AUD/USD outlook: Drops after RBA rate cut but remains within broader consolidation range

AUD/USD

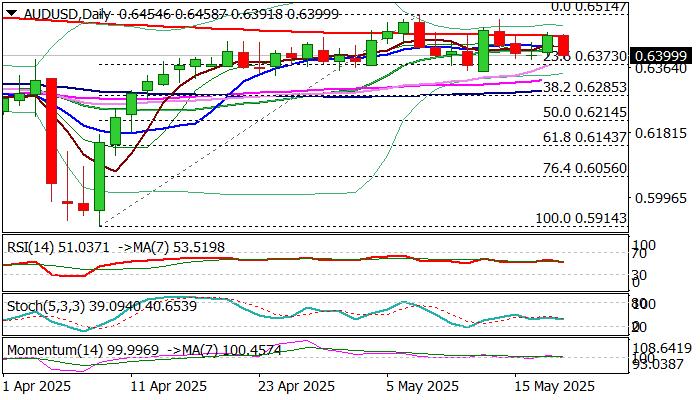

AUDUSD fell on Tuesday after the Reserve Bank of Australia cut interest rate by 25 basis points, in a widely expected decision.

Fresh weakness has fully reversed Monday advance and heading into the lower part of the recent 0.6350/0.6500 congestion, as the pair holds within a broader range in extended consolidation under new 2025 high (0.6514).

Weaker US dollar continues to fuel its Australian counterpart, which implies that negative impact of RBA’s rate cut on Aussie, might be limited.

Situation on daily chart shows that larger uptrend from 0.5914 (2025 low, posted on Apr 9) is in consolidative phase and expected to remain in play while the price stays above consolidation floor.

Technical picture is still positive overall, although with fading bullish momentum and 200DMA (0.6454) marking significant barrier after several attempts failed to register clear break higher.

Cautious playing within the range is currently preferred scenario, with focus on reaction on key levels – 0.6350 on the downside or 0.6454/0.6500 at the upside, which would provide clearer direction signals.

Res: 0.6454; 0.6500; 0.6514; 0.6550.

Sup: 0.6373; 0.6350; 0.6300; 0.6285.

Interested in AUD/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.