AUD/USD Forecast: Turning bearish ahead of Australian employment data

AUD/USD Current Price: 0.6445

- Australia expected to have lost over half a million jobs in April.

- AUD/USD at daily lows although still above the 0.6400 level.

The AUD/USD pair was unable to retain its early gains, ending a third consecutive day in the red at around 0.6440. Australian data released at the beginning of the day was most encouraging, as the Westpac Consumer Confidence Index for May came in at 16.4%, much better than the previous -17.7%. Also, wages’ growth matched the market’s expectations in the first quarter of the year, up by 0.5% in the three months to March and by 2.1% when compared to a year earlier.

Australia will release April employment data this Thursday. The country is expected to have lost 575,000 job positions in the month, a result of the coronavirus-related lockdown. The unemployment rate is seen soaring to 8.3% from 5.2% in the previous month. The country will also publish Consumer Inflation Expectations for May, previously at 4.6%.

AUD/USD short-term technical outlook

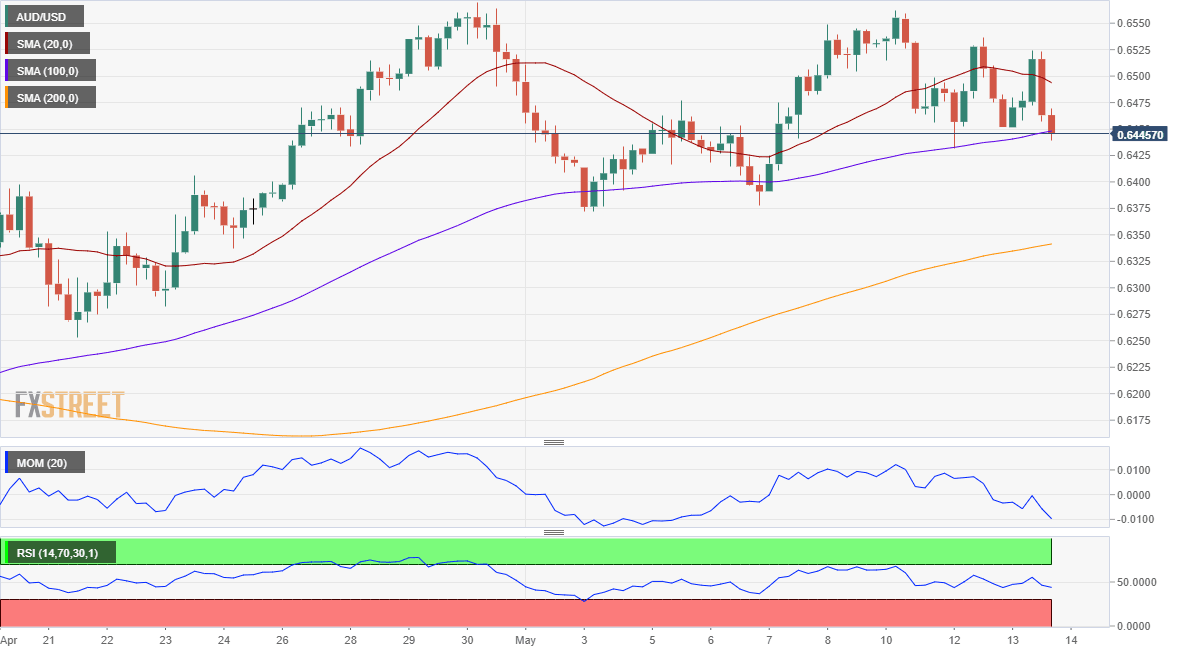

The AUD/USD pair has spent the last hours consolidating losses and seems poised to extend its decline. In the 4-hour chart, the pair continues to find support around a bullish 100 SMA, although the 20 SMA is gaining bearish strength above the current level. Technical indicators, in the meantime, stand within negative levels lacking clear directional strength. Dismal employment data has been already priced in, although a much worse-than-expected report could be the catalyst for a bearish move.

Support levels: 0.6405 0.6370 0.6325

Resistance levels: 0.6475 0.6510 0.6550

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.