Australian Dollar Price Forecast: Immediate up-barrier comes at 0.7100

- AUD/USD remains under pressure below the 0.7000 yardstick on Monday.

- The US Dollar keeps its intense upside momentum, hitting multi-day highs.

- The RBA is expected to hike its OCR by 25 bps to 3.85% on Tuesday.

AUD/USD attempts to regain some composure following the strong rejection from recent peaks near the 0.7100 barrier in a context of renewed demand for the US Dollar (USD) and expectations ahead of the RBA meeting on Tuesday.

The Australian Dollar (AUD) adds to recent losses on Monday, prompting AUD/USD to maintain its offered stance and slip back below the key 0.7000 support amid the widespread continuation of the bid bias in the US Dollar (USD).

Indeed, the Greenback remains firm and trades in multi-day highs as investors continue to evaluate President Trump’s nomination of Kevin Warsh as the next Fed Chair.

Australia: cooling, but still on its feet

Recent Australian data haven’t exactly wowed the market, but they do tell a fairly reassuring story. The economy is clearly cooling, yet it’s doing so in an orderly way rather than hitting a wall. In other words, the soft-landing narrative is still very much intact.

January’s Purchasing Managers’ Index (PMI) surveys support that view. Both Manufacturing and Services activity picked up and stayed comfortably in expansion territory, with readings of 52.4 and 56.0, respectively. Retail Sales are holding up reasonably well too, while November’s trade surplus narrowed to A$2.936 billion but remained firmly in the black.

Growth is easing, but only gradually, after the Gross Domestic Product (GDP) expanded by 0.4% QoQ in Q3, down from 0.7% previously. On a yearly basis, growth was unchanged at 2.1%, exactly in line with the Reserve Bank of Australia’s (RBA) own projections.

The labour market continues to be a clear bright spot: Employment jumped by a hefty 65.2K in December, while the Unemployment Rate unexpectedly edged lower to 4.1% from 4.3%.

Inflation, however, remains the tricky part. December’s Consumer Price Index (CPI) surprised on the upside, with headline inflation rising to 3.8% YoY from 3.4%. The trimmed mean, which the RBA watches closely, came in at 3.3% YoY, matching consensus but ticking above November’s 3.2% and, more importantly, overshooting the RBA’s own December forecast. On a quarterly basis, trimmed mean inflation rose to 3.4% YoY in Q4, its highest since Q3 2024. That mix keeps a 25 basis point hike at the February 3 meeting firmly on the table.

China: helpful, but not a game changer

China continues to offer some support to the Australian Dollar, although without the kind of momentum that usually fuels a sustained rally.

Economic growth ran at an annualised pace of 4.5% in the October–December quarter, with quarterly growth at 1.2%. Retail Sales rose at an annualised 0.9% in December. Solid enough, but not exactly eye-catching.

More recent data hint at some loss of momentum, unwinding part of the acceleration seen previously as both the National Bureau of Statistics (NBS) Manufacturing PMI and the Non-Manufacturing PMI slipped back into contraction territory in January, at 49.3 and 49.4 respectively.

By contrast, the Caixin Manufacturing index edged up slightly to 50.3, while investors now await the Services reading due later in the week.

Trade was one of the clearer positives. The surplus widened sharply to $114.1 billion in December, helped by a near-7% surge in exports alongside a solid 5.7% increase in imports.

Inflation remains a mixed bag after consumer prices were unchanged at 0.8% YoY in December, while producer prices stayed firmly negative at -1.9%, underscoring that deflationary pressures haven’t fully gone away.

For now, the People’s Bank of China (PBoC) is sticking with a cautious stance. Loan Prime Rates (LPR) were left unchanged in January at 3.00% for the one-year and 3.50% for the five-year, reinforcing the idea that any policy support will be gradual rather than aggressive.

RBA: tightening risks refuse to go away

The RBA struck a firm tone at its December meeting, leaving the Official Cash Rate (OCR) unchanged at 3.60% and signalling little urgency to shift policy.

Governor Michele Bullock pushed back against expectations of near-term rate cuts, making it clear the Board is comfortable keeping rates higher for longer and remains willing to tighten further if inflation proves stubborn.

The December Minutes added some nuance, revealing internal debate over whether financial conditions are restrictive enough. That discussion keeps rate cuts firmly in the “not a given” category.

After the latest inflation surprise, markets are now pricing roughly a 76% chance of a rate hike at Tuesday’s meeting, with just over 58 basis points of tightening priced in by year-end.

