AUD/USD Price Forecast: Further consolidation seems the name of the game

- AUD/USD added to Tuesday’s losses amid the broad consolidation range.

- The US Dollar remained firm despite disheartening US results.

- Australia’s inflation prints came in firmer than estimated.

The Australian Dollar (AUD) remained on the back foot vs. the US Dollar (USD) on Wednesday, motivating AUD/USD to retreat for the second day in a row, this time slipping back to the mid-0.6400s despite US-China trade tensions continued to ease.

The US Dollar’s rebound was underpinned by easing trade concerns, helping to stabilise investor sentiment. With a packed calendar of key US economic releases ahead, traders expect volatility around the Dollar to remain elevated.

Given Australia’s close economic ties with China, the Aussie remains particularly vulnerable to shifts in global trade dynamics.

Central banks in wait-and-see mode

Both the Federal Reserve (Fed) and the Reserve Bank of Australia (RBA) held interest rates steady at their most recent policy meetings, citing persistent inflation pressures and lingering trade-related uncertainties.

Fed Chair Jerome Powell reiterated the central bank’s commitment to anchoring inflation expectations, emphasising a data-dependent approach going forward. Meanwhile, RBA Governor Michele Bullock pointed to sticky inflation and a tight labour market in maintaining the benchmark rate at 4.10%.

Australia’s latest inflation data came in slightly above expectations, with headline and trimmed mean CPI steady but still elevated. The figures support a cautious approach from the RBA, with markets fully pricing in a 25 basis point rate cut on May 20 but no longer expecting a larger move. Traders still anticipate 125 basis points of easing over the next year.

Speculators trim bearish bets on the Aussie

According to the latest CFTC data, non-commercial traders reduced their net short positions on the Australian Dollar to approximately 54.5K contracts as of April 22. The drop in bearish bets, alongside rising open interest, hints at a potential shift in sentiment.

Key data in focus Down Under

Australia’s economic calendar turns busy in the coming days, with the final S&P Global Manufacturing PMI, Trade Balance data, Commodity Prices, and Q1 Import/Export prices all due on May 1, while Retail Sales and Producer Prices will round out the week on May 2.

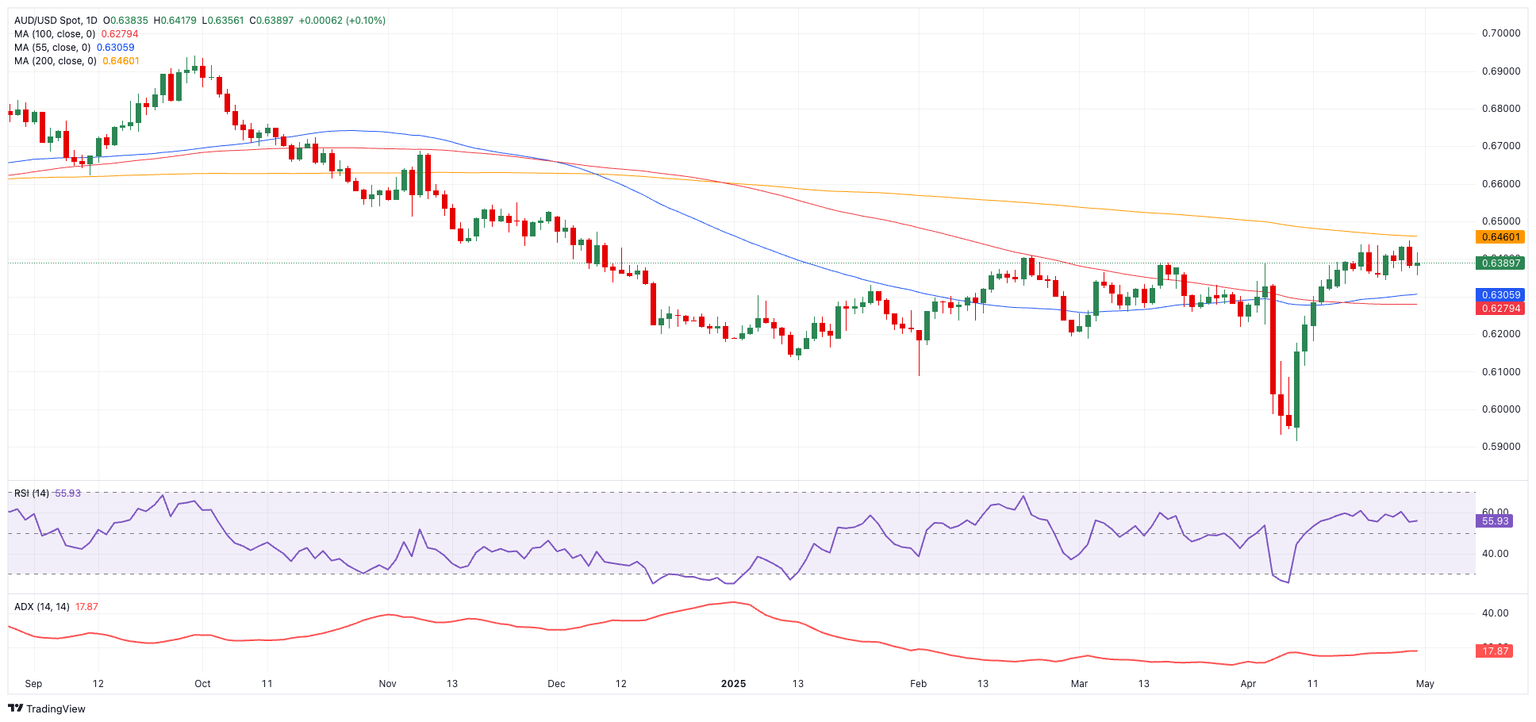

Technical picture: Resistance holds

AUD/USD continues to trade below its 200-day simple moving average (SMA), now at 0.6462. A sustained break above this level would reinforce bullish momentum and bring the November 2024 high of 0.6687 into view.

On the downside, interim support lies at the 55-day and 100-day SMAs, at 0.6304 and 0.6281, respectively. A breach of these levels could expose the pair to deeper losses, potentially toward the 2025 bottom of 0.5913 or even the pandemic-era trough of 0.5506.

Momentum indicators remain mixed. While the Relative Strength Index (RSI) near 55 suggests room for further gains, a low Average Directional Index (ADX) reading near 18 points to a lack of strong trend conviction.

AUD/USD daily chart

Outlook: Volatility ahead

With inflation data, trade headlines, and central bank rhetoric all in play, AUD/USD is likely to remain choppy in the near term. Markets will be watching closely for any shifts in policy tone from Washington or Beijing that could sway the currency’s next move.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.