AUD/USD Forecast: Increased bearish potential in the short-term

AUD/USD Current Price: 0.7280

- Australia will publish this Monday the AIG Performance of Services Index for August.

- US employment data and falling equities put the pair under pressure on Friday.

- AUD/USD corrective decline could continue this Monday, but bulls retain control.

The Australian dollar edged lower against its American rival last week but held not far from the multi-year high set at 0.7413. In fact, the pair closed Friday unchanged in the 0.7280 price zone, despite generally encouraging US employment data and another bad day in Wall Street. The Aussie came under selling pressure at the beginning of the day, as July Retail Sales in the country were downwardly revised to 3.2% from a preliminary estimate of 3.3%.

At the beginning of the new week, Australia will publish the AIG Performance of Services Index for August, previously at 44. China, on the other hand, will release the August Trade Balance, seen posting a surplus of $50.5B.

AUD/USD short-term technical outlook

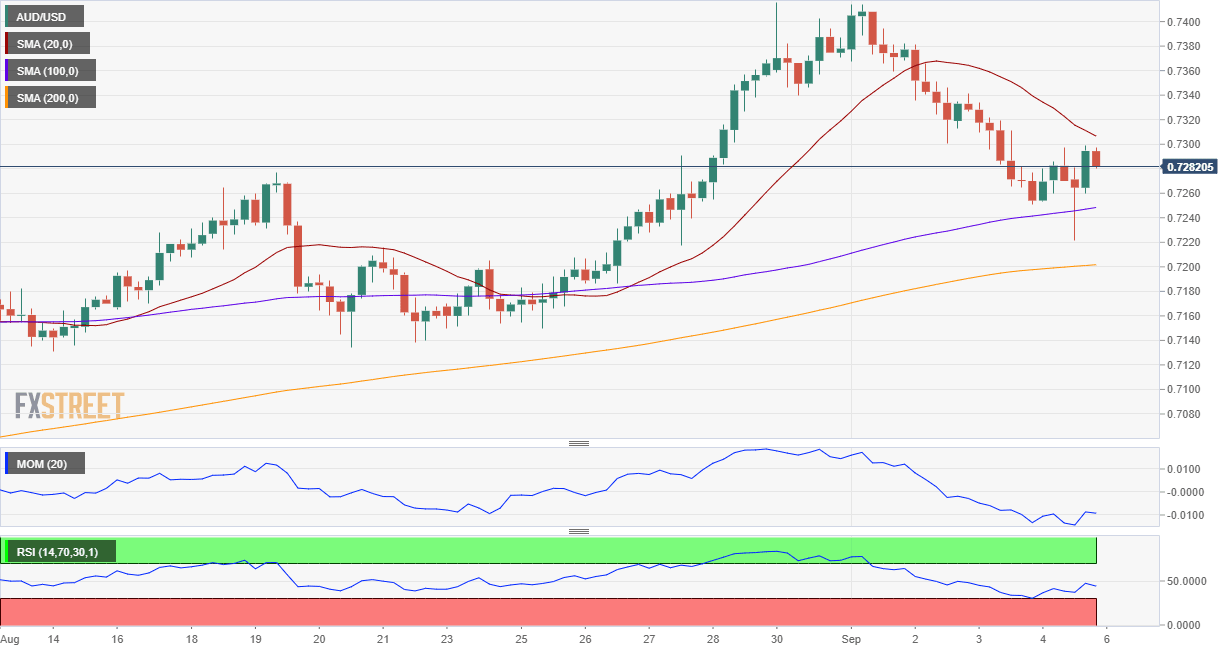

The daily chart for the AUD/USD pair shows that it bounced from its 20 DMA, while the 100 DMA advances above the 200 DMA, both far below the shorter one. Technical indicators corrected from overbought readings but lost bearish potential within positive levels. In the 4-hour chart, technical indicators recovered from oversold readings, but remain within negative levels with limited bullish strength. The 20 SMA, in the meantime, heads lower above the current level, increasing the risk of a bearish extension ahead.

Support levels: 0.7265 0.7220 0.7170

Resistance levels: 0.7305 0.7340 0.7380

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.