AUD/USD Price Forecast: Further consolidation in the pipeline

- AUD/USD reversed three consecutive days of losses, regaining 0.6500 and above.

- The US Dollar suffered from rumours that Trump could fire Powell soon.

- All attention now shifts to the Australian labour market report on Thursday.

The Australian Dollar (AUD) managed to regain the smile vs. the US Dollar (USD) on Wednesday, motivating AUD/USD to advance past the key 0.6500 barrier after bottoming out in multi-day lows.

RBA’s delicate balancing act

Earlier this month, the Reserve Bank of Australia (RBA) caught traders off guard by keeping its cash rate at 3.85%. While six of nine board members backed the hold, three pushed for an immediate 25‑basis‑point cut, an internal split Governor Michele Bullock chalked up to “timing, not direction.” Bullock has since signalled that, should Q2 inflation land near forecasts, rate cuts would follow.

In that line, expectations have soared as futures markets now price in about a 90% chance of an August cut, even as they nudge the likely terminal rate higher, from 2.85% to around 3.10%.

China’s push–pull recovery

China’s latest data offered both relief and restraint.

Indeed, Q2 GDP showed a modest 1.1% QoQ expansion, seen at 5.2% on a yearly basis and roughly in line with Beijing’s 5% full‑year growth target.

Industrial production remains robust, up 6.8% from a year earlier, but retail sales’ growth slowed to 4.8%, underscoring deeper structural hurdles like high savings rates and mounting consumer debt. June’s trade surplus of $114.8 billion rounded out the mixed picture, leaving Australia’s largest export market treading water.

Diverging central‑bank paths

Globally, policymakers are at a crossroads. The RBA’s pause echoes the Federal Reserve’s (Fed) June hold, yet Fed Chair Jerome Powell has warned that US tariffs could reignite goods‑price inflation, hinting at potential policy divergence if either economy sees another inflation shock. Indeed, the uptick in US inflation observed in June only adds fuel to that fire.

Traders go short

Speculators are taking aim at the Aussie: CFTC figures for the week to July 8 show net short positions climbed to roughly 74.3 K contracts, or two‑week highs, while open interest hit nearly 153.4 K, marking a fourth straight weekly increase.

