AUD/USD Forecast: Poised to challenge the year’s low at 0.6669

AUD/USD Current Price: 0.6690

- RBA Meeting Minutes showed policymakers are concerned about growth and employment.

- The poor performance of Wall Street undermined demand for the aussie.

- AUD/USD is technically bearish and could reach fresh multi-year lows.

The AUD/USD pair trades in the 0.6690 price zone, ending the day in the red. The greenback appreciated on the back of a dismal market mood ahead of central banks’ announcements and as investors fear the US Federal Reserve could turn more aggressive with its quantitative tightening after recent data showed that core inflation reached fresh multi-year highs.

The negative sentiment weighed on Wall Street, usually drag for AUD/USD. Meanwhile, the greenback advanced alongside government bond yields, which jumped to fresh multi-year highs.

The aussie was hit by the Reserve Bank of Australia, as the Minutes for the September meeting showed that policymakers saw the case for a slower pace of rate increases becoming stronger. The Board said they are committed to doing what is necessary to ensure inflation returns to target over time but remarked that they need to account for the risks to growth and employment. Early Wednesday, Australia will release the August Westpac Leading Index, previously at -0.15%.

AUD/USD short-term technical outlook

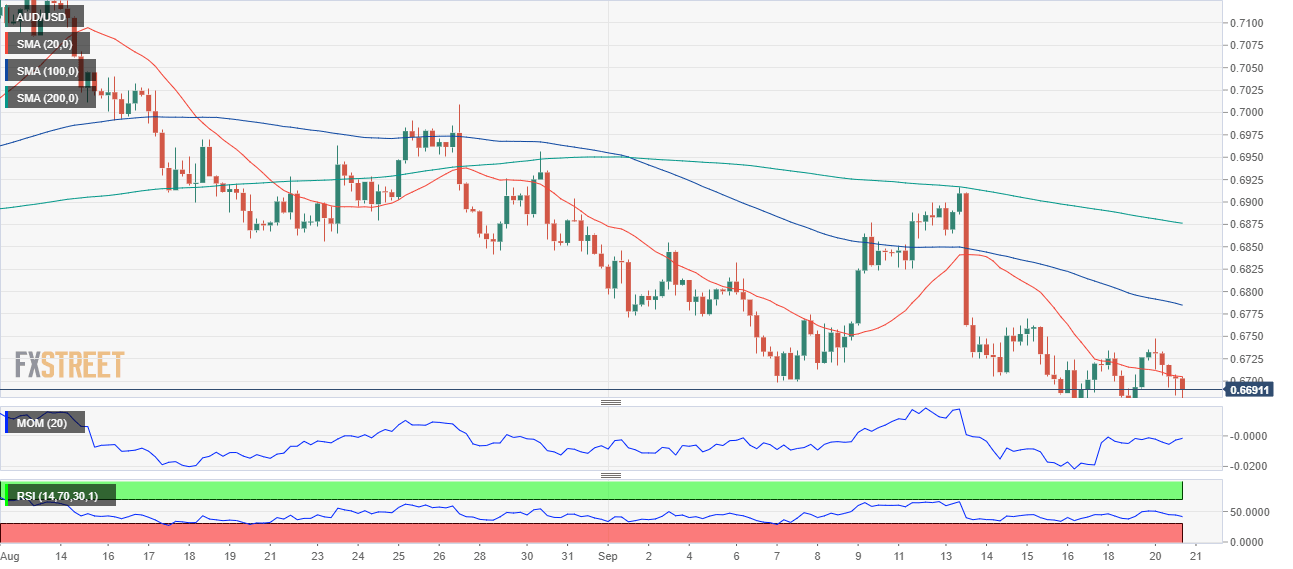

The AUD/USD pair trades near its recent multi-month low of 0.6669, and the daily chart favors a decline below the level. Technical indicators turned south within negative levels, with the RSI approaching oversold readings. At the same time, the pair is developing well below bearish moving averages, with the 20 SMA currently around the 0.6800 figure.

In the near term, and according to the 4-hour chart, the pair is neutral-to-bearish. A mildly bearish 20 SMA provides intraday resistance while extending its slide below the longer ones. The Momentum indicator stands directionless around its 100 level, while the RSI indicator consolidates within negative levels, skewing the risk to the downside.

Support levels: 0.6665 0.6620 0.6580

Resistance levels: 0.6710 0.6745 0.6780

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.