AUD/USD Forecast: Downside momentum limited near 0.6700

- AUD/USD kept the bearish mood unchanged on Thursday.

- The US Dollar regained traction and weighed on the pair.

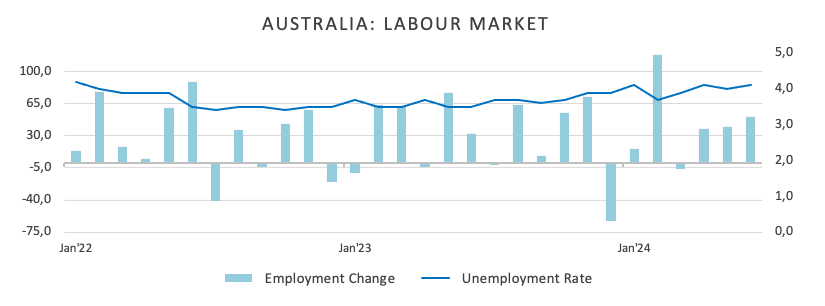

- The Australian labour market report came in mixed.

The marked uptick in the US Dollar (USD) saw AUD/USD extend its downward trajectory further on Thursday. The downtick, however, remained contained around the low 0.6700s.

The pair's consecutive losses were driven by the resumption of the upside impetus in the Greenback, which was reinforced by higher US yields, always amidst steady speculation of an interest rate cut by the Federal Reserve (Fed) as early as September.

Market expectations of a reduction of rates by the Fed accelerated after Chair Jerome Powell remarked earlier in the week that the three US inflation readings for the second quarter "slightly increase confidence" that inflation is moving towards the Fed's target in a stable manner. Powell's comments appear to have heightened anticipation of rate cuts sooner than previously expected.

Still around the Fed, Chicago Federal Reserve Bank President Austan Goolsbee argued that the US economy appears to be returning to a 2% inflation target after an uptick earlier this year, suggesting that he is becoming more confident that the time to cut interest rates may be approaching.

In other news, the persistent decline in copper prices and further retracements in iron ore prices contributed to the negative sentiment towards the Aussie dollar.

Regarding monetary policy, it appears the Reserve Bank of Australia (RBA) will be the last G10 central bank to start lowering interest rates.

In its latest meeting, the RBA maintained a hawkish stance, keeping the official cash rate at 4.35% and signalling flexibility for future decisions. The meeting minutes revealed that officials considered another rate hike to curb inflation but decided against it, partly due to concerns about a potential sharp slowdown in the labour market.

That said, the RBA is in no rush to ease policy, expecting that it will take time for inflation to consistently fall within the 2-3% target range.

Potential Fed easing in the medium term, in contrast to the RBA’s likely prolonged restrictive stance, could support AUD/USD in the coming months. However, concerns about slow momentum in the Chinese economy might hinder a sustained recovery of the Australian currency as China continues to face post-pandemic challenges. The persistent lack of traction in Chinese inflation could prompt some stimulus from the People’s Bank of China (PBoC), which might eventually support the AUD, although disappointing Q2 GDP figures are likely to temper any optimism.

On the data front, the Australian labour market report showed mixed results after the Unemployment Rate ticked higher to 4.1% in June and the Employment Change increased by 50.2 individuals in the same period.

