AUD/USD Forecast: Bearish divergences suggest Aussie may turn south

AUD/USD Current Price: 0.6657

- RBA’s Governor Lowe said that the economy might be in a better condition than originally feared.

- The Aussie’s advance could be once again attributed to equities’ rally.

- AUD/USD is holding near a fresh multi-week high but further gains at doubt.

Having started the day with a soft tone, the AUD/USD pair is ending it with gains near the multi-week high set this Wednesday at 0.6679. RBA’s Governor Lowe spoke at the beginning of the day and backed the Aussie by saying that the economy may be in a better condition than originally feared, adding that the stimulus package launched in March seems to be performing well. On rates, Lowe said that they are unlikely to rise for some years.

The pair’s rally, however, was once again the result of equities’ solid performance and the dollar’s broad weakens. Early on this Friday, Australia will publish Private Sector Credit for April.

AUD/USD short-term technical outlook

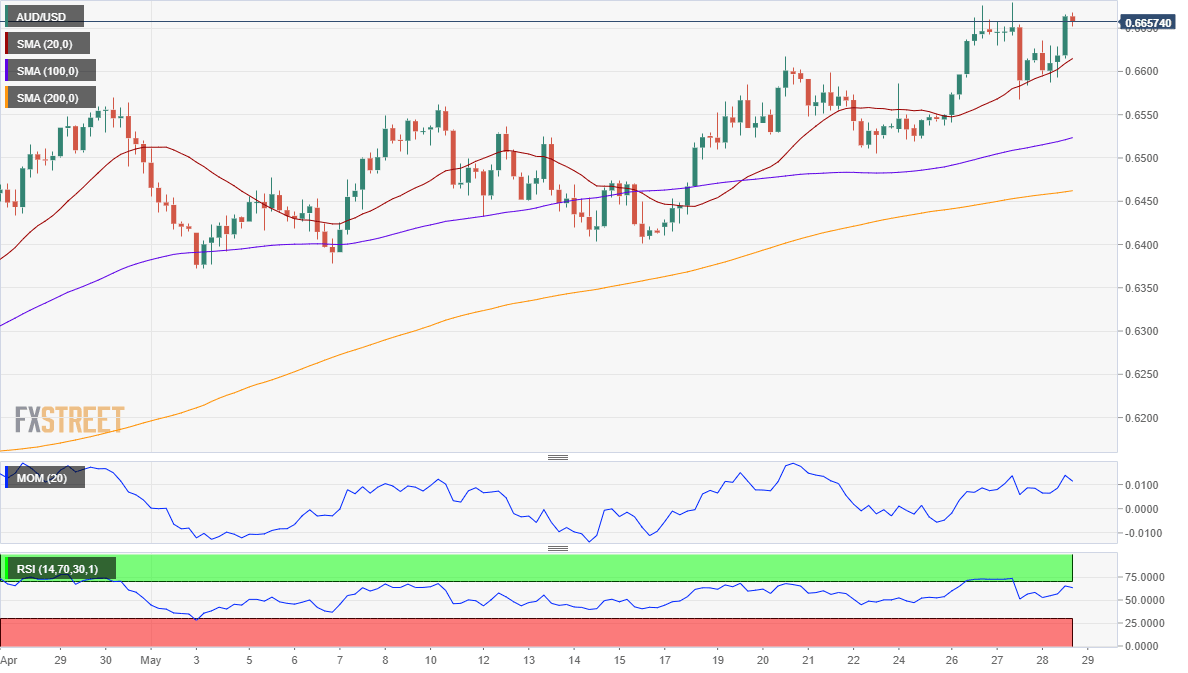

The AUD/USD pair is trading in the 0.6650 price zone, and the 4-hour chart shows that a bullish 20 SMA continued to provide dynamic support. Still, the bullish potential seems limited, at least as long as the pair remains below the 0.6680 price zone, as the Momentum indicator keeps heading lower, now approaching its 100 level, drawing a clear divergence. The RSI indicator barely retreats, currently at around 61.

Support levels: 0.6635 0.6590 0.6545

Resistance levels: 0.6685 0.6720 0.6760

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.