AUD/USD Price Forecast: Bulls seem reluctant as weaker US jobs data-inspired USD selling abates

- AUD/USD gains positive traction for the second straight day, though it lacks follow-through.

- The post-US NFP USD selloff abates amid a weaker risk tone and caps the upside for the pair.

- Bets for another RBA rate cut in August act as a headwind for the Aussie amid trade jitters.

The AUD/USD pair struggles to capitalize on Friday's positive move and remains below the 0.6500 psychological mark through the first half of the European session on Monday, though it lacks bearish conviction. The Melbourne Institute's Monthly Inflation Gauge jumped 0.9% in July 2025, picking up sharply from a 0.1% rise in the previous month and marking the steepest increase since December 2023. This comes on top of the Reserve Bank of Australia's (RBA) caution about the inflation outlook, which, along with US President Donald Trump's decision to keep the minimum tariff rate of 10% for Australia, acts as a tailwind for the Aussie.

Investors, however, seem convinced that the RBA would lower borrowing costs in August. According to the Minutes from the July RBA meeting, policymakers remain inclined to ease further as inflation is expected to stay within the target. In fact, the June quarter Consumer Price Index (CPI) dropped to the 2.1% YoY rate from 2.4% the previous quarter, while trimmed mean inflation fell to 2.7% from 2.9%. Moreover, RBA Deputy Governor Andrew Hauser reiterated last week that the central bank's gradual and measured approach to lowering interest rates. This, along with a softer risk tone and modest US Dollar (USD) uptick, caps the AUD/USD pair.

The global risk sentiment remains fragile as investors remain uncertain about the potential effects of newly announced US tariffs. In fact, US President Donald Trump signed an executive order last week imposing higher tariffs of up to 41% on key trading partners across the globe. Moreover, Trump ordered the deployment of two nuclear submarines near Russia in response to provocative comments from former Russian President Dmitry Medvedev, saying that each new ultimatum by Trump would be seen as a threat and a step towards war. This keeps geopolitical risks in play, which weighs on investors' sentiment and benefits the safe-haven Greenback.

Any meaningful USD appreciation, however, seems elusive in the wake of the growing acceptance that the Federal Reserve (Fed) will resume its rate-cutting cycle in September. The expectations were reaffirmed by the disappointing release of the US monthly employment details on Friday. The US Bureau of Labor Statistics (BLS) reported on Friday that the economy added 73K new jobs in July, compared to the market expectation of 110K. Furthermore, readings for May and June were revised lower, while the Unemployment Rate edged higher to 4.2% from 4.1% in June. This pointed to signs of a cooling US labor market and might cap the USD.

Meanwhile, Trump ordered the firing of the head of the Bureau of Labor Statistics hours after the dismal jobs report. Adding to this, Fed Governor Adriana Kugler resigned from her position on the central bank’s board. This comes amid relentless political pressure on the Fed to lower borrowing costs and revives fears about the central bank's independence, which might hold back the USD bulls from placing aggressive bets and offer support to the AUD/USD pair. Traders now look forward to the release of US Factory Orders for some impetus. The mixed fundamental backdrop, however, warrants some caution before placing aggressive directional bets.

