AUD/USD Forecast: Still struggling to rally beyond 0.7400

AUD/USD Current Price: 0.7395

- The RBA surprised market’s participants with a not so dovish stance.

- Australian housing-related data was generally disappointing in June.

- AUD/USD is technically neutral, but there is a chance it could move up.

The AUD/USD pair advanced for a second consecutive day, although it is still unable to extend gains beyond the 0.7400 figure. The pair peaked at 0.7408 during Asian trading hours, with the aussie supported by the RBA’s monetary policy decision. The central bank left the cash rate at 0.1% as expected, as well as the 3-year bond yield target at the same level. The central bank decided to maintain its previous decision to reduce its weekly bond-buying in September to A$ 4 billion per week, at least until mid-November. Policymakers reiterated that they don’t expect to raise the cash rate until at least 2024.

Australia published housing-related data which was generally discouraging. Building Permits were down 6.7% in June, while Home Loans contracted by 2.5%. On Wednesday, the country will publish the July AIG Performance of Construction Index, previously at 55.5, the Commonwealth Bank Services PMI for the same month, and June Retail Sales.

AUD/USD short-term technical outlook

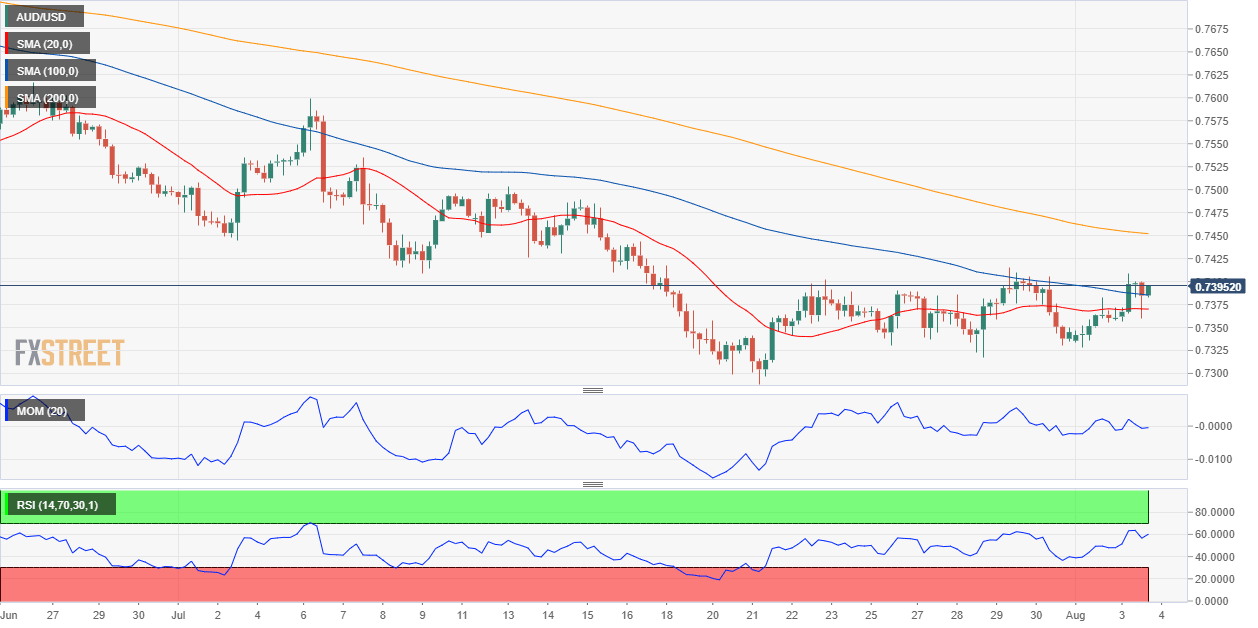

The AUD/USD pair is technically neutral but could extend its gains in the near-term, mainly if the positive market’s mood persists. The 4-hour chart shows that technical indicators are within positive levels, the Momentum advancing and the RSI stable at around 57. Meanwhile, the price is struggling around a flat 100 SMA while developing above an also directionless 20 SMA. The 200 SMA maintains its bearish slope well above the current level, suggesting longer-term sellers still hold the grip.

Support levels: 0.7370 0.7330 0.7290

Resistance levels: 0.7410 0.7450 0.7490

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.