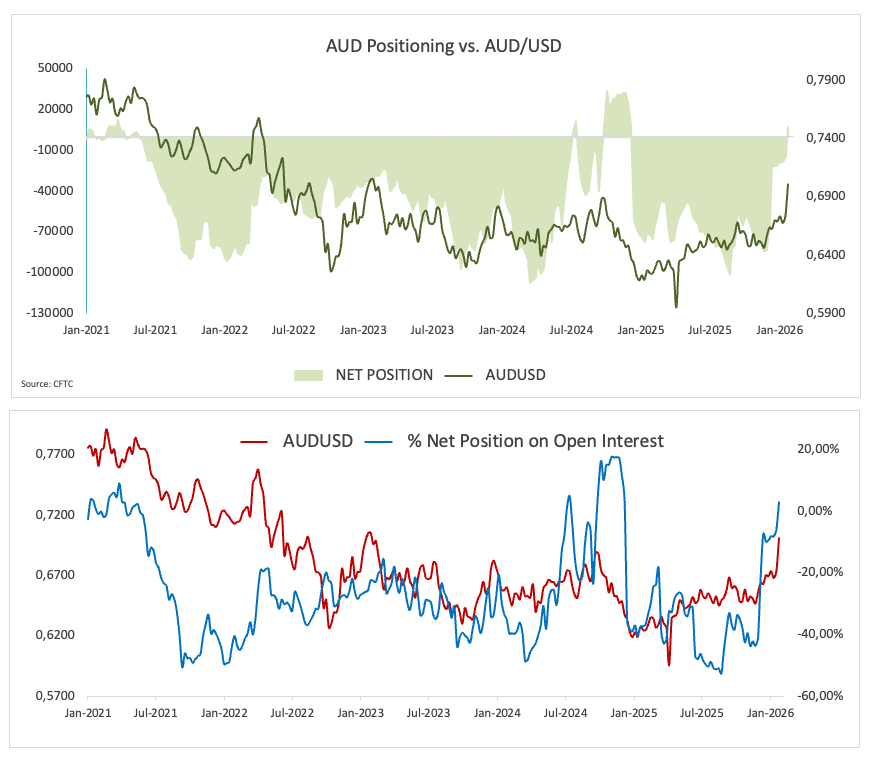

Positioning: sentiment stabilises, enthusiasm lags

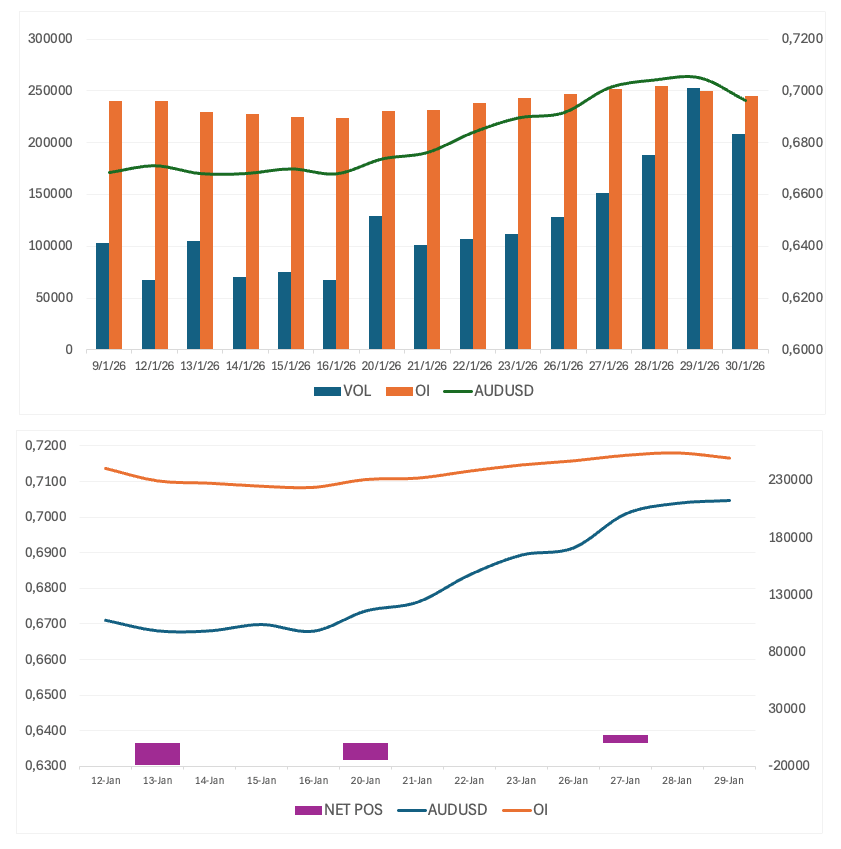

Positioning data suggest the worst of the bearish mood around the AUD may be behind us. Speculators flipped net long for the first time since early December 2024, taking net longs to just over 7.1K contracts in the week ended January 27, according to the Commodity Futures Trading Commission (CFTC).

