AUD/USD Forecast: Further declines expected in the near-term

AUD/USD Current Price: 0.7760

- Upbeat Australian employment data were not enough to push aussie higher.

- The poor performance of Wall Street and higher US Treasury yields backed the greenback.

- AUD/USD is at risk of falling during the upcoming hours, mainly on a break below 0.7730.

The Australian dollar advanced to 0.7848 against its American rival, helped by an upbeat employment report. Australia added 88.7K new jobs during February, all full-time positions. The unemployment rate decreased to 5.8%, while the participation rate held steady at 66.1%. The pair turned south as the greenback gathered momentum alongside rising US Treasury yields, while the poor performance of Wall Street added pressure on the pair. During the upcoming Asian session, Australia will publish the preliminary estimate of February Retail Sales, foreseen at 0.4% MoM.

AUD/USD short-term technical outlook

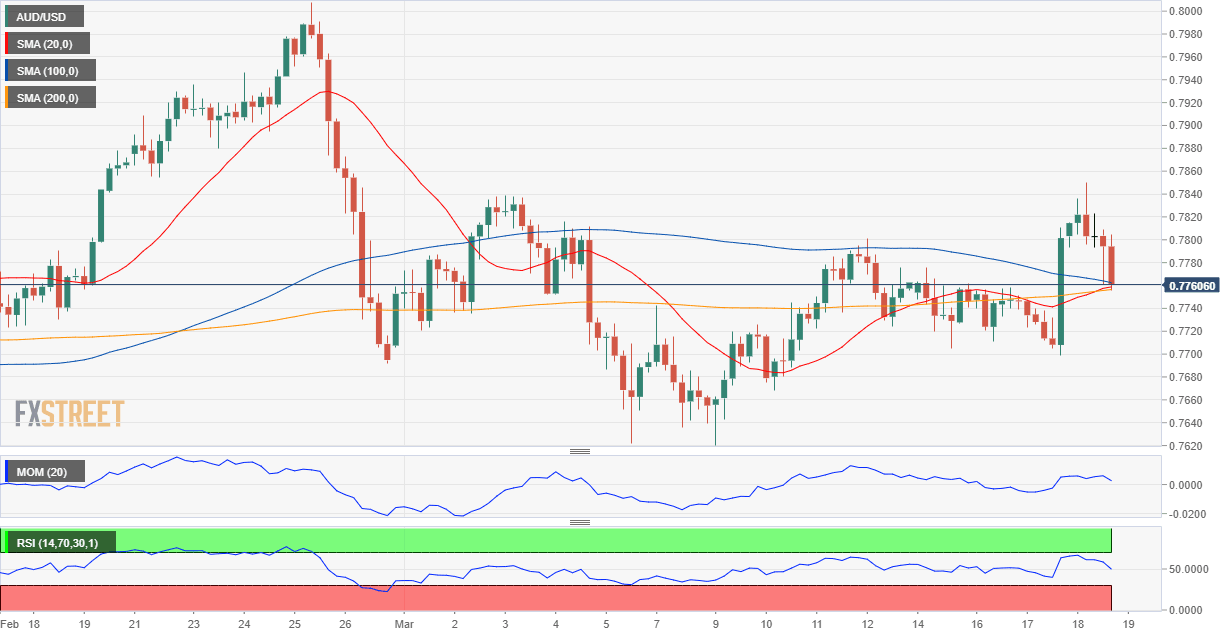

The AUD/USD pair trades near daily lows in the 0.7760 price zone heading into the Asian opening. The 4-hour chart shows that moving averages are confined to a tight 15 pips range, a sign of absent directional strength. The price is at the upper end of the mentioned range, while technical indicators turned sharply lower within positive levels, approaching their midlines. The risk has turned to the downside, with additional declines expected on a break below 0.7730, the immediate support.

Support levels: 0.7730 0.7690 0.7650

Resistance levels: 0.7820 0.7855 0.7900

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.