AUD/USD Forecast: Further weakness appears on the cards

- AUD/USD dropped to a new three-month low near 0.6500.

- Chinese Caixin data came in slightly above estimates.

- The RBA is largely anticipated to leave its rates unchanged.

There was no respite for the selling pressure around the Aussie dollar on Thursday, this time dragging AUD/USD to fresh three-month lows in the boundaries of the 0.6500 contention zone.

Indeed, the pair retreated for the third straight session on the back of tepid gains in the greenback and discouraging results from the Chinese docket, where China’s Caixin Manufacturing PMI failed to surprise markets in January, coming in just above consensus.

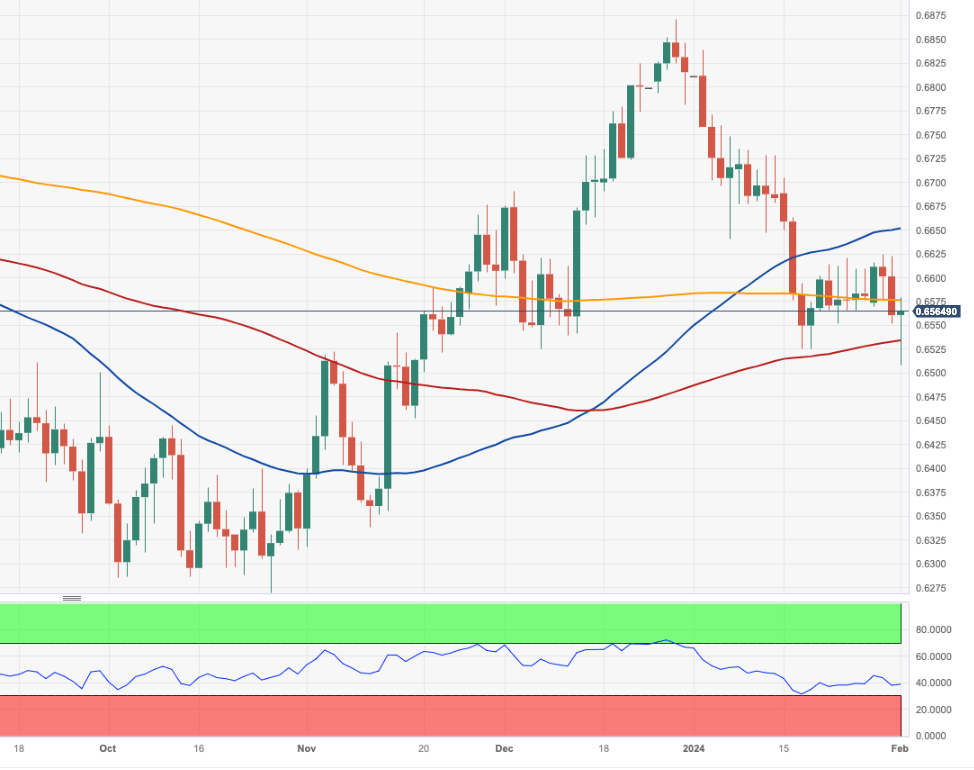

Meanwhile, the ongoing leg lower in spot seems to have broken below the critical 200-day SMA in quite convincing fashion, allowing for the continuation of the bearish trend at least in the short-term horizon.

While additional stimulus measures by the PBoC to support China's stock market and foster economic recovery post-pandemic initially lent some support to the Aussie dollar, those effects rapidly dissipated pari passu with the absence of positive surprises from the fundamentals of that economy.

On another front, the anticipated decision of the Reserve Bank of Australia (RBA) to maintain its current policy stance at its February 6 meeting is seen as a factor favouring further weakness in the Australian currency in the near term. Underpinning this prospect emerges the latest inflation data in Australia, where disinflationary pressures gathered extra steam towards the end of last year, as both the Inflation Rate and the RBA’s Monthly CPI Indicator rose by (much) less than initially estimated by 4.1% in Q4 and by 3.4% in December, respectively.

Next on tap in the domestic calendar are the December readings for Home Loans and Investment Lending for Homes.

AUD/USD daily chart

AUD/USD short-term technical outlook

Further losses might prompt the AUD/USD to retest its 2024 level of 0.6508 (February 1), which is underpinned by the vicinity of the interim 100-day SMA (0.0.6529) and the December 2023 low. Extra weakening from here should not meet any contention of significance until the 2023 bottom of 0.6270 (October 26) ahead of the round level of 0.6200, all of which precede the 2022 low of 0.6169 (October 13). On the upside, there is a brief obstacle at the 55-day SMA of 0.6644. The breakout of this zone may inspire the pair to set sails for the December 2023 high of 0.6871 (December 28), prior to the July 2023 top of 0.6894 (July 14) and the June 2023 peak of 0.6899 (June 16), just before the key 0.7000 level.

The 4-hour chart shows initial contention near the 0.6500 neighbourhood for the time being. Once this area is cleared, there is no major disagreement until 0.6452. On the bullish side, 0.6624 is an immediate obstacle ahead of the 200-SMA at 0.6681. The break of this zone suggests a possible advance to 0. 6728.The MACD remains slightly in the negative zone, while the RSI rises to 35.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.