AUD/USD Forecast: Waiting for the RBA near the 2021 low

AUD/USD Current Price: 0.7361

- Australian inflation printed at 2.6% YoY in July, according to the TD Securities report.

- The RBA is set to keep its monetary policy unchanged, turn dovish.

- AUD/USD retains its bearish tone after a modest intraday advance.

The AUD/USD pair posted a modest intraday advance on Monday, ending the day in the 0.7360 price zone. It peaked at 0.7381, later weighed by the poor performance of US equities. Absent demand for the greenback kept the downside in check. Higher gold prices helped limit slides, despite tepid Australian data released at the beginning of the day. Australian TD Securities Inflation improved from 0.4% to 0.5% MoM in July, while the annual reading printed at 2.6%. The AIG Performance of Manufacturing Index came in at 60.8 in July, down from 63.2 in the previous month.

The Reserve Bank of Australia will announce its monetary policy decision on Tuesday, August 3. The central bank is expected to maintain the cash rate steady at 0.1% and the three-year target of 0.1% on government bonds. In its previous meeting, the RBA decided to reduce the pace of bond purchases starting September from A$ 5 billion per week to A$ 4 billion. However, and given the latest coronavirus-related developments, market participants are expecting the RBA to revert such a decision and present a more cautious stance.

AUD/USD short-term technical outlook

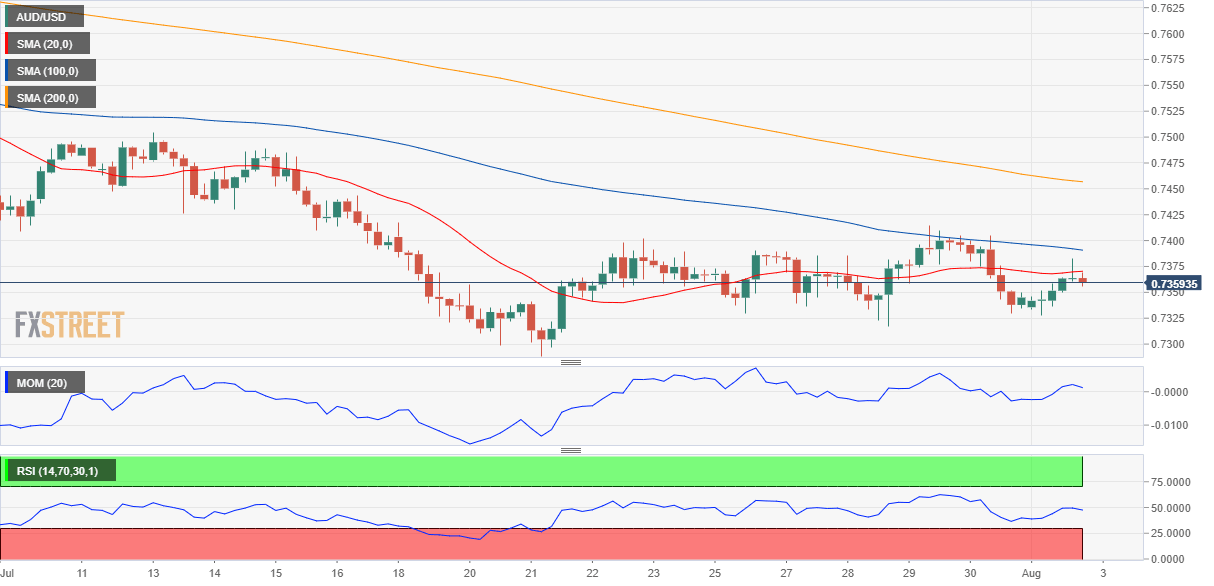

From a technical point of view, the AUD/USD pair is still at risk of falling. The 4-hour chart shows that a flat 20 SMA keeps capping the upside while developing below bearish longer moving averages. Meanwhile, technical indicators remain within negative levels, lacking directional strength. The bearish case will be firmer on a break below 0.7288, this year low.

Support levels: 0.7330 0.7290 0.7250

Resistance levels: 0.7370 0.7410 0.7450

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.