AUD/USD Price Forecast: Further consolidation in the pipeline

- AUD/USD resumed its uptrend and flirted with its 200-day SMA.

- The US Dollar added to the ongoing leg lower and eased to two-week lows.

- The Westpac Leading Index came in flat on a monthly basis in April.

The Australian Dollar (AUD) managed to regain composure and quickly forget about Tuesday’s marked retracement, lifting AUD/USD back above 0.6400 the figure and flirting with its critical 200-day SMA in the 0.6460 region on Wednesday.

Once again, the persistent weakness in the US Dollar (USD) was almost exclusive behind the Aussie’s price action on Wednesday, while investors seem to have already digested the Reserve Bank of Australia’s (RBA) dovish cut at its meeting on Tuesday.

Policy divergence emerges as a key theme

A growing divergence in monetary policy between the Federal Reserve (Fed) and the RBA is becoming a central theme for AUD/USD.

At its May 7 meeting, the Fed left interest rates unchanged, with Chair Jerome Powell striking a cautious tone and emphasising a wait-and-see approach regarding future rate cuts. Softer April inflation and improving trade sentiment have led markets to start pricing in a potential Fed cut as early as September.

By contrast, the RBA cut its official cash rate (OCR) by 25 basis points to 3.85% on May 20, in line with expectations. The move signals a slight easing in policy amid a murky economic outlook. The latest Monetary Policy Report (MPR) projects the OCR will decline to around 3.2% by 2027, hinting at a gradual departure from tight monetary conditions. While officials acknowledged policy is now “somewhat less restrictive,” they maintained a cautious stance, citing significant uncertainty around both demand and supply dynamics.

In addition, the RBA trimmed its GDP growth forecast for 2025 to 2.1% and lowered its trimmed mean inflation estimate to 2.6%.

Support from China fades

Earlier in the wee, the Australian currency found some support from mixed Chinese data, which showed continued resilience despite signs of a modest slowdown. Strong industrial output contrasted with weaker retail sales and fixed asset investment, pointing to a mild deceleration in Q1 but keeping the economy on track for around 5% growth in Q2.

Despite the somewhat encouraging tone from these data releases, and looking at the broader picture, the Chinese economy is still looking for its footing in the aftermath of the COVID pandemic.

Nevertheless, lingering concerns over potential US tariffs and ongoing weakness in China’s property market remain downside risks. It is worth recalling that the People’s Bank of China (PBoC) cut its 1-year and 5-year Loan Prime Rates (LPR) by 10 basis points to 3.00% and 3.50%, respectively, also on Tuesday.

Bearish sentiment on AUD eases

According to CFTC data as of May 13, speculative positioning in the Aussie appears to be stabilising as net short bets remained near multi-week lows around 49.3K contracts, with a slight decline in open interest suggesting a less bearish stance.

Technical outlook: Direction still unclear

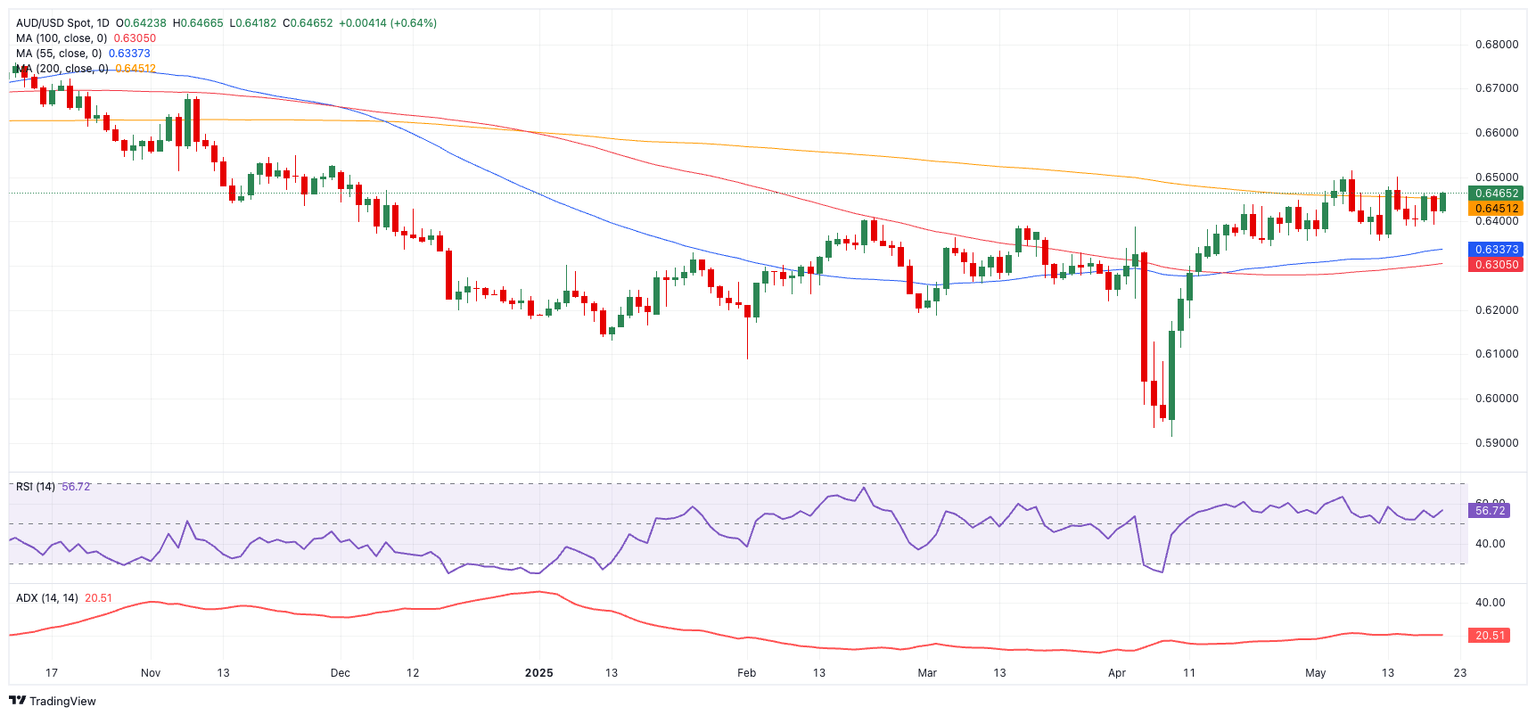

From a technical perspective, AUD/USD needs to break above the 200-day SMA at 0.6454 to regain bullish momentum. A sustained move higher could open the door to a potential visit to the YTD high at 0.6514 (May 7), seconded by the November 2024 peak of 0.6687.

On the other hand, initial support is seen at the May floor of 0.6356 (May 12), ahead of the provisional 55-day and 100-day SMAs, at 0.6335 and 0.6303, respectively. Below that, key levels include the 2025 bottom at 0.5913 (April 9), and the March 2020 pandemic trough at 0.5506.

Momentum indicators offer a slightly constructive bias, with the Relative Strength Index (RSI) approaching 57 and the Average Directional Index (ADX) around 21, suggesting a modest uptrend.

AUD/USD daily chart

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.