AUD/USD Forecast: Retreating from record highs, more gains in the docket

AUD/USD Current Price: 0.6405

- The poor performance of Wall Street weighed on the pair in the American session.

- US President Donald Trump criticized Federal Reserve Chairman Jerome Powell.

- AUD/USD eases from fresh yearly highs, near-term support at 0.6390.

The AUD/USD pair rallied at the beginning of the new week, hitting 0.6438 before retreating during the American session. The fresh 2025 high resulted from broad US Dollar (USD) weakness, as concerns about the American economic health undermined investors’ confidence on the world’s largest economy.

The pair retreated after Wall Street’s opening as United States (US) stocks collapsed, weighing on the pair. The dismal mood exacerbated after the latest comment from US President Donald Trump, who once again criticized Federal Reserve (Fed) Chairman Jerome Powell for not trimming interest rates, calling him “Mr. Too Late” and a loser. At the time of writing US major indexes are down roughly 3% each.

Australian markets have remained closed since Thursday amid the Easter holiday, and will return to normal on Tuesday, although the local macroeconomic calendar will remain empty.

AUD/USD short-term technical outlook

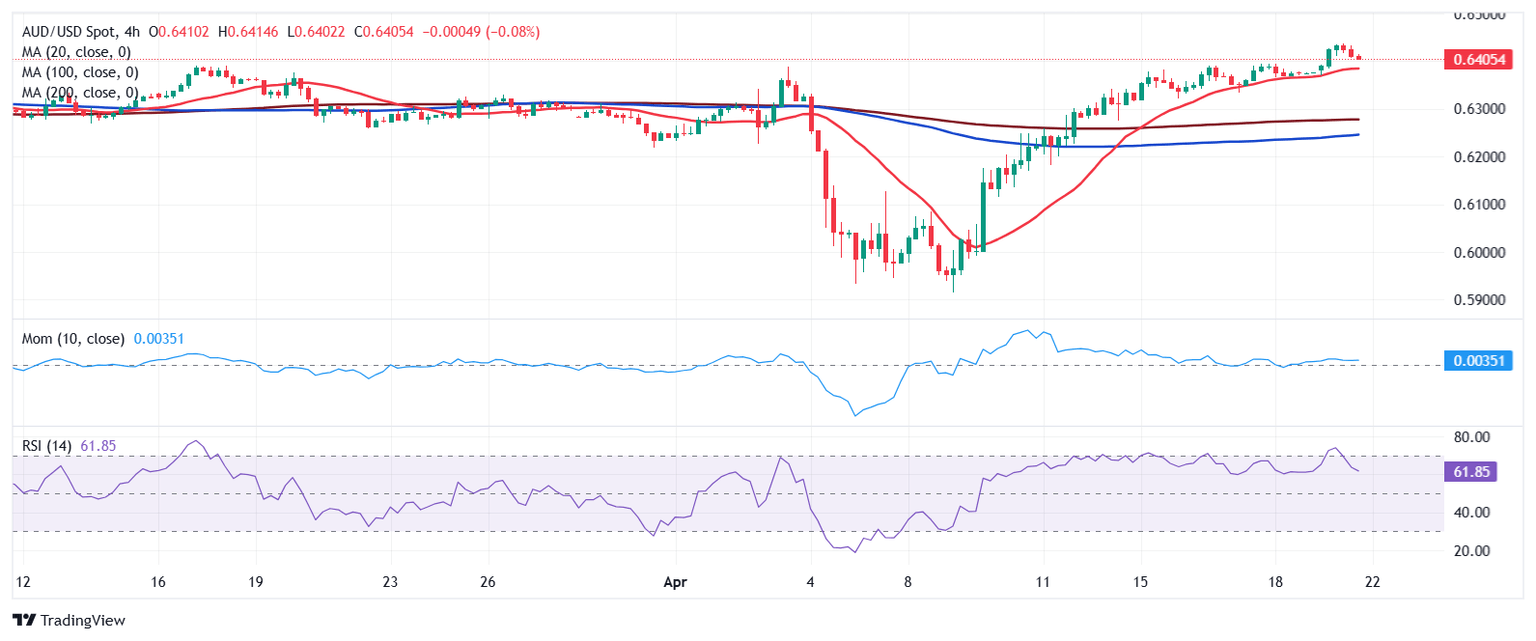

The AUD/USD pair trades just above 0.6400 ahead of the Asian opening, up for a ninth consecutive day. Technical readings in the daily chart suggest the positive momentum eases, but the risk remains skewed to the upside, given that technical indicators develop well above their midlines, despite losing their upward strength. The same chart shows AUD/USD develops above its 20 and 100 Simple Moving Averages (SMAs), while a mildly bearish 200 SMA provides dynamic resistance at around 0.6470.

In the near term, and according to the 4-hour chart the ongoing retracement could be short lived. Former intraday highs around 0.6390 provide near-term support, while a mildly bullish 20 SMA reinforces the area. At the same time, the 100 and 200 SMAs run in parallel far below the shorter one, although with limited upward strength. Finally, technical indicators eased from their peaks, maintaining downward slopes within positive levels.

Support levels: 0.6390 0.6360 0.6325

Resistance levels: 0.6435 0.6470 0.6505

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.