AUD/USD Forecast: Picking up bullish momentum

AUD/USD Current Price: 0.7130

- The Aussie is among the best performers, finding support in soaring gold prices.

- Chinese official September PMIs to be out during the upcoming Asian session.

- AUD/USD is technically bullish, could extend its advance beyond 0.7200.

The AUD/USD pair advanced for a second consecutive day, trading near its daily highs in the 0.7130 price zone as Asian the US session comes to an end. The Aussie rallied on the back of the American dollar´s broad weakness, ignoring the sour tone of equities. Gold soared, providing additional support to the Australian currency.

This Wednesday, Australia will publish August Private Sector Credit and Building Permits for the same month. More relevantly, China will release the official NBS Manufacturing PMI, foreseen in September at 51.2 from 51 in August, and the Non-Manufacturing PMI for the same month, seen shrinking from 55.2 to 52.1

AUD/USD short-term technical outlook

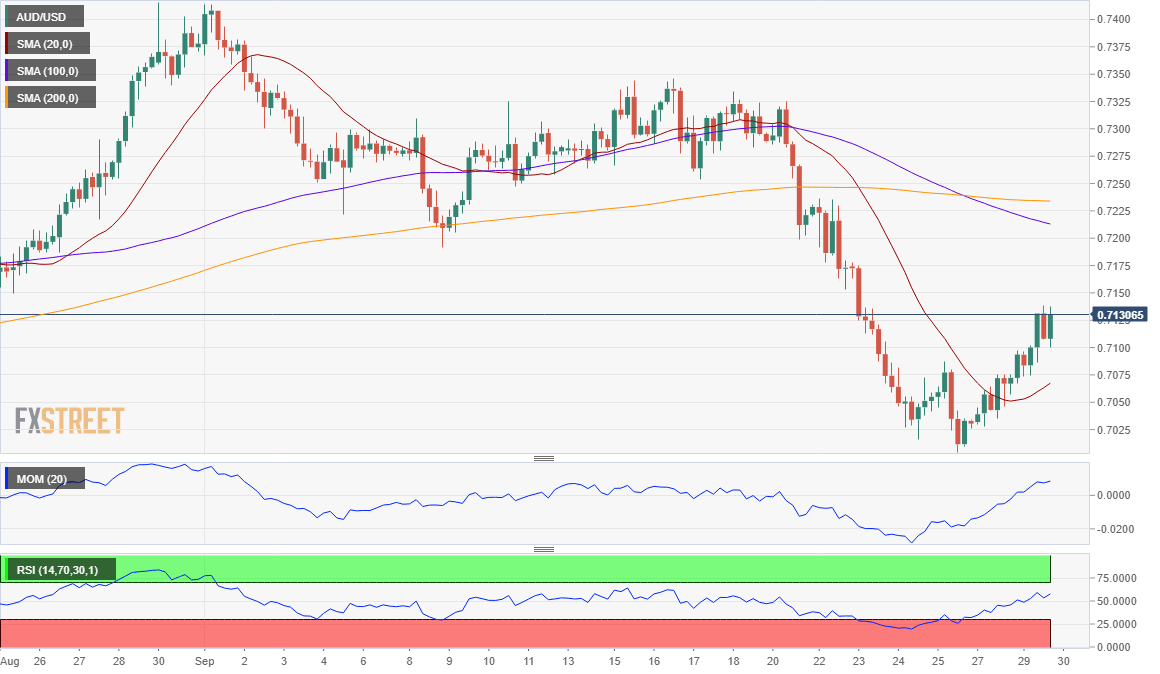

The AUD/USD pair is firmly bullish and poised to extend its advance. The 4-hour chart shows that the pair advanced above its 20 SMA, which turned higher at around 0.7070, although it remains below the larger ones. Technical indicators, in the meantime, head firmly higher well above their midlines, anticipating another leg higher in the near-term. The pair has room to extend its advance beyond 0.7200, mainly if the sentiment improves.

Support levels: 0.7100 0.7060 0.7015

Resistance levels: 0.7170 0.7210 0.7250

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.