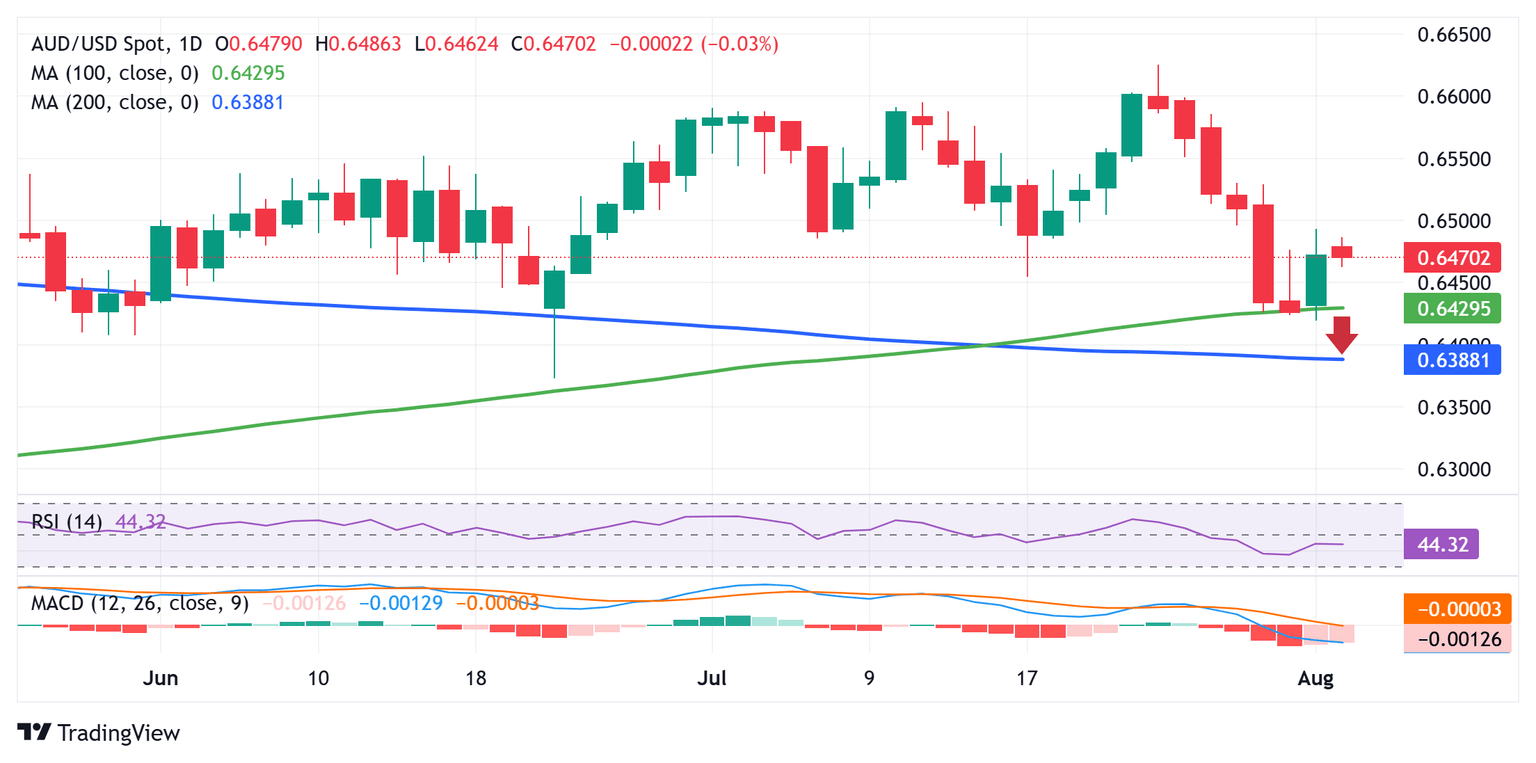

AUD/USD daily chart

Technical Outlook

The AUD/USD pair showed some resilience below the 100-day Simple Moving Average (SMA) last week, and the subsequent move up favors bullish traders. However, the lack of strong follow-through buying and still negative oscillators on the daily chart warrants some caution. Hence, it will be prudent to wait for a move and acceptance above the 0.6500 psychological mark before positioning for any further gains towards the next relevant hurdle near the 0.6550 area. The momentum could extend further towards the 0.6585 region, or the year-to-date peak touched in July. Some follow-through buying beyond the 0.6600 mark could lift spot prices to the 0.6640 region en route to the 0.6680 region, or November 2024 swing high, and the 0.6700 round figure.

On the flip side, a slide back towards the 100-day SMA, currently pegged near the 0.6440 region, could be seen as a buying opportunity and remain limited. However, some follow-through selling below the 0.6420-0.6415 area, or over a one-month low touched last Friday, will be seen as a fresh trigger for bearish traders. The AUD/USD pair might then weaken further below the 200-day SMA, currently pegged just below the 0.6400 round figure, and test the June monthly swing low, around the 0.6375-0.6370 region. A convincing break below the latter will be seen as a fresh trigger for bearish traders and pave the way for the resumption of the recent sharp corrective decline from the YTD top.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.