AUD/USD analysis: Reacts to RBA statement

AUD/USD

On December 7, the Reserve Bank of Australia published an official monetary policy statement. In addition, the official cash rate was revealed. The announcement caused a recovery of the Australian Dollar's value. By 09:00 GMT, the rate had already recovered 43 base points or 0.60%.

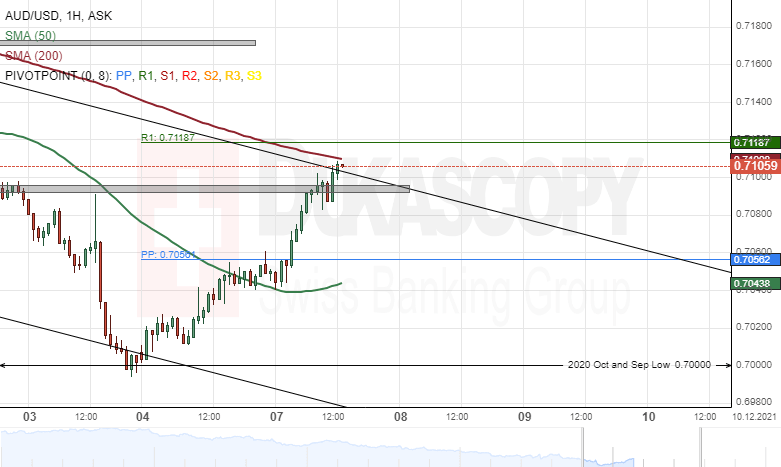

Meanwhile, from a technical analysis perspective, the rate had reached and pierced the resistance zone at 0.7092/0.7096. The pair did not extend its decline, as it found resistance in the 0.7100 level.

A passing of the 0.7100 level's resistance would most likely result in a test of the trend line, which connects the November 2, November 16 and December 1 high levels. In addition, note the 200-hour simple moving average near 0.7110 and the weekly R1 simple pivot point at 0.7119.

However, a decline of the AUD/USD might reach the support of the weekly simple pivot point at 0.7056, the 0.7050 mark and the 50-hour simple moving average near 0.7040. Below these levels, the 0.7000 mark might once again act as support.

Author

Dukascopy Bank Team

Dukascopy Bank SA

Dukascopy Bank stands as an innovative Swiss online banking institution, with its headquarters situated in Geneva, Switzerland.