AUD/USD Forecast: Extra gains appears on the cards near term

- AUD/USD advances to five-week highs past 0.6600.

- Further weakness in the Greenback sustains the pair’s upside.

- Australian Balance of Trade figures came in a tad below estimates.

The intense decline in the US Dollar (USD) bolstered risk-associated assets once again on Thursday, lifting AUD/USD to the area above the 0.6600 mark for the first time since late January.

The Greenback’s extra losses aligned with the continuation of the multi-session retracement in US yields across the board, always amidst ongoing speculation regarding the Federal Reserve's anticipated first interest rate cut, slated for June.

The Greenback experienced additional weakness following Chair J. Powell's remarks on Wednesday and Thursday during his testimonies, which broadly matched markets’ expectations. Powell indicated that while the Federal Reserve still plans to lower its benchmark interest rate later in the year, there are uncertainties regarding sustained progress in combating inflation.

Apart from the negative sentiment surrounding the US Dollar, the upbeat sentiment in the commodity market also contributed to the Aussie's strength on Thursday, particularly following the improvements of both prices of copper and iron ore

Looking at the broader scenario, developments in China are poised to impact the AUD: Potential stimulus measures in China might offer temporary relief, but a sustained improvement of economic indicators is essential for bolstering the Australian currency and potentially initiating a robust upward trend in the pair

Additionally, the Reserve Bank of Australia's cautious approach, as one of the last major central banks to consider interest rate cuts, acts as a restraint on the downside potential of the pair.

In the Australian docket, Balance of Trade figures showed a A$11.027B surplus in January, while Home Loans contracted by 4.6% MoM in January and Investment Lending for Homes dropped by 2.6% from a month earlier.

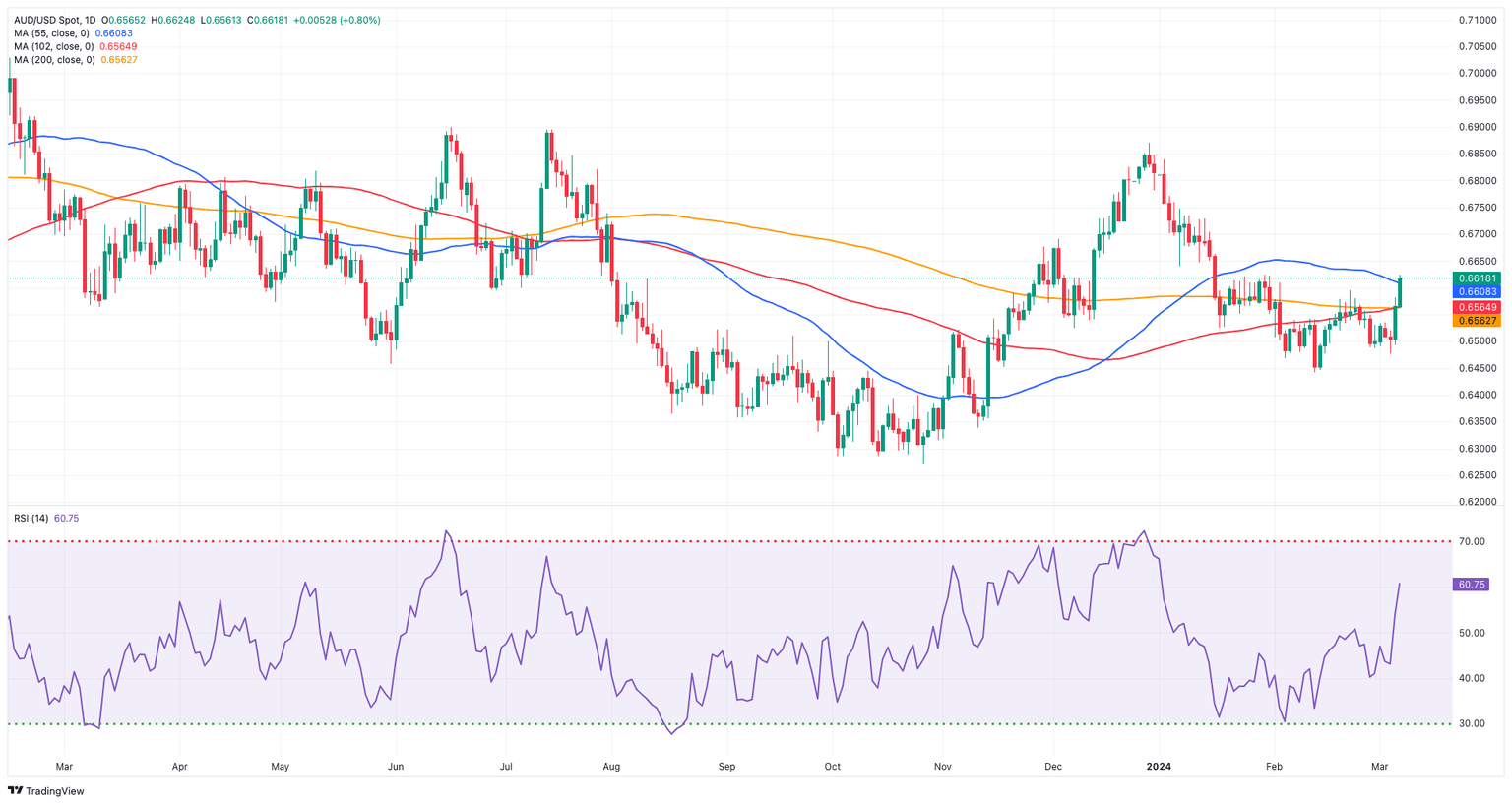

AUD/USD daily chart

AUD/USD short-term technical outlook

Next on the upside for AUD/USD is the weekly high of 0.6624 (January 30). A break above this range might lead to the December 2023 top of 0.6871 (December 28), followed by the July 2023 peak of 0.6894 (July 14) and the June 2023 high of 0.6899 (June 16), all before the critical 0.7000 barrier.

If sellers reclaim control, the pair may encounter early resistance at the so-far March low of 0.6477 (March 5) prior to the 2024 low of 0.6442 (February 13). Breaking below this level may result in a visit to the 2023 low of 0.6270 (October 26), followed by the round level of 0.6200 and the 2022 low of 0.6169 (October 13).

It is worth noting that the AUD/USD's positive bias should remain unchanged while above the critical 200-day SMA at 0.6560.

According to the 4-hour chart, spot appears to have broken above the recent consolidation zone. However, the initial hurdle now emerges at 0.6624, followed by 0.6728. On the other hand, the 200-SMA at 0.6549 offers immediate contention, seconded by 06477 and then 0.6442. Furthermore, the MACD regains further upside traction and the RSI eases a tad to 73.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.