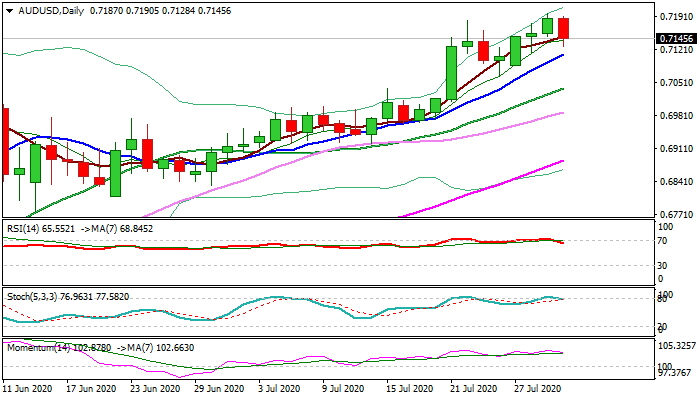

AUD/USD outlook: Aussie pulls back after bulls failed at 0.7200 barrier on first attempt

AUD/USD

The Australian dollar pulls back from new 15-month high (0.7196) as traders took profits after bulls failed to break 0.7200 round-figure barrier. Stronger than expected drop in Australia's export and imports in Q2 and record coronavirus cases contributed to fresh weakness. Daily stochastic and RSI reversed from overbought territory and head south, while bullish momentum is fading and supporting near-term scenario. Larger bulls see current easing as positioning ahead of renewed attempt at 0.7200, with initial support at 0.7110 (rising 10DMA) and 0.7063 (24 July higher low). Extended dips should not exceed ascending 20DMA (0.7037) to keep bulls intact. Release of US Q2 GDP is the key event today and is expected to generate strong signal.

Res: 0.7196; 0.7205; 0.7250; 0.7295

Sup: 0.7132; 0.7110; 0.7063; 0.7037

Interested in AUD/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.