AUD/USD flips back to recent lows after RBA’s decision

-

AUDUSD gives up gains after RBA’s inflation comments.

-

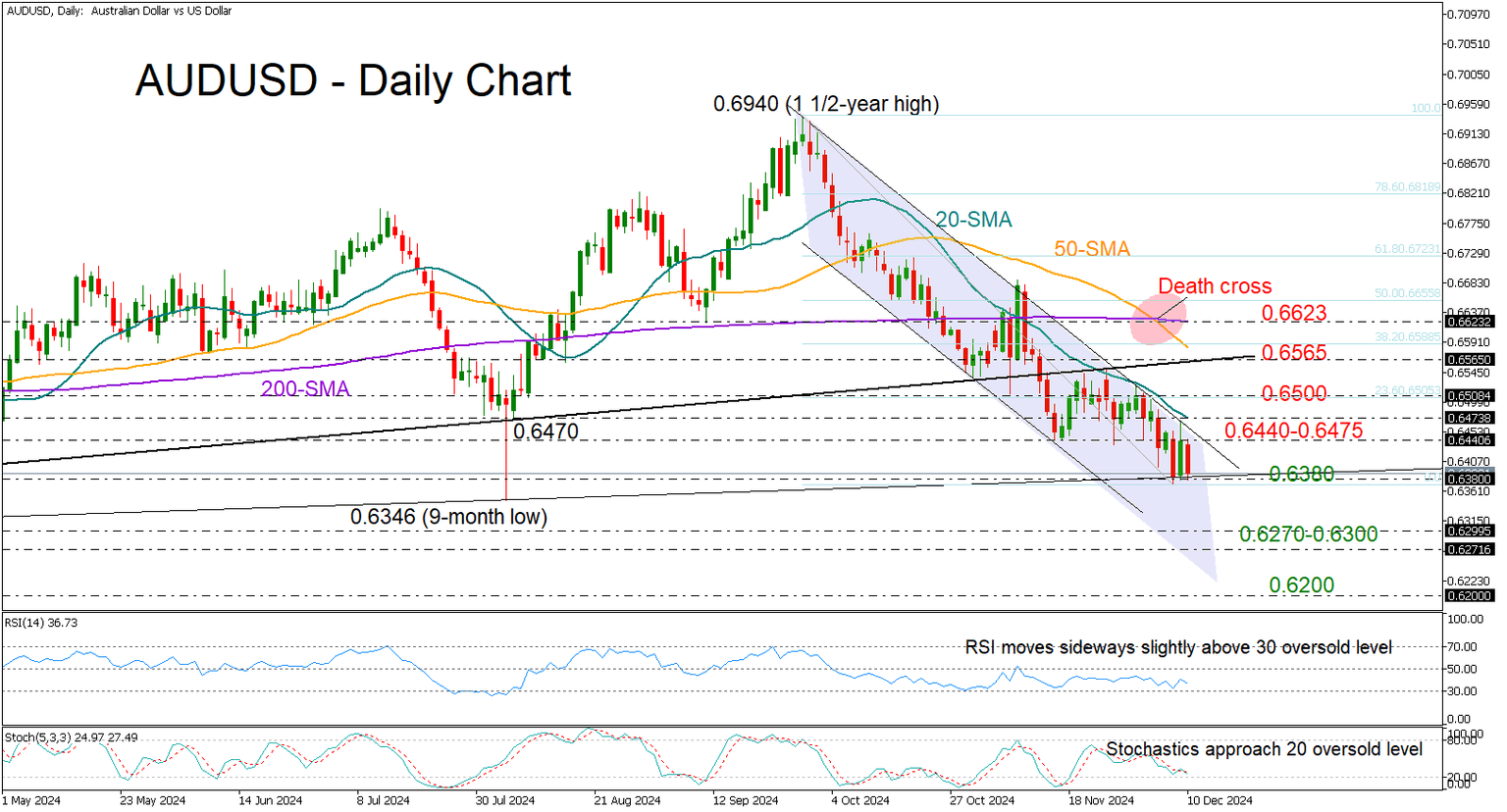

Trend signals remain negative, support is nearby at 0.6380.

AUDUSD erased Monday’s rebound following the Reserve Bank of Australia’s (RBA) well anticipated decision to keep interest rates unchanged at 4.35%. The central bank’s comments on easing inflation pressures led investors to bet on a rate cut as early as February, adding pressure on the aussie.

The pair pulled below the 0.6440 barrier to trade again near the 0.6380 area, where the familiar support trendline from 2022 is sitting. The RSI and the stochastic oscillator are approaching their oversold levels, suggesting selling interest could soon fade out. However, if that floor cracks, the next pivot point could be found within the critical 0.6270-0.6300 territory last seen in October 2023. A continuation lower could pause within the 0.6170-0.6200 zone taken from October 2022.

For the bulls to regain control, the pair may have to run sustainably above the bearish channel and the 20-day simple moving average (SMA) at 0.6470. If such efforts prove successful, the door could open for the 0.6500 round mark and then for the 0.6565 constraining zone, where the broken support trendline from October 2023 is located. Additional gains from there would officially declare a bullish trend reversal in the short-term picture, bringing the 200-day SMA next into view at 0.6620. However, with the 50-day SMA crossing recently below the 200-day SMA for the first time since April 2023, hopes for a trend reversal could stay muted.

All in all, AUDUSD continues to face a bearish outlook in the short-term picture, though another recovery attempt or a consolidation phase cannot be ruled out as the price seems to be approaching oversold territory.

Author

Christina joined the XM investment research department in May 2017. She holds a master degree in Economics and Business from the Erasmus University Rotterdam with a specialization in International economics.