AUD/USD Price Forecast: All the attention is on the RBA

- AUD/USD bounced sharply and revisited the 0.6470 zone.

- The US Dollar kept a vacillating tone at the beginning of the week.

- The RBA is expected to keep its OCR unchanged on Tuesday.

The US Dollar (USD) traded in an irresolute fashion on Monday, gyrating around the key 106.00 zone when gauged by the Dollar Index (DXY). Meanwhile, the Australian Dollar (AUD) managed to regain strong balance, staging a pronounced rebound to the 0.6470 region after bottoming out near 0.6380 during early trade.

What’s Weighing on the Australian Dollar?

The Aussie’s recent struggles stem largely from disappointing GDP data for the July-September quarter, released last week. The economy grew by just 0.3% QoQ and 0.8% year-on-year, falling short of expectations, and at the same time reigniting speculation that the RBA might deliver a dovish hold at its gathering on Tuesday.

Adding to the fresh upside bias in the Aussie Dollar, prices for key Australian exports like copper rose to multi-week highs vs. a subdued price action in iron ore, all against the backdrop of market chatter suggesting that extra Chinese stimulus might be in the pipeline after inflation figures in China once again disappointed expectations in November.

The Chinese Yuan also bounced sharply and collaborated with the positive sentiment surrounding the Australian currency.

The RBA’s Wait-and-See Approach

The Reserve Bank of Australia (RBA) has taken a cautious stance, holding interest rates steady at 4.35% in November. While the broad consensus points to the same outcome on December 10, the loss of momentum in the Australian economic activity could pave the way for a potential dovish tilt in the bank’s statement, potentially opening the door to a rate cut in early 2025, rather than around May.

What Lies Ahead for AUD/USD?

The Australian Dollar faces a challenging road ahead. While a potential shift by the US Federal Reserve (Fed) toward rate cuts could provide support, persistent US inflation and the resilience of the Greenback remain hurdles. China’s ongoing slowdown also casts a long shadow over Australia’s economic prospects.

On the bright side, Australia’s labour market remains a point of strength, with unemployment holding steady at 4.1% and 16K new jobs added in October.

Technical picture for AUD/USD

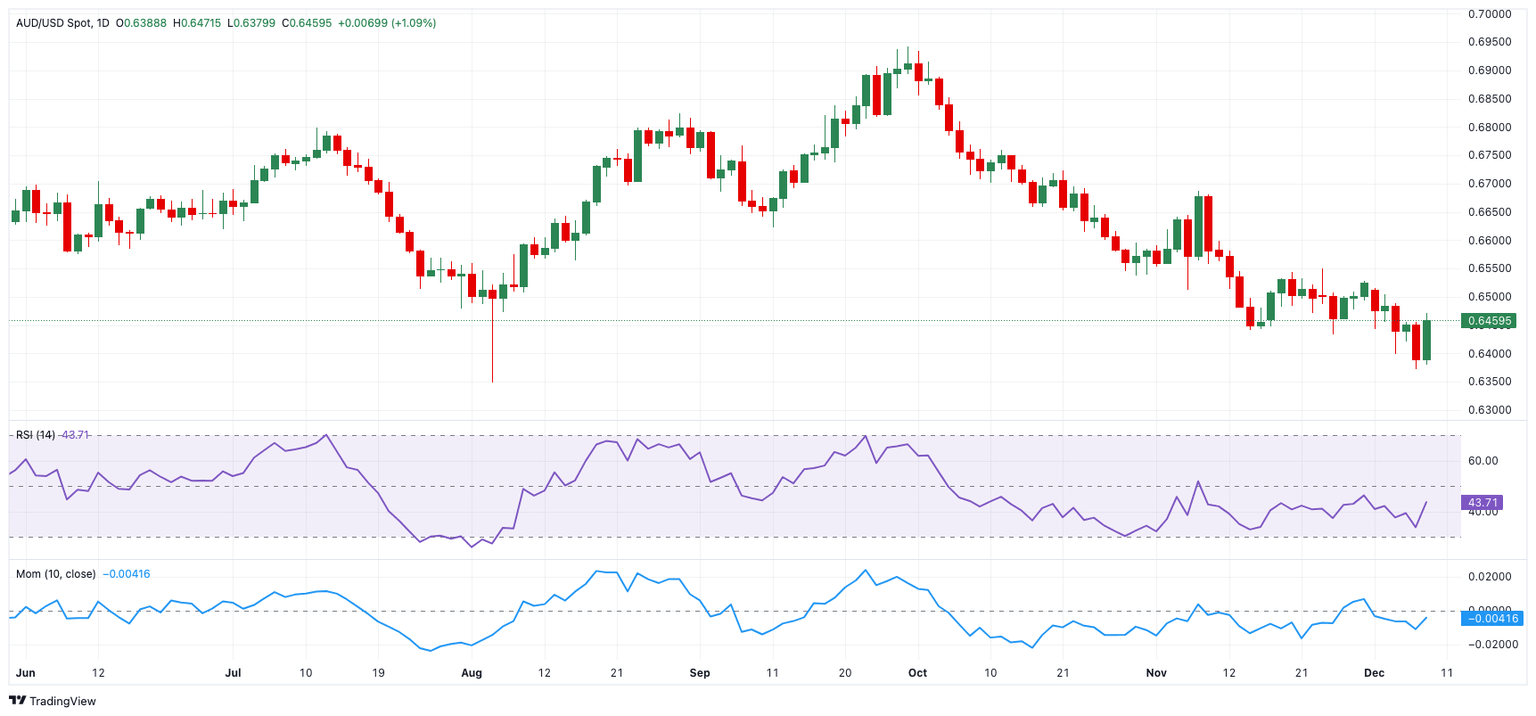

Immediate resistance sits at 0.6549, followed by the 200-day Simple Moving Average (SMA) at 0.6625 and November’s high of 0.6687. On the downside, initial support comes at 0.6399 (December’s low), with a deeper floor at 0.6347 (the August low for the year).

Momentum indicators show that the Relative Strength Index (RSI) has rebounded to nearly 44, hinting at weakening bearish momentum, while the Average Directional Index (ADX) at around 34 signals further strength in the trend’s direction.

Key Data to Watch

Next up for Australia is the RBA’s interest rate decision (Tuesday), seconded by the release of the crucial jobs report on Thursday.

AUD/USD daily chart

Bottom Line

AUD/USD remains under pressure from a mix of domestic and global headwinds, leaving sentiment fragile. While there’s potential for recovery, much will depend on upcoming economic data and developments in the US and China as well as the tone of the imminent RBA event. Until then, caution is likely to dominate the outlook for the Australian Dollar.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.