AUD/CAD: Battle of the commodity currencies

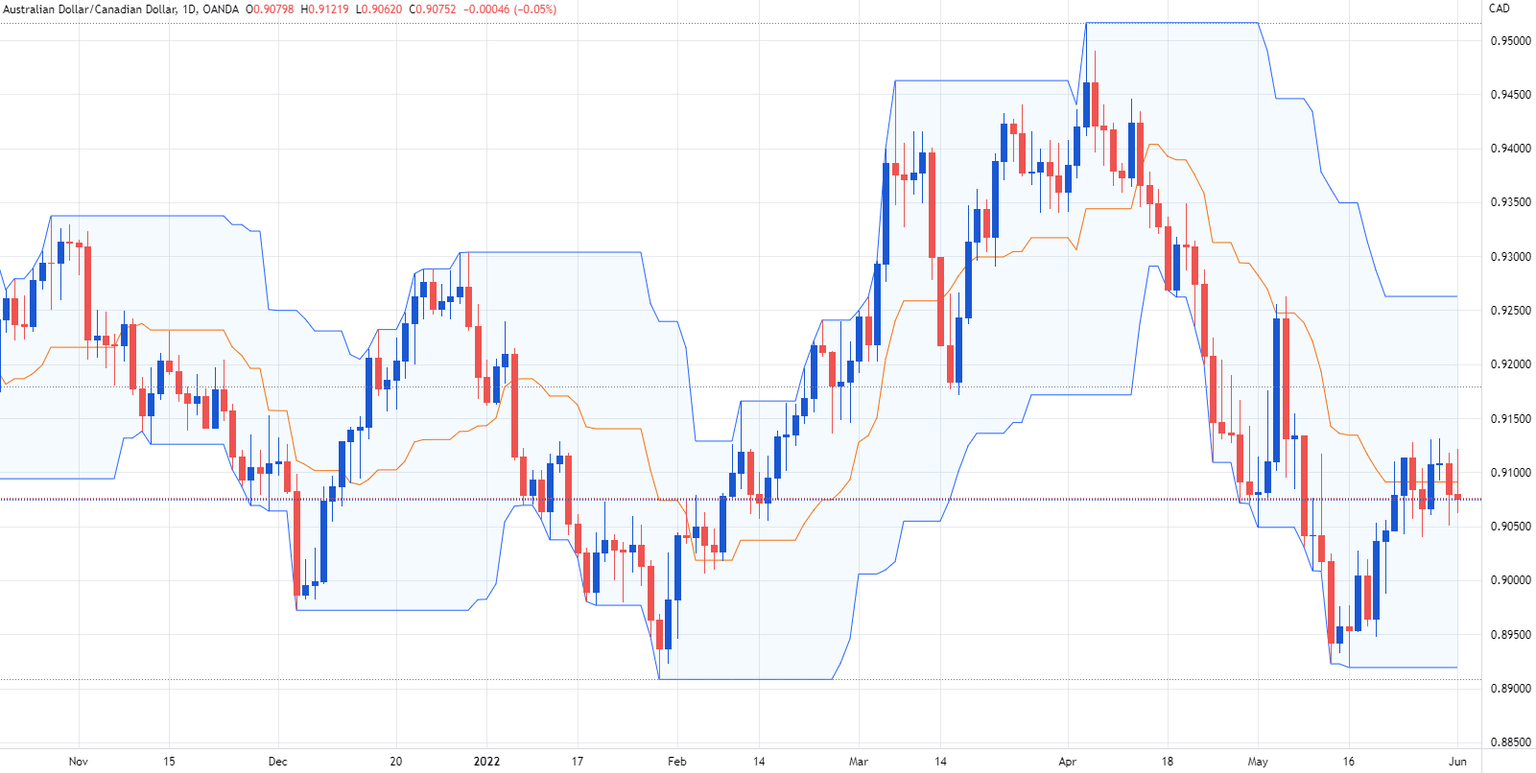

The AUDCAD pair has had an interesting year so far, with plenty of volatility.

A bearish January was followed by a 600 pip rise during February and March. Then, in April, a 400 pip sell off completely reversed the trend. The bearish momentum continued in the first half of May as well. The last time we saw this pair have a month with over 400 pips in one direction was at the beginning of the pandemic back in March and April 2020. So where do we stand now with the AUDCAD?

Looking at the daily chart with a Donchian Channels indicator, we can see price has been straddling the bottom channel for most of April, barely coming up to the equilibrium line. Only this past week have we seen the AUDCAD consolidate on top of the equilibrium line. Donchian Channels are a fair way to visualise the extreme prices of a pair compared to its moving average.

A big influence on this currency pair is the price levels of certain commodities. Notably, Canada is a major producer of crude oil, while Australia supplies roughly one-third of the world’s iron ore.

Generally, it can be said that Canada’s commodities are performing better than Australia’s. Crude oil has booked six consecutive months of gains, and Brent oil now trades at $115 per barrel (up from $68 per barrel). On the other hand, iron ore has booked half as many gainful months in the same time period, stagnating at ~$140 per tonne.

Moving forward, the EU banning Russian oil imports, the latest in a long line of oil-related crises, could be seen as a bullish event for the Canadian dollar. While, the reopening of China, and its factories re-energising their iron-ore imports, is on the side of the Australian.

Author

Mark O’Donnell

Blackbull Markets Limited

Mark O’Donnell is a Research Analyst with BlackBull Markets in Auckland, New Zealand.