AUD/USD Forecast: Trapped around 0.7140 amid unimpressive data

AUD/USD Current Price: 0.7145

- The easing dollar’s demand and falling equities left AUD/USD in limbo.

- The Reserve Bank of Australia will publish the Minutes of its latest meeting.

- AUD/USD trades with a neutral stance in the near term could fall once below 0.7100.

The AUD/USD pair is little changed for a second consecutive day, trading in the 0.7130/40 price zone, trapped between the poor performance of equities and absent demand for the American currencies. The pair posted a higher high and a lower low on a daily basis, peaking with the upbeat surprise of the European Central Bank at the beginning of the American session. The Bank of England came out with a hawkish monetary policy decision and, alongside the ECB, dented the greenback’s demand.

Australian data released at the beginning of the day was mixed, dragging the pair lower. The AIG Performance of Construction Index contracted to 45.9 in December, down from 57 previously. The Commonwealth Ban Services PMI printed at 46.6 in January, slightly better than the 45 anticipated. Also, Q4 NAB’s Business Confidence resulted upbeat, surging to 18 from the previous -2.

On Friday, the Reserve Bank of Australia will release the Minutes of its latest monetary policy meeting. The central bank maintained rates on hold, keeping the official interest rate at the current historic low of 0.10%. At the same time, Governor Philip Lowe said that it would end its bond-purchase program next week. The document is not expected to bring more surprises.

AUD/USD short-term technical outlook

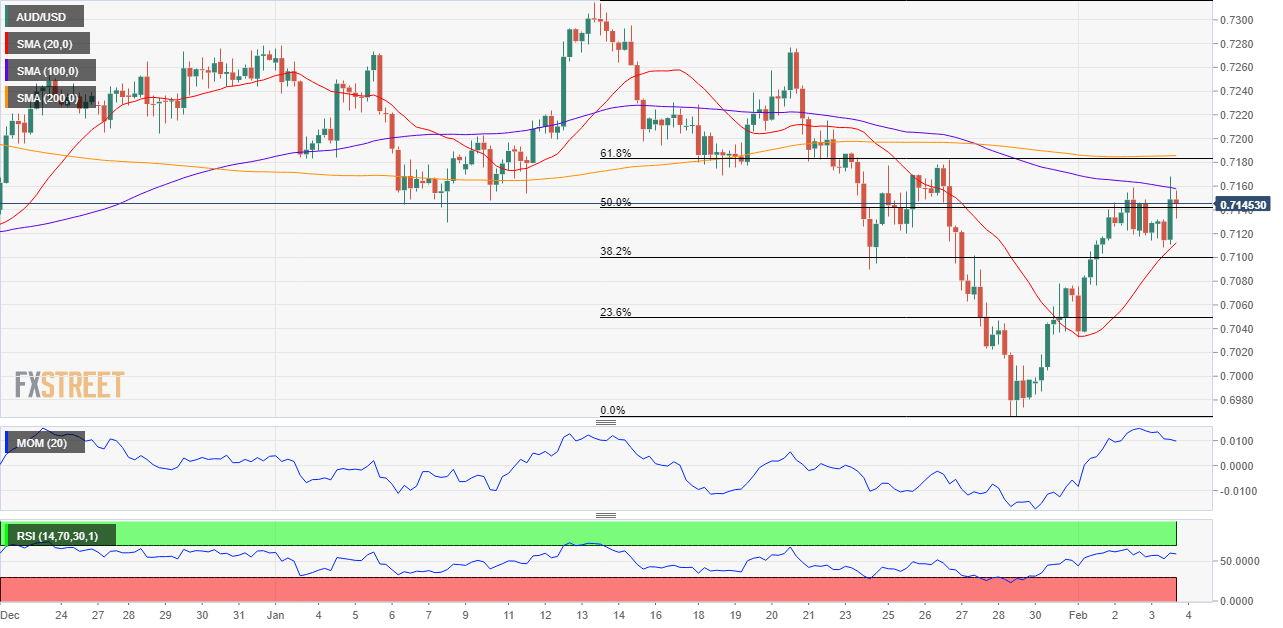

The AUD/USD pair remains stuck around the 50% retracement of its January decline. The daily chart shows that the pair topped for a second consecutive day at around a mildly bearish 20 SMA while holding below the longer ones. Technical indicators remain within negative levels. The Momentum indicator aims higher, but the RSI indicator is now flat.

The 4-hour chart shows that the pair is above a bullish 20 SMA but below the longer ones, which remain directionless. In the meantime, the Momentum indicator eases within positive levels while the RSI remains stable at around 61, suggesting limited selling interest. A break below 0.7100 should put the pair in the bearish track, at least in the near term, while bulls could gain control on an extension above 0.7175.

Support levels: 0.7100 0.7050 0.7005

Resistance levels: 0.7175 0.7210 0.7250

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.