AUD/USD Analysis: Bulls take control amid sluggish US Dollar ahead of US jobs report

- AUD/USD scales higher for the second straight day and rallies to a nearly two-week high.

- Reduced bets for another 25 bps Fed rate hike in June weigh on the USD and lend support.

- A positive risk tone further benefits the risk-sensitive Aussie ahead of the US NFP report.

The AUD/USD pair gains strong follow-through traction for the second successive day on Friday and climbs back above the 0.6600 mark, hitting a nearly two-week high during the Asian session. A combination of factors keeps the US Dollar (USD) depressed, which, in turn, is providing a lift to the major. Recent comments by a slew of Federal Reserve (Fed) officials force investors to scale back their expectations for another 25 bps lift-off at the upcoming FOMC meeting on June 13-14. In fact, Philadelphia Fed President Patrick Harker reiterated on Thursday that it’s time to at least hit the stop button for one meeting and see how it goes. This led to a further decline in the US Treasury bond yields, which, along with a generally positive risk tone, continues to weigh on the safe-haven buck and benefits the risk-sensitive Aussie.

A private survey showed Thursday that China’s manufacturing sector unexpectedly registered modest growth in May, raising hopes of a recovery in the world's second-largest economy. Furthermore, the passage of bipartisan legislation to lift the US government's $31.4 trillion debt ceiling and avert an unprecedented default boosts investors' confidence. The USD is further pressured by the overnight disappointing release of the US ISM Manufacturing PMI, which contracted for the seventh straight month, dropping to a lower-than-expected 46.9 in May. Meanwhile, Automatic Data Processing (ADP) reported that US private-sector employers added 278K jobs in May, down from 296K in the previous month. The reading, however, was well above consensus estimates for a reading of 170K, albeit failed to provide any meaningful impetus to the buck.

The Australian Dollar (AUD), on the other hand, continues to draw support from speculation that the Reserve Bank of Australia (RBA) could tighten its monetary policy further. In fact, RBA Governor Philip Lowe had warned on Wednesday that sticky prices could invite more rate hikes by the central bank. This was followed by the release of stronger domestic consumer inflation figures, bolstering the case for additional rate increases by the Australian central bank. The fundamental backdrop suggests that the path of least resistance for the AUD/USD pair is to the upside. Bulls, however, might refrain from placing fresh bets and prefer to wait on the sidelines ahead of the US monthly employment details, due for release later during the early North American session. The popularly known NFP report will drive the USD demand and provide fresh impetus to the pair.

Technical Outlook

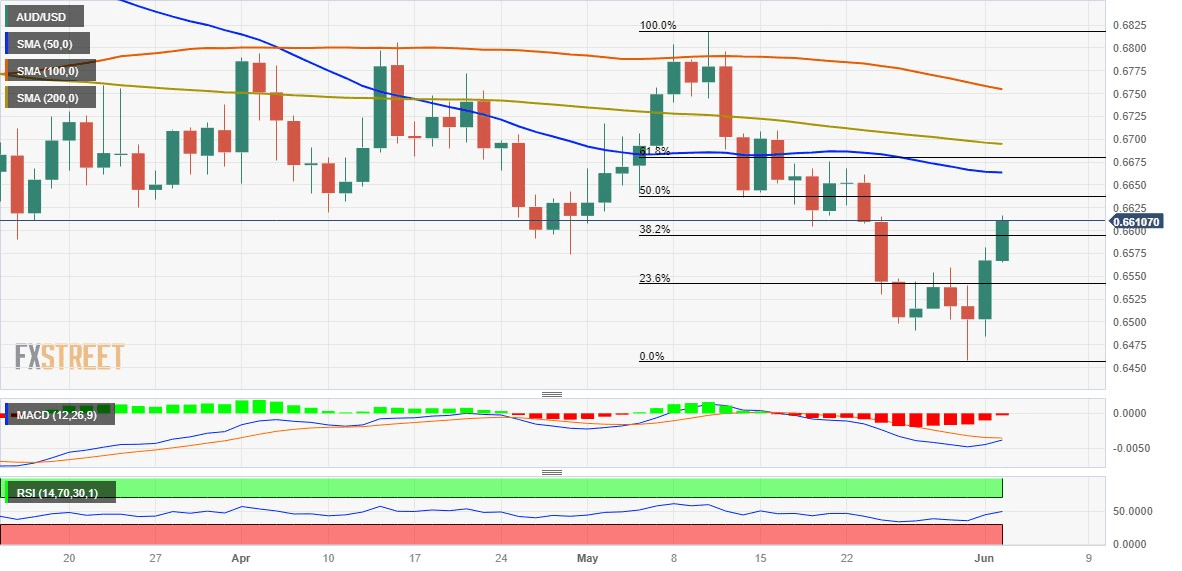

From a technical perspective, a sustained move above the 0.6600 mark, which coincides with the 38.2% Fibonacci retracement level of the downfall in May, could be seen as a fresh trigger for bullish traders. Moreover, oscillators on the daily chart have recovered from the negative territory and support prospects for an extension of this week's solid bounce from the lowest level since November 2022. Hence, a subsequent move beyond the 50% Fibo. level, around the 0.6635-0.6640 region, en route to the 50-day Simple Moving Average (SMA), currently pegged near the 0.6660 zone, looks like a distinct possibility. The next relevant hurdle is seen near the 0.6680-0.6690 confluence, comprising 61.8% Fibo. and the 100-day SMA, which if cleared decisively should pave the way for additional near-term gains.

On the flip side, any meaningful slide back below the 0.6600 mark (38.2% Fibo. level) might be seen as a buying opportunity and remain limited near the 23.6% Fibo. level, around the 0.6545-0.6640 region. Failure to defend these support levels could drag the AUD/USD pair back towards the 0.6500 psychological mark. Some follow-through selling will make spot prices vulnerable to accelerate the fall back towards challenging the YTD low, around the 0.6460-0.6455 region touched on Wednesday.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.