AUD/USD Forecast: Focus now shifts to US inflation

- AUD/USD advanced modestly on Wednesday.

- Australian CPI lent support to a pause by the RBA.

- Next risk event will be the release of US CPI.

In line with the broad-based positive sentiment in the risk-associated space, AUD/USD clocked a decent advance on Wednesday, this time managing to reclaim, albeit briefly, the area north of 0.6700 the figure.

The small pullback in the greenback prompted the USD Index (DXY) to keep orbiting around the low-102.00s amidst the continuation of the downward bias in US yields, at a time when market participants kept their focus on the imminent release of US inflation figures gauged by the CPI and their implication on the Fed’s plans to start trimming its interest rates.

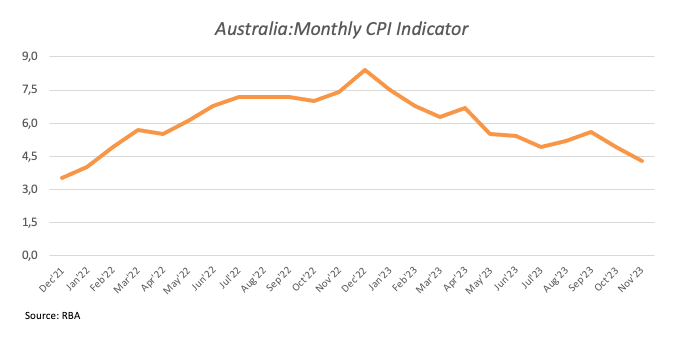

Speaking about inflation, consumer prices in Australia rose less than initially estimated by 4.3% in the year to November, the slowest rate since January 2022 when tracked by the RBA’s Monthly CPI Indicator. Indeed, further signs of disinflationary pressures in the economy could prompt the central bank to stay on the sidelines at its upcoming meeting in February, despite inflation continuing to run well above the bank’s target.

In addition, the mixed performance of the commodity complex saw copper prices regain some composure following their decline since late December, while iron ore traded slightly on the defensive, although keeping the $140.00 barrier per tonne intact.

Looking at Friday’s docket in Oz, Trade Balance figures are expected to show a A$7.5B trade surplus in November (vs. October’s A$7.129B).

AUD/USD short-term technical outlook

The resumption of the selling pressure could drag AUD/USD to the 2024 low of 0.6640 (January 5) before reaching the 200-day SMA at 0.6581. The December 2023 low of 0.6525 comes next ahead of the intermediate 100-day SMA of 0.6502. If bulls regain control, the attention will shift to the December 2023 top of 0.6871 (December 28), which will emerge before the July 2023 peak of 0.6894 (July 14) and the June high of 0.6899 (June 16). If the pair breaks out of this range, the psychological level of 0.7000 will be the next to be watched.

The significant conflict zone, according to the 4-hour chart, is approximately 0.6650. There are no notable disagreement levels until 0.6525 and 0.6452 if this zone is exceeded. The MACD remains in the negative zone, and the RSI approaches 40, both of which appear to signal additional losses in the near future. The bullish trend, on the other hand, may face first resistance around the 55-SMA at 0.6752, which is seen as the last line of defense before the previous top at 0.6870.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.