AUD/USD Forecast: Risks remain on the downside prior to the RBA

- AUD/USD dropped to new 2024 lows around 0.6350.

- The broad-based sell-off in the risk complex hurt AUD and commodities.

- The RBA is widely expected to keep its interest rate at 4.35%.

AUD/USD extended its retracement further and reached a new 2024 bottom in the 0.6350-0.6345 band at the beginning of the week, resuming its downtrend and entering its fourth consecutive week in negative territory.

Meanwhile, the Aussie dollar continued trading below the significant 200-day SMA (0.6592) against the US Dollar (USD), indicating a short-term vulnerability to further losses.

This notable pullback in the pair was driven by an equally strong resumption of the risk aversion in the broader markets, all on the back of accelerating speculation of a potential slowdown in the US economic activity in combination with a potential emergency rate cut by the Federal Reserve (Fed) anytime soon.

Additionally, copper prices resumed their downtrend and retreated to an area last seen in April, while the decent rebound in iron ore prices helped limit the downside.

In terms of monetary policy, recently released inflation data in Australia has reduced the likelihood of further rate hikes by the Reserve Bank of Australia (RBA), as previously expected by market participants. As a result, the probability of the RBA maintaining the official cash rate at 4.35% in its August 6 meeting has increased, with broader expectations that rates will remain unchanged for the rest of the year.

Overall, the RBA is expected to be the last among G10 central banks to start cutting interest rates. The central bank is in no rush to ease policy, anticipating that it will take time for inflation to consistently fall within the 2-3% target range.

Potential easing by the Federal Reserve (Fed) in the medium term, contrasted with the RBA's likely prolonged restrictive stance, could support AUD/USD in the coming months.

However, sluggish momentum in the Chinese economy might hinder a sustained recovery of the Australian dollar as China continues to face post-pandemic challenges, deflation, and insufficient stimulus for a convincing recovery. Concerns about demand from China, the world's second-largest economy, also emerged following the country's Politburo meeting, where, despite promises to support the economy, no specific new stimulus measures were announced.

In Oz, the final Judo Bank Services PMI eased a tad to 50.4 in July (from 51.2).

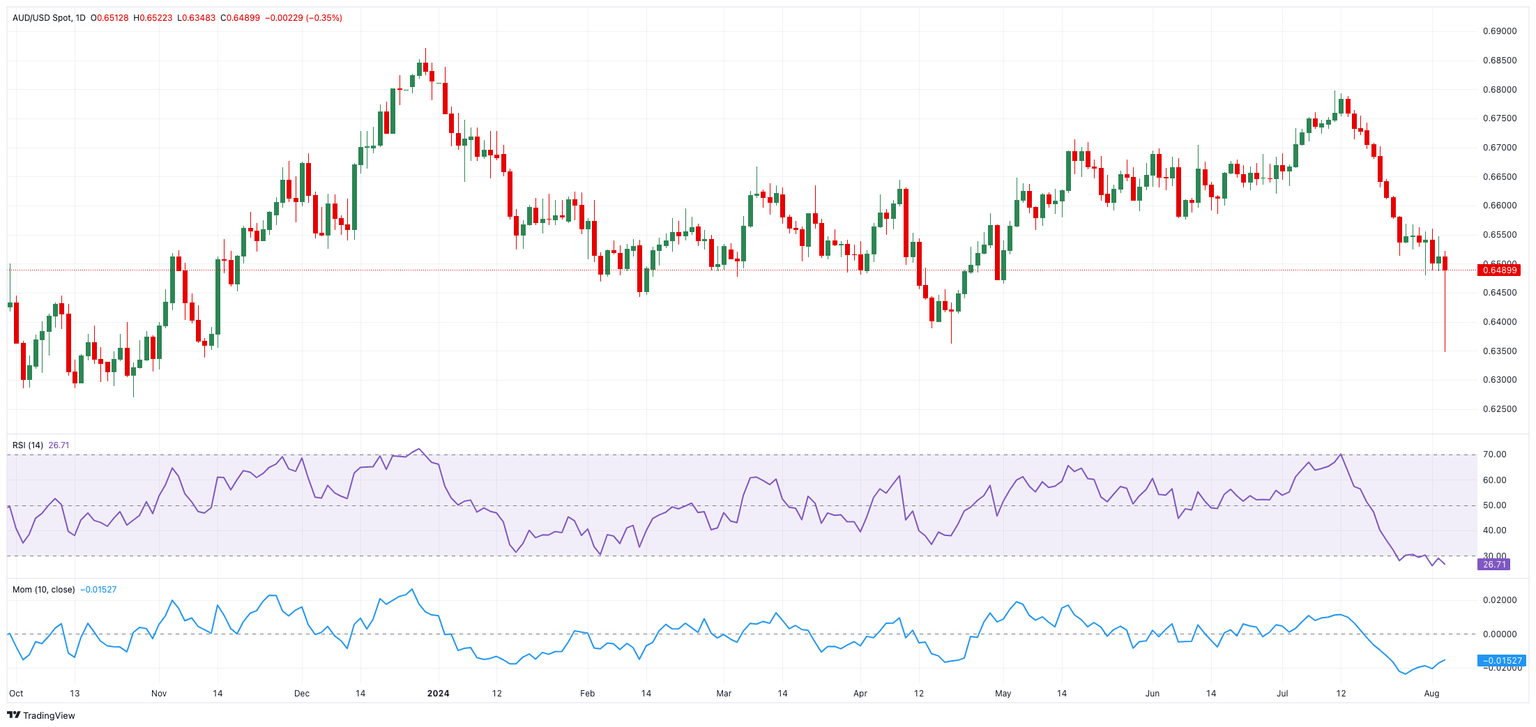

AUD/USD daily chart

AUD/USD short-term technical outlook

Further losses in the AUD/USD may find first support at the 2024 bottom of 0.6347 (August 5), followed by the 2023 low of 0.6270 (October 26).

Bullish efforts, on the other hand, may encounter first resistance at the important 200-day SMA of 0.6591, ahead of the temporary 100-day and 55-day SMAs of 0.6601 and 0.6645, respectively, before the July high of 0.6798 (July 8) and the December top of 0.6871.

Overall, additional retracements of the AUD/USD are predicted as the pair remains below the 200-day SMA.

The four-hour data reveals a persistent increase of the negative bias. However, immediate support is at 0.6347, which comes before 0.6338 and then 0.6270. On the positive side, the initial hurdle is located at 0.6559 ahead of 0.6610 and the 200-SMA of 0.6654. The RSI hovered around 45.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.