Open interest has also picked up sharply, rising above 252K contracts, a six-week high, which points to renewed participation.

That said, this still looks more like cautious re-engagement than outright conviction, something echoed by last week’s open interest and volume dynamics.

What to watch next

Near term: The RBA meeting on Tuesday is the key domestic event, while US data releases, particularly from the labour market, are likely to drive AUD/USD from the US Dollar side.

Risks: The AUD remains highly sensitive to global risk sentiment. Any abrupt risk-off move, renewed concerns around China, or a stronger-than-expected rebound in the US Dollar could quickly cap further upside.

Technical landscape

Further correction could prompt AUD/USD to challenge the weekly trough at 0.6908 (February 2), while the breach below this level could put a test of the interim 55-day SMA at 0.6675 back into focus, all ahead of the 2026 bottom at 0.6663 (January 9). Down from here sits, the transitory 100-day SMA at 0.6620, closely followed by the weekly low at 0.6592 (December 18).

In case bulls regain their footing, the initial hurdle comes at the 2026 ceiling at 0.7093 (January 29), ahead of the 2023 high at 0.7157 (February 2).

Meanwhile, the pair’s bullish bias should remain in place above its 200-day SMA.

In addition, momentum indicators point to extra gains in the short-term horizon: the Relative Strength Index (RSI) eases to around the 70 threshold, while the Average Directional Index (ADX) near 48 suggests a robust trend.

-1770048566572-1770048566573.png&w=1536&q=95)

Bottom line

AUD/USD remains tightly linked to global risk appetite and China’s economic outlook. A sustained break above 0.7000 would be needed to send a clearer bullish signal.

RBA FAQs

The Reserve Bank of Australia (RBA) sets interest rates and manages monetary policy for Australia. Decisions are made by a board of governors at 11 meetings a year and ad hoc emergency meetings as required. The RBA’s primary mandate is to maintain price stability, which means an inflation rate of 2-3%, but also “..to contribute to the stability of the currency, full employment, and the economic prosperity and welfare of the Australian people.” Its main tool for achieving this is by raising or lowering interest rates. Relatively high interest rates will strengthen the Australian Dollar (AUD) and vice versa. Other RBA tools include quantitative easing and tightening.

While inflation had always traditionally been thought of as a negative factor for currencies since it lowers the value of money in general, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Moderately higher inflation now tends to lead central banks to put up their interest rates, which in turn has the effect of attracting more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in the case of Australia is the Aussie Dollar.

Macroeconomic data gauges the health of an economy and can have an impact on the value of its currency. Investors prefer to invest their capital in economies that are safe and growing rather than precarious and shrinking. Greater capital inflows increase the aggregate demand and value of the domestic currency. Classic indicators, such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can influence AUD. A strong economy may encourage the Reserve Bank of Australia to put up interest rates, also supporting AUD.

Quantitative Easing (QE) is a tool used in extreme situations when lowering interest rates is not enough to restore the flow of credit in the economy. QE is the process by which the Reserve Bank of Australia (RBA) prints Australian Dollars (AUD) for the purpose of buying assets – usually government or corporate bonds – from financial institutions, thereby providing them with much-needed liquidity. QE usually results in a weaker AUD.

Quantitative tightening (QT) is the reverse of QE. It is undertaken after QE when an economic recovery is underway and inflation starts rising. Whilst in QE the Reserve Bank of Australia (RBA) purchases government and corporate bonds from financial institutions to provide them with liquidity, in QT the RBA stops buying more assets, and stops reinvesting the principal maturing on the bonds it already holds. It would be positive (or bullish) for the Australian Dollar.

For now, a softer USD, steady if unspectacular domestic data, an RBA still leaning towards renewed tightening, and modest support from China keep the balance tilted towards further gains rather than a deeper reversal.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.