AUD/USD Forecast: Bears maintain the pressure ahead of the RBA’s decision

AUD/USD Current Price: 0.6387

- Australian inflation surged by more than anticipated in October, according to TD Securities Inflation.

- The Reserve Bank of Australia will announce its monetary policy decision on Tuesday.

- AUD/USD is technically bearish in the near term, but further slides depend on the RBA.

The AUD/USD pair trades in the 0.6380 price zone, falling on Monday for a third consecutive day. The Australian dollar was hit by Chinese figures, as the official NBS Manufacturing PMI fell to 49.2 in October, while the Non-Manufacturing PMI slid to 48.7, missing the market’s estimates and signaling a steep contraction in business activity.

Australian data added pressure on the pair as October TD Securities Inflation surged by 5.2% YoY, higher than the previous 5%. Private Sector Credit, in the meantime, increased a modest 0.7% MoM in September.

Finally, the sour tone of global equities maintained the pair on the losing side. Equities eased as global inflation figures show that aggressive quantitative tightening has done little to take price pressures down. Speaking of which, the Reserve Bank of Australia will announce its decision on monetary policy first thing Tuesday.

Governor Philip Lowe and co are anticipated to proceed with a modest 25 bps rate hike amid the risk of a recession, although a 50 bps is not completely out of the table. The Australian Consumer Price Index (CPI) rose by 1.8% in the third quarter of the year, while the annualized pace of inflation hit 7.3%. The Trimmed Mean CPI, which tends to soften the average prices´ increase, rose by 6.1% YoY, the highest reading since the series commenced two decades ago.

AUD/USD short-term technical outlook

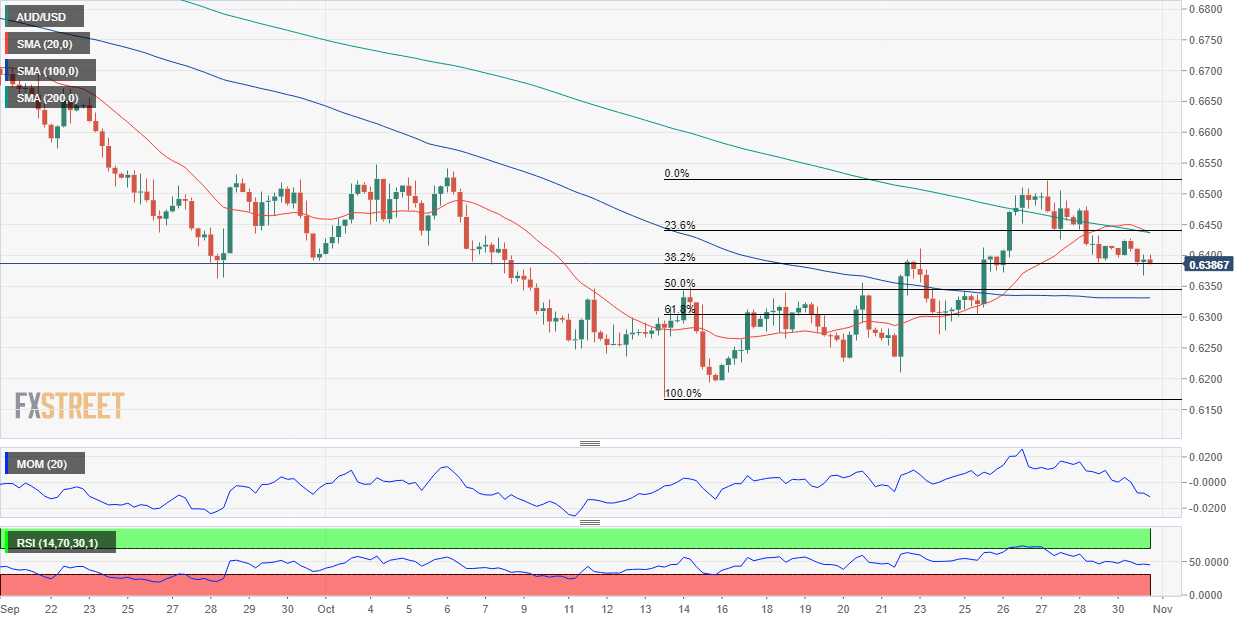

The AUD/USD pair is hovering around the 38.2% retracement of its latest daily run measured between 0.6169, the year low, and 0.6521, at 0.6385. The daily chart shows that the pair is also above a mildly bearish 20 SMA, which stands a few pips below the daily low. The longer moving averages keep heading south far above the current level, maintaining the long-term bearish trend in place. In the meantime, the Momentum indicator remains flat above its 100 level, but the RSI indicator already turned south, now standing at around 47.

The pair is at risk of falling, according to the 4-hour chart, as the pair trades below bearish 20 and 100 SMAs, both converging with the immediate Fibonacci resistance at 0.6440. Technical indicators, in the meantime, consolidating within negative levels after a failed attempt to advance. The 61.8% retracement of the aforementioned rally provides relevant support at around 0.6305, with a break below it opening the door for a retest of the year low.

Support levels: 0.6345 0.6305 0.6270

Resistance levels: 0.6440 0.6495 0.6540

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.