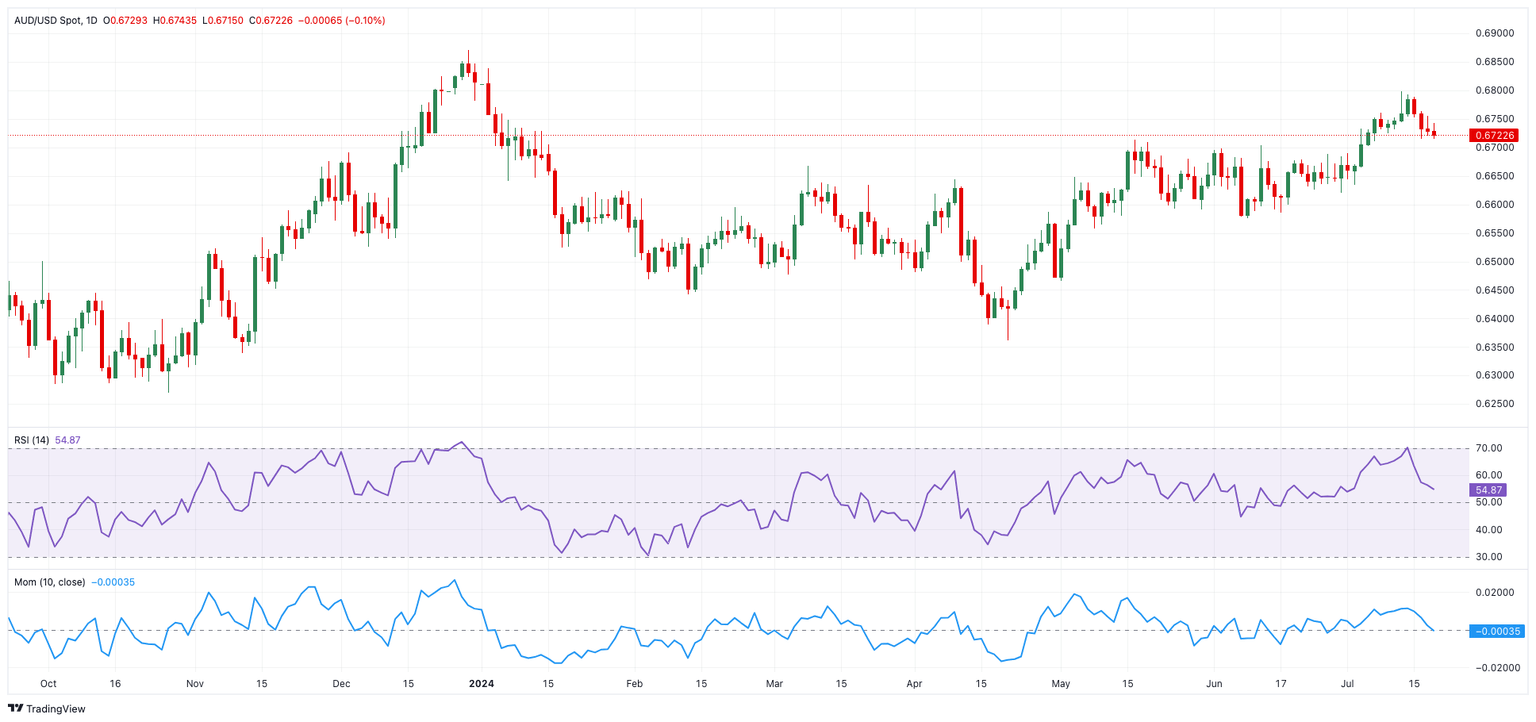

AUD/USD daily chart

AUD/USD short-term technical outlook

Further losses in AUD/USD should find temporary support at the 55-day SMA of 0.6661. If the pair breaks through this level, it might target the June low of 0.6574 (June 10), which appears to be supported by the important 200-day SMA (0.6578). From here, the May low of 0.6465 is followed by the 2024 bottom of 0.6362 (April 19).

If buyers recover some momentum, the immediate goal is the July high of 0.6798 (July 8), followed by the December 2023 top of 0.6871, the July 2023 peak of 0.6894 (July 14), and the 0.7000 yardstick.

Overall, the uptrend should continue as long as the AUD/USD trades above the 200-day SMA.

The 4-hour chart shows some consolidative fashion in the near term. Against this, the immediate support is 0.6714, which is supported by the 100-SMA at 0.6716, and comes ahead of the 200-SMA at 0.6678. On the upswing, the first obstacle is the 55-SMA of 0.6748, closely followed by 0.6754 and then 0.6798. The RSI dropped to about 41.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.