AUD/USD Forecast: Constructive bias persists above the 200-day SMA

- AUD/USD maintained its bullish stance well in place above 0.6700.

- The US Dollar traded on the defensive ahead of US CPI.

- Australian Consumer Inflation Expectations come on Thursday.

Another firm session saw AUD/USD extend its advance further north of the 0.6700 barrier on Wednesday, adding to Tuesday’s gains and trading closer to recent monthly highs in the 0.6760-0.6765 band (July 8).

The pair’s second uptick in a row was driven by an incipient weakness in the US Dollar (USD), as investors parsed Chief Jerome Powell's second semi-annual testimony before Congress. On this, Powell adopted a cautious stance on the potential timing of a Federal Reserve (Fed) interest rate cut, indicating that more evidence of inflation trending towards the target is necessary before making any rate adjustments.

In a more domestic scenario, the Australian dollar's uptick was influenced by some signs of life in copper and iron ore prices, which managed to dissipate part of the recent bearishness.

In terms of monetary policy, the Reserve Bank of Australia (RBA), like the Federal Reserve (Fed), is expected to be among the last G10 central banks to begin cutting interest rates.

In its latest meeting, the RBA maintained a hawkish stance, keeping the official cash rate at 4.35% and expressing flexibility for future decisions. The Minutes from that meeting revealed that the decision to hold the policy rate was primarily due to "uncertainty around consumption data and clear evidence of financial stress among many households."

Overall, the RBA is in no rush to ease policy, expecting that it will take some time before inflation is sustainably within the 2-3% target range. There is approximately a 25% probability of a rate reduction in August, rising to around 50% in the subsequent months.

Moreover, the potential easing by the Fed, contrasted with the RBA's likely prolonged restrictive stance, could support AUD/USD in the coming months.

However, concerns about sluggish momentum in the Chinese economy might impede a sustained recovery of the Australian currency as China continues to face post-pandemic challenges. Something to bear in mind is the persistent lack of traction in Chinese inflation, which could eventually morph into some sort of stimulus from the PBoC. According to latest data, the Inflation Rate in China rose by 0.2% in. the year to June and contracted by 0.2% vs. the previous month. Furthermore, Producer Prices contracted by 0.8% from a year earlier.

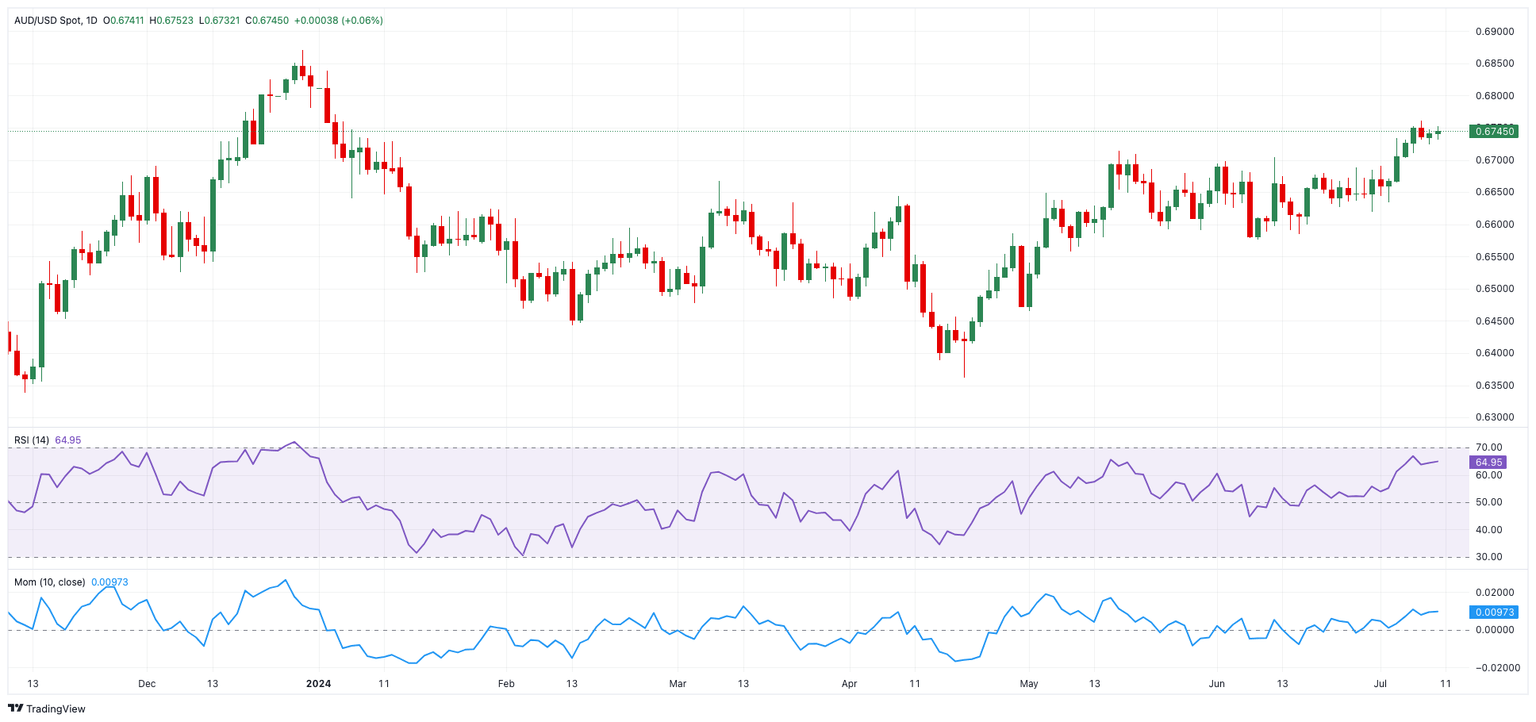

AUD/USD daily chart

AUD/USD short-term technical outlook

If bulls push further and AUD/USD clears the July high of 0.6761 (July 8), it might challenge the December 2023 top of 0.6871, followed by the July 2023 peak of 0.6894 (July 14), all ahead of the critical 0.7000 barrier.

Bearish attempts, on the other hand, might push the pair lower, first to the June low of 0.6574 (June 10) and then to the important 200-day SMA of 0.6567. A further dip might result in a return to the May low of 0.6465 and the 2024 bottom of 0.6362 (April 19).

Overall, the uptrend should continue as long as AUD/USD is above the 200-day SMA.

The 4-hour chart reveals that the pair is trapped inside a consolidative range. However, 0.6761 looks to be the early obstacle, ahead of 0.6871. On the other hand, 0.6709 offers immediate support, ahead of the 55-SMA of 0.6703. The RSI eased to approximately 58.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.