AUD/USD Analysis: Traders seem non-committed amid banking crisis jitters, ahead of FOMC

- AUD/USD retreats from a nearly two-week high touched earlier during the Asian session on Monday.

- Fears of a global banking crisis benefit the safe-haven USD and weigh on the risk-sensitive Aussie.

- Traders now look to the RBA meeting minutes on Tuesday ahead of the crucial FOMC policy decision.

The AUD/USD pair struggles to capitalize on its modest Asian session gains and retreats from a nearly two-week high touched earlier this Monday. Despite the recent emergency liquidity measures and multi-billion-dollar lifelines for troubled banks in the US and Europe, concerns about the contagion risk and the possibility of a full-blown global banking crisis showed little signs of subsiding. This, in turn, tempers investors' appetite for riskier assets, which drives some haven flows towards the US Dollar and attracts fresh sellers around the risk-sensitive Aussie. Bulls, meanwhile, seem rather unimpressed by the fact that the People’s Bank of China (PBoC) unexpectedly cut its reserve requirement ratio on Friday and also kept its loan prime rates unchanged at record lows earlier today, to loosen support economic growth.

The upside for the USD, however, seems limited amid diminishing odds for a more aggressive policy tightening by the Federal Reserve. In fact, the markets are now pricing in a smaller 25 bps lift-off at this week's FOMC meeting, starting on Tuesday, and the US central bank will cut rates during the second half of the year. The bets were lifted by the disappointing release of the Michigan US Consumer Confidence Index on Friday, which fell from 67.0 to 63.4 for March. Adding to this, the survey's reading of one-year inflation expectations fell from 4.1% in February to 3.8% - the lowest since April 2021 - and the five-year inflation outlook dropped to 2.8%. This has been a key factor behind the recent sharp decline in the US Treasury bond yields, which might cap the USD and help limit deeper losses for the AUD/USD pair.

In fact, the rate-sensitive 2-year US government bond last week recorded its biggest three-day slump since Black Monday in October 1987 and might hold back the USD bulls from placing aggressive bets. Traders might also prefer to wait for the release of the Reserve Bank of Australia's (RBA) monetary policy meeting minutes, due during the Asian session on Tuesday. Moreover, there isn't any relevant market-moving US economic data due for release on Monday. This further makes it prudent to wait for strong follow-through selling before confirming that the AUD/USD pair's recovery move from the 0.6565 area, or its lowest level since November 2022, has run its course and positioning for any further depreciating move. In the meantime, the broader risk sentiment could influence the USD and provide some impetus to the major.

Technical Outlook

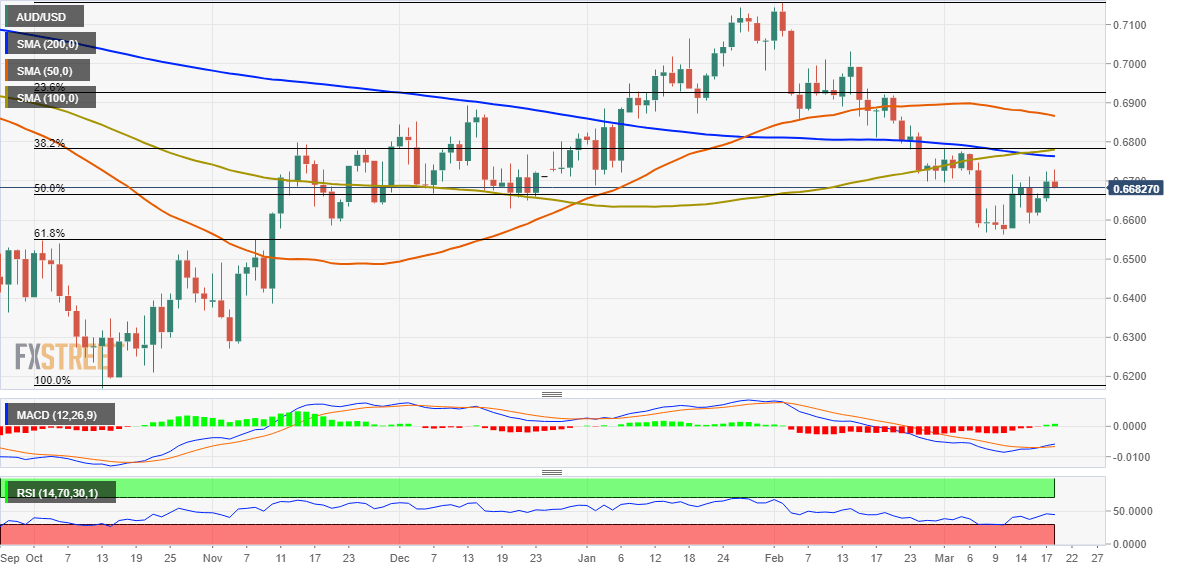

From a technical perspective, the recent repeated failures to capitalize on the momentum beyond the 0.6700 mark warrants some caution for the AUD/USD bulls. Moreover, oscillators on the daily chart - though have been recovering from lower levels - are yet to confirm a near-term positive outlook. That said, a move back above the daily swing high, around the 0.6730 region, has the potential to lift spot prices to the 0.6760-0.6770 confluence, comprising the 100-day and the 200-day Simple Moving Averages (SMA). Some follow-through buying will mark a fresh breakout and lift the pair beyond the 0.6800 mark, towards testing the 50-day SMA, currently around the 0.6860-0.6865 region.

On the flip side, any further slide below the 0.6660-0.6650 horizontal zone is likely to find some support near the 0.6620-0.6615 area ahead of the 0.6600 round figure. This is followed by the multi-month low, around the 0.6565 region, which coincides with the 61.8% Fibonacci retracement level of the rally from the October 2022 low. A convincing break below the latter will be seen as a fresh trigger for bearish traders and make the AUD/USD pair vulnerable to accelerate the fall towards testing the 0.6500 psychological mark before eventually dropping to the next relevant support near the 0.6410-0.6400 region.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.