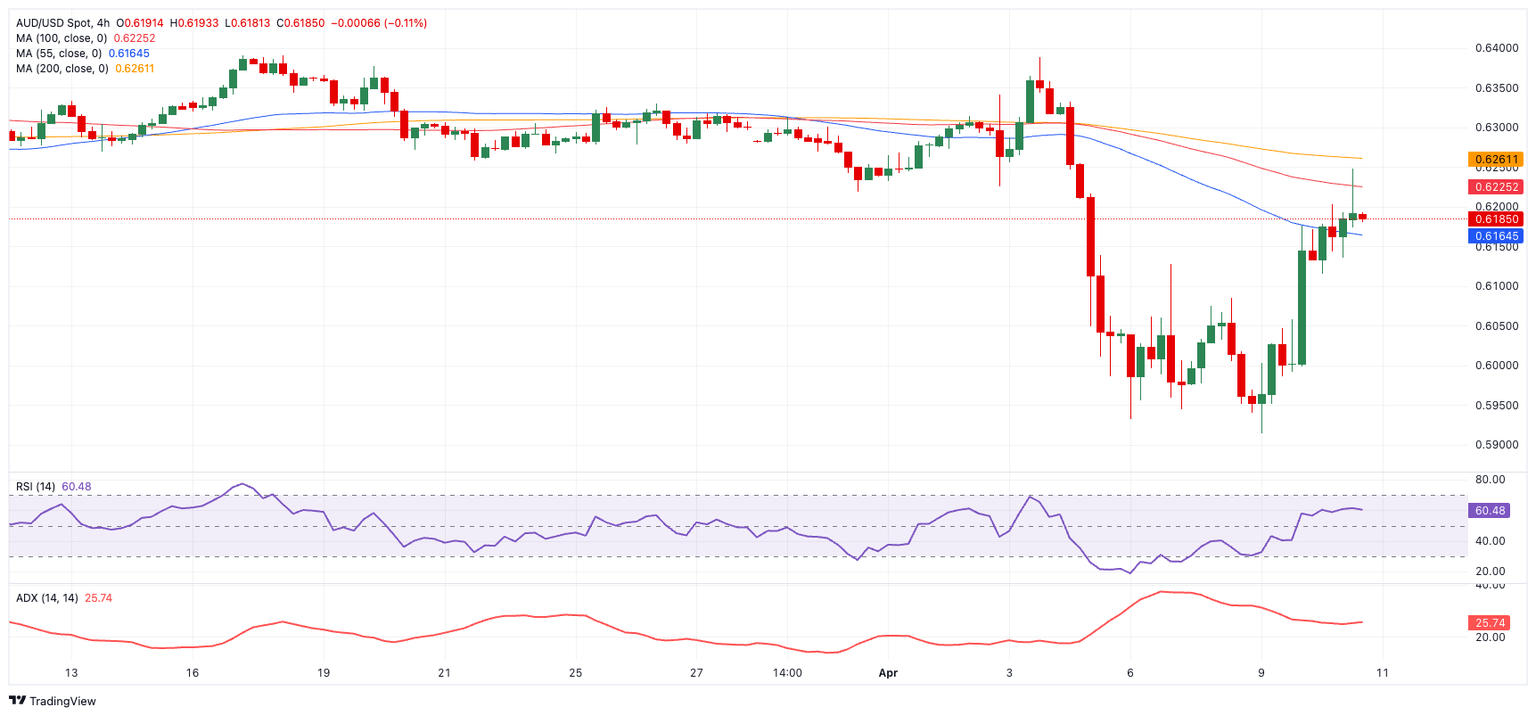

The technicals still caution a downside bias as long as AUD/USD trades below the 200-day Simple Moving Average (SMA), now near 0.6490.

Any fresh selling could take the pair toward its 2025 trough at 0.5913 (April 8), and potentially back to the 2020 bottom at 0.5506 (March 19).

A convincing break above the 2025 high at 0.6408 (February 21) would target the 200-day SMA at 0.6487 and possibly the November 2024 top at 0.6687.

Meanwhile, a bounce in the Relative Strength Index (RSI) around 47 points to some momentum recovery, and a still-muted Average Directional Index (ADX) near 16 suggests the recent rally is fragile at best.

AUD/USD daily chart

Bottom line

With trade conflicts heating up, China’s economic pulse beating loudly for Australia, and both the RBA and Fed finely tuning their next moves, the Australian Dollar remains especially sensitive to headlines. As global trade theatrics continue, expect the Aussie to react in real time—both in the spot market and across risk sentiment more broadly.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.