AUD/USD Price Forecast: Bulls await breakout through multi-week-old range ahead of Fed

- AUD/USD regains positive traction on Monday amid the emergence of fresh USD selling.

- Mixed Chinese macro data does little to impress the Aussie bulls or provide any impetus.

- Rising geopolitical tensions might cap gains ahead of the FOMC decision on Wednesday.

The AUD/USD pair attracts some dip-buyers at the start of a new week and climbs back above the 0.6500 psychological mark during the first half of the European session. A generally positive tone around the equity markets is seen driving flows toward the risk-sensitive Aussie, which, along with the emergence of some US Dollar (USD) selling, acts as a tailwind for the currency pair. Spot prices, however, remain confined in a multi-week-old trading range, warranting some caution before positioning for any further gains ahead of this week's key central bank event risk.

US President Donald Trump's renewed tariff threats spark concerns over the economy and fail to assist the USD to capitalize on Friday's modest bounce from a three-year low. In fact, Trump told reporters last Wednesday that he will be sending out letters to notify trading partners about the new unilateral tariff rates within the next two weeks. This comes ahead of the July 9 deadline for sweeping “liberation day” tariffs and revives US recession fears. This, along with dovish Federal Reserve (Fed) expectations, continues to weigh on the USD and supports the AUD/USD pair.

Meanwhile, the Australian Dollar (AUD) reacted little to mixed Chinese macro data released earlier today, which showed that Retail Sales rose more than expected in May, while the increase in Industrial Production fell short of consensus estimates. The National Bureau of Statistics (NBS) in China noted that the domestic economy is expected to have remained generally stable for the first half (H1) of 2025, though the growth may struggle since the second quarter due to uncertain trade policies. This might cap gains for the AUD/USD pair amid rising geopolitical tensions.

Israel struck Iran’s nuclear sites and key personnel last Friday, calling the operation necessary to counter an existential threat, and began another series of strikes on military targets across Iran on Sunday. Iran responded with hundreds of drones over the weekend and warned of further retaliation. Deadly strikes between Israel and Iran continued into Monday, with Israel vowing to intensify its operation against Iran and keeping the geopolitical risk in play. This could benefit the Greenback's relative safe-haven status and keep a lid on the AUD/USD pair.

Traders might also opt to wait for the outcome of the highly-anticipated two-day FOMC monetary policy meeting starting on Tuesday. The US central bank is scheduled to announce its decision on Wednesday and widely expected to keep interest rates unchanged. Hence, the focus will be on the accompanying policy statement. Apart from this, investors will scrutinize Fed Chair Jerome Powell's comments during the post-meeting press conference for cues about the future rate-cut path, which, in turn, will drive the buck and the AUD/USD pair in the near term.

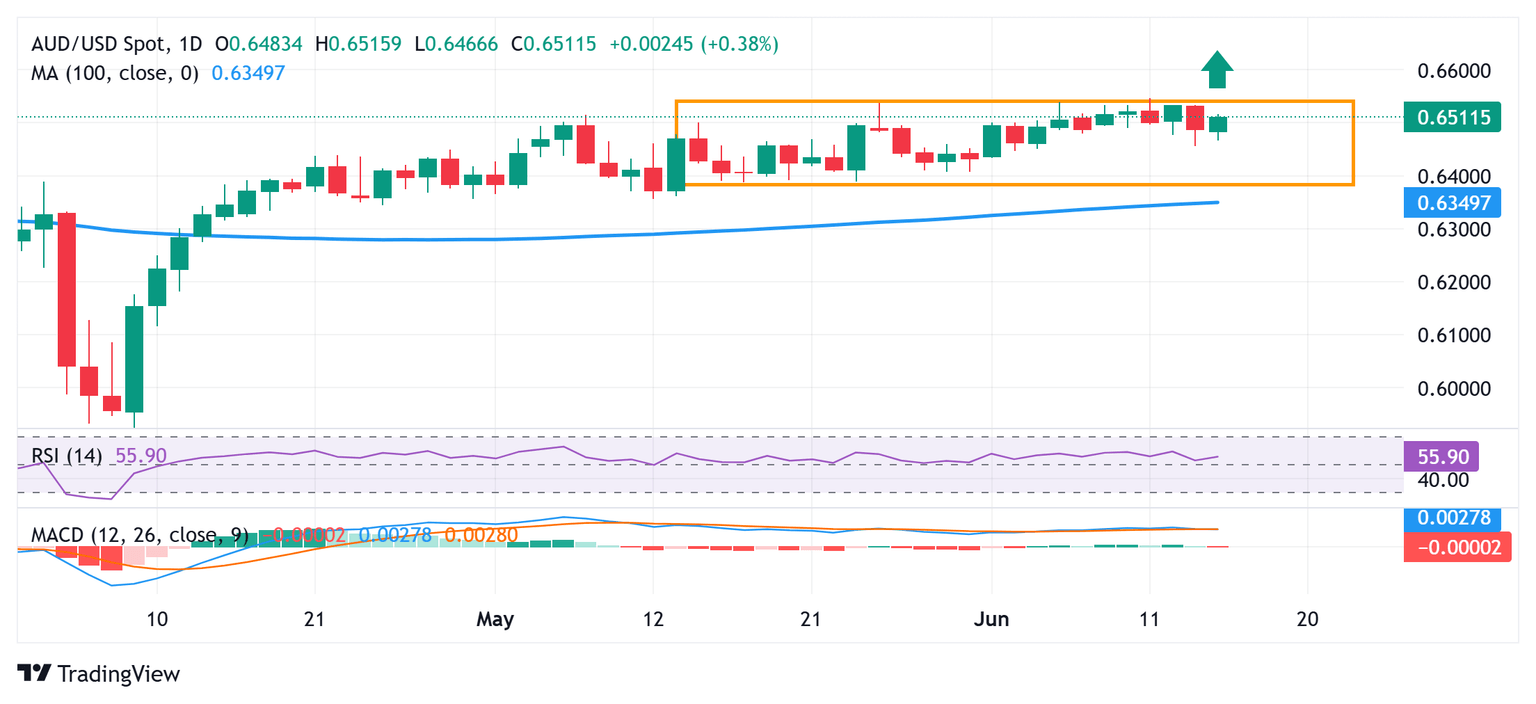

AUD/USD daily chart

Technical Outlook

From a technical perspective, positive oscillators on the daily chart back the case for additional gains and an eventual bullish breakout through a multi-week-old trading range hurdle, around the 0.6545 region. The said area represents the year-to-date peak touched earlier this month, above which the AUD/USD pair could aim to reclaim the 0.6600 mark. The momentum could extend further towards the 0.6640 hurdle and the 0.6680 region, or November 2024 swing high.

On the flip side, any corrective slide might continue to attract dip-buyers near the 0.6450 area and cushioned near the 0.6400 mark. The next relevant support is pegged near the 0.6365-0.6360 horizontal zone, or the lower boundary of the short-term range, which if broken decisively might shift the near-term bias in favor of bearish traders. The AUD/USD pair might then turn vulnerable to accelerate the fall towards testing the 100-day Simple Moving Average (SMA), currently pegged around mid-0.6300s. Spot prices could eventually drop to the 0.6300 round figure en route to the 0.6245 intermediate support and sub-0.6200 levels.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.