On the charts

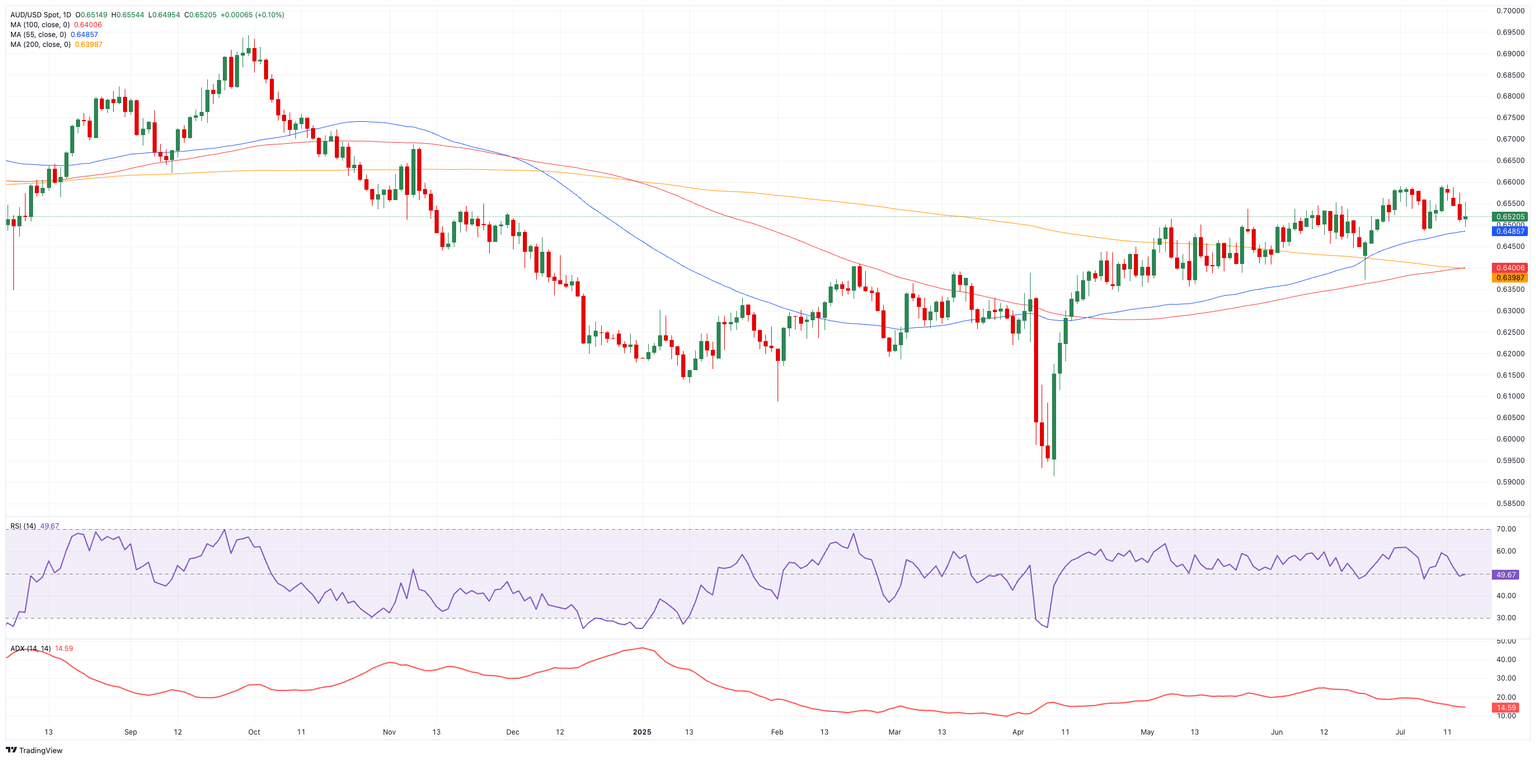

AUD/USD must clear its 2025 high of 0.6590 (June 30) before eyeing the November 2024 peak at 0.6687 and the psychologically significant 0.7000 level.

Support lies at the weekly trough of 0.6485 (July 7), which remains propped up by the interim 55‑day SMA, prior to the 200‑day SMA at 0.6402.

Additionally, momentum indicators are mixed: the Relative Strength Index (RSI) has eased to around 50, while the Average Directional Index (ADX), below 16, suggests the current trend lacks conviction.

AUD/USD daily chart

The takeaway

With China’s recovery uneven and both Beijing and Washington hinting at fresh trade‑policy tweaks, the Aussie may remain range‑bound until a clear catalyst appears. For now, the RBA looks set to tread carefully, signalling that any rate cuts are likely to be gradual rather than aggressive.

Employment FAQs

Labor market conditions are a key element to assess the health of an economy and thus a key driver for currency valuation. High employment, or low unemployment, has positive implications for consumer spending and thus economic growth, boosting the value of the local currency. Moreover, a very tight labor market – a situation in which there is a shortage of workers to fill open positions – can also have implications on inflation levels and thus monetary policy as low labor supply and high demand leads to higher wages.

The pace at which salaries are growing in an economy is key for policymakers. High wage growth means that households have more money to spend, usually leading to price increases in consumer goods. In contrast to more volatile sources of inflation such as energy prices, wage growth is seen as a key component of underlying and persisting inflation as salary increases are unlikely to be undone. Central banks around the world pay close attention to wage growth data when deciding on monetary policy.

The weight that each central bank assigns to labor market conditions depends on its objectives. Some central banks explicitly have mandates related to the labor market beyond controlling inflation levels. The US Federal Reserve (Fed), for example, has the dual mandate of promoting maximum employment and stable prices. Meanwhile, the European Central Bank’s (ECB) sole mandate is to keep inflation under control. Still, and despite whatever mandates they have, labor market conditions are an important factor for policymakers given its significance as a gauge of the health of the economy and their direct relationship to inflation.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.