AUD/USD Price Forecast: Extra upside seems in the pipeline

- AUD/USD extended its bullish stance north of the 0.6300 hurdle.

- The US Dollar traded mostly on the defensive on risk-on mood.

- Trump announced some exemptions to tariffs on China.

The Australian Dollar (AUD) extended Friday’s momentum, pushing AUD/USD above the key 0.6300 level at the beginning of the week. This advance was largely driven by a modest pullback in the US Dollar (USD) amid steady US-China trade tensions.

Trade war effervescence

The latest round of tariff moves has intensified fears of a global trade war. President Trump’s announcement of tariffs ranging from 10% to 50% has sparked retaliation talks and raised concerns that the brewing dispute could slow global growth, drive consumer prices higher, and complicate monetary policies worldwide.

Australia, with its strong economic ties to China and a significant commodities export profile, has found itself particularly exposed. Just last week, China imposed its own set of tariffs, sending AUD/USD to multi-year lows, and the situation escalated last Thursday after Trump’s announcement of a 145% tariff on certain Chinese goods.

Views on the Fed and the RBA

In the United States, the Federal Reserve (Fed) is caught in a delicate balancing act between managing inflationary pressures triggered by climbing tariffs and addressing signs of an economic slowdown. In March, the Fed decided to hold rates at 4.25–4.50%, adopting a cautious “wait-and-see” approach. Fed Chair Jerome Powell pointed out that upcoming trade headlines could significantly influence the central bank’s next steps, given the potential for a greater-than-expected impact on inflation and growth.

Across the Pacific, the Reserve Bank of Australia (RBA) maintained its Official Cash Rate (OCR) at 4.10%, a decision that was largely expected. RBA Governor Michele Bullock underlined the challenge of bringing inflation back into the target range of 2–3%.

Traders interpreted this slightly hawkish tone as an indicator that the likelihood of a 25 basis point cut at the May 20 meeting had dropped from 80% to 70%. Market participants are now eagerly awaiting the RBA’s meeting Minutes on April 15, which should provide further insight into the board’s discussions.

Sentiment outlook

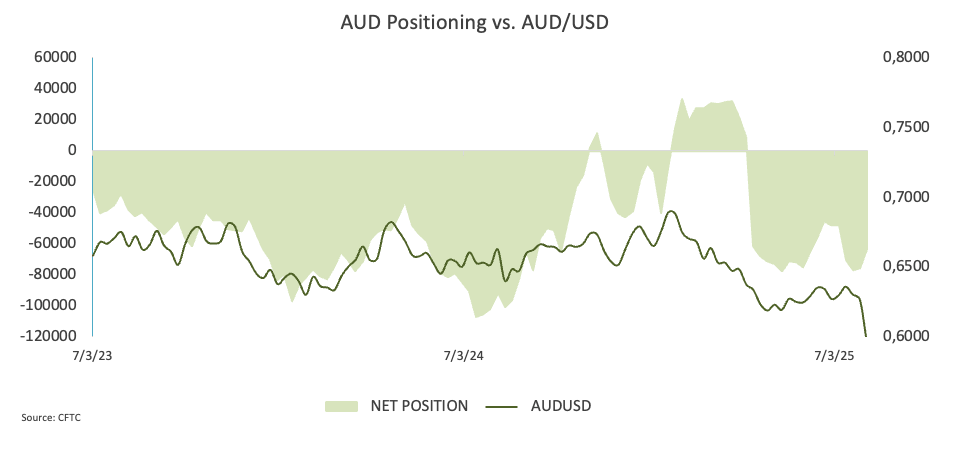

Speculative net longs in the Australian Dollar (AUD) plunged to a four-week low of around 63.3K contracts, coinciding with a surge in open interest to multi-week highs. Meanwhile, renewed selling pressure in AUD/USD accelerated, pushing the pair into the 0.5900 territory for the first time since Q1 2020 during the period.

