AUD/USD Forecast: Bulls maintain the pressure near 0.7600

AUD/USD Current Price: 0.7581

- Australian trade surplus shrank to A$1,958 million in November.

- The positive tone of equities underpinned the AUD/USD.

- AUD/USD is bullish according to intraday charts, could run past 0.7640.

The AUD/USD pair has edged higher this Wednesday, helped by persistent dollar’s weakness and the better tone of equities, amid hopes for a Brexit deal. The aussie advanced despite the Australian trade surplus came in at A$1,958 million, a drop from the previous month's A$7,456 million, according to November’s preliminary estimate. Imports were up by 11%, while exports increased by a modest 1%. The country also published November Private Sector Credit, which printed at 0.1% MoM. Australian markets will remain close on Thursday.

AUD/USD short-term technical outlook

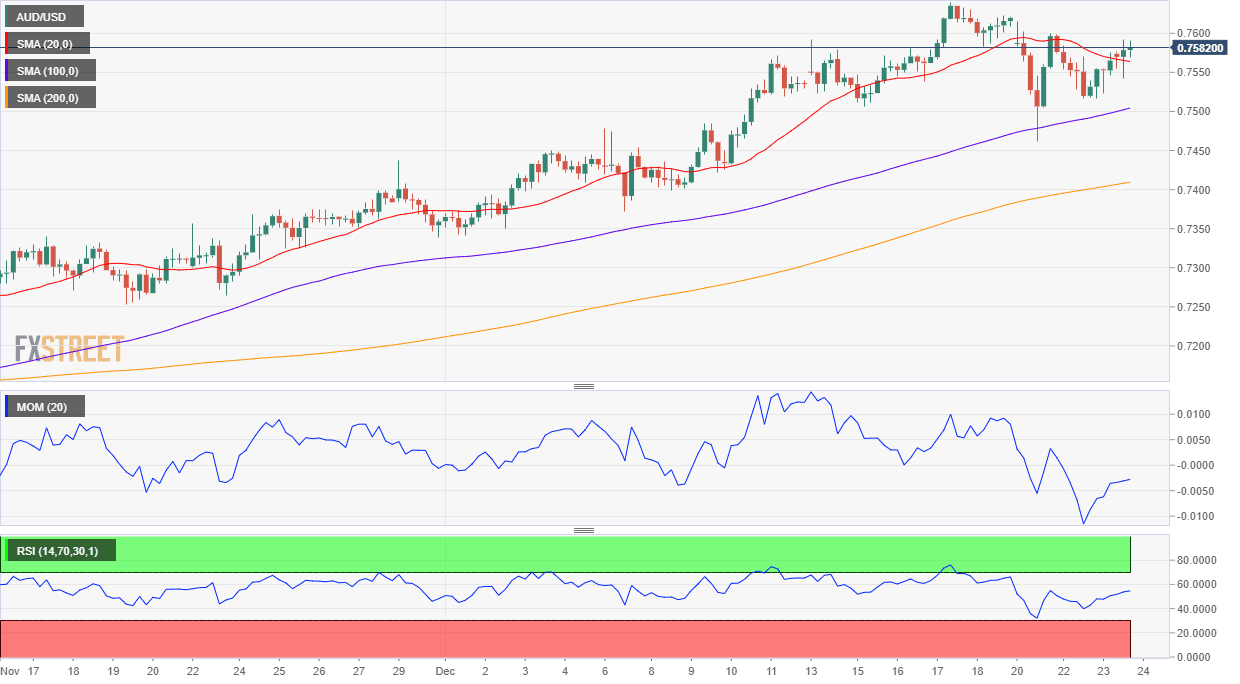

The AUD/USD pair is bullish in the near-term. The 4-hour chart shows that it has advanced above a mildly bearish 20 SMA, while the longer ones keep advancing below the shorter one. Technical indicators remain at daily highs well into positive territory, favoring another leg higher, mainly if the pair regains the 0.7600 threshold.

Support levels: 07550 0.7515 0.7470

Resistance levels: 0.7600 0.7640 0.7680

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.