What techs are saying

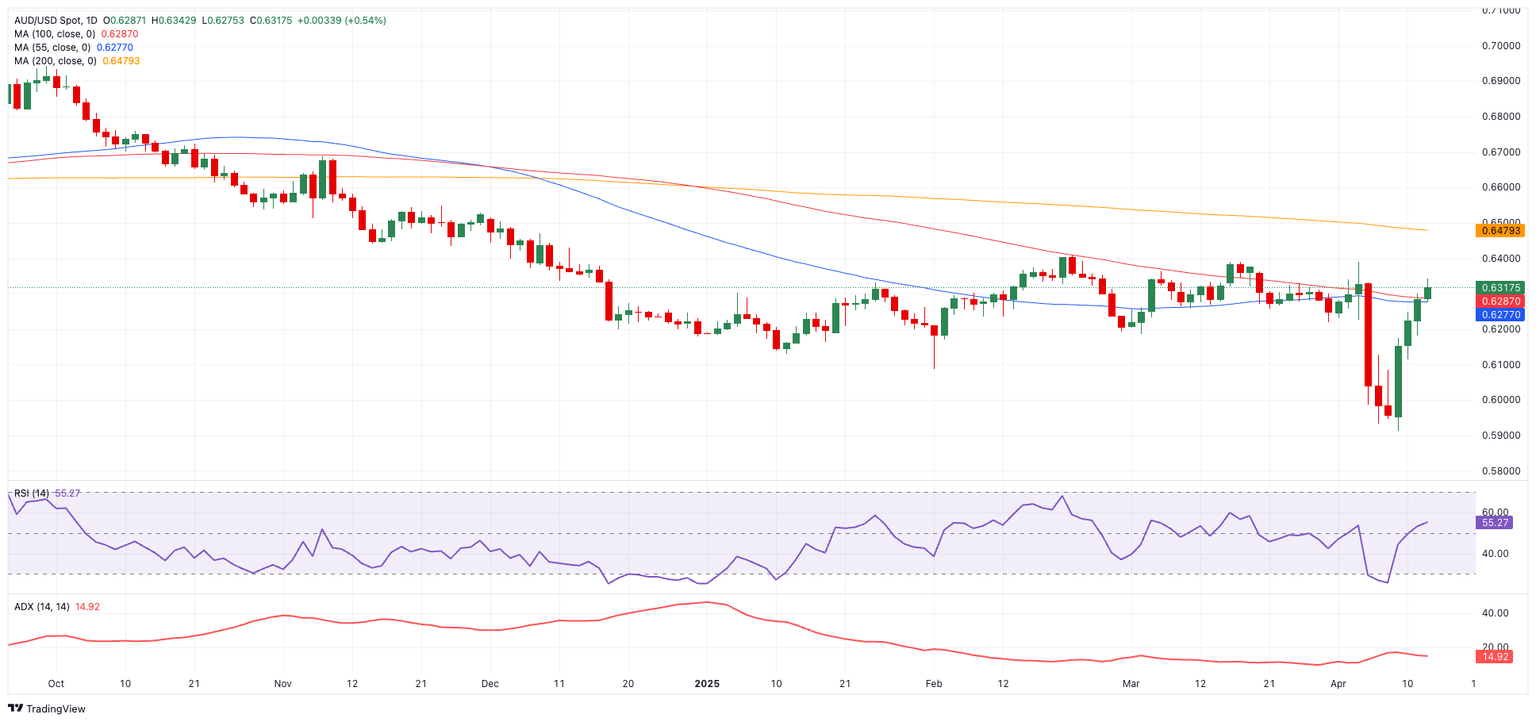

From a technical perspective, the outlook remains somewhat bearish as long as AUD/USD stays below its 200-day simple moving average (SMA), currently at 0.6483.

The resurgence of the bearish tone could see the pair testing support levels at the 2025 bottom of 0.5913 (April 8) and potentially pushing further down to the 2020 floor at 0.5506.

Conversely, breaking above the 2025 high at 0.6408 might open the door for a rally toward the 200-day SMA at 0.6483 and even the November 2024 top at 0.6687 (November 7).

A decent uptick in the Relative Strength Index (RSI) to 55 suggests a continuation of the upside momentum, though a low Average Directional Index (ADX) near 15 hints that the current rally may be fragile.

AUD/USD daily chart

Conclusion

With trade conflicts heating up and both the Fed and RBA carefully monitoring the evolving global landscape, the Australian Dollar is likely to remain highly sensitive to new developments in the trade saga.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.