Are commodities fading the global economic recovery?

Commodities are a leading indicator for economic growth. The recent plunge in pricing could indicate that the threads of the global economic recovery are quickly fraying. Alternatively it might be a final psychological reaction from pandemic frazzled traders culminating in the Omicron panic. Join FXStreet senior analysts Valeria Bednarik, Dhwani Metha, Eren Sengezer, Yohay Elam and Joseph Trevisani for a look at the commodity market from China to Wall Street.

Valeria Bednarik: So, the US Federal Reserve shook markets a bit this week, after Chief Powell said its time to drop the word “transitory” to describe inflation and warned that the Omicron Covid variant could slow job growth, and extend the supply chain disruption, the latter one of the reasons why inflation is skyrocketing. How concerned should we be? And what happens with employment?

Dhwani Mehta: Right but Omicron Covid variant is not that dreaded as thought last week and the US dollar fails to capitalize on Fed's hawkishness while risk trades seem to ignore the new variant.

Eren Sengezer: Powell sounded more worried about Omicron's impact on inflation rather than the economic activity.

Valeria Bednarik: Yups, but because Omicron may be a setback in economic progress while inflation stands at record highs…

Dhwani Mehta: Speaking on employment, Powell's comments to retire 'transitory' on inflation seems that the Fed could be doing away with its maximum employment goal, as he hinted at speeding up tapering and rate hikes.

Eren Sengezer: Fed is really concerned about wage inflation feeding into persistently high consumer inflation. They will have to define what "maximum employment" is because the participation rate is nowhere near pre-Covid levels.

Valeria Bednarik: Agreed. There's a lot to rethink these days. I was wondering whether soaring inflation is enough to trigger tightening, or if poor employment figures will be a drag in monetary policy decisions.

Dhwani Mehta: Yes, agreed. But I believe Friday's employment data is unlikely to alter Fed's tapering plan, in case it is going to accelerate the reduction in the asset purchases.

Valeria Bednarik: Yups, most likely scenario. A solid report should provide a boost to the greenback, as it will sort of confirm a tighter policy.

Eren Sengezer: I don't think the dollar has a lot more to offer to buyers at least until the December policy meeting. It took only a couple of hours for the US Dollar Index to erase the Powell-inspired spike earlier in the week.

Dhwani Mehta: Yes. The US dollar, although, may receive a lift on encouraging payrolls. The upside could be limited ahead of the Fed decision. Fed is finally expressing its concerns on hot inflation and it could only intensify if Omicron news, which are somewhat upbeat so far, turn south.

Valeria Bednarik: Well, the next Fed meeting is in a few days...

Dhwani Mehta: The good part is volatility in the market is back, especially in the bond market and commodities.

Valeria Bednarik: Yeah, we have volatility, but missing trends. Anyway, I do think that the dollar does have more to offer, particularly against gold and other metals, although I still can't see a clear oil slump.

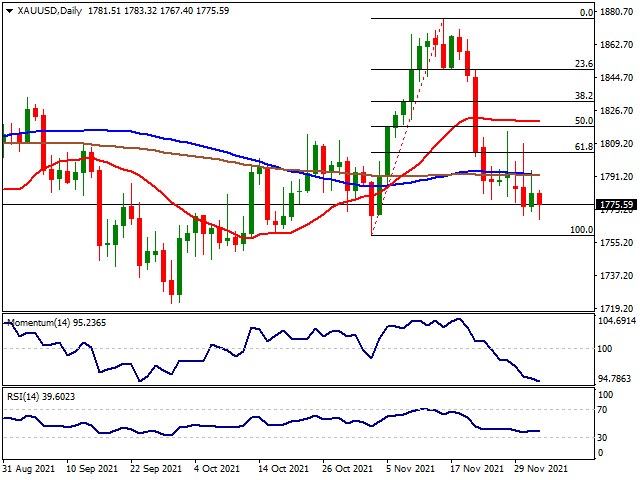

Dhwani Mehta: Gold price has been enjoying about $30-$40 movement on a daily basis over the past couple of weeks. And yes, there is no clear trend in commodities. Probably markets are awaiting more clarity on the new Covid variant and the final central banks' decisions of this year. The recent downtrend in commodities, however, could likely extend into the first half of 2022.

Valeria Bednarik: Yups. Gold seems to be offering better possibilities at the time being, en route to November's low at $ 1,758.81. A break below the level could see a quick slide towards the 1,700 figure after repeated failure at $1,800.

Eren Sengezer: So, you think gold lost its "inflation hedge" status?

Dhwani Mehta: I assume gold is sold on rallies as its status as 'inflation hedge' is likely to be outweighed by the global tightening spree. Which seems to accelerate in H2 2022 worldwide.

Valeria Bednarik: And its safe-haven status has weakened.

Dhwani Mehta: So all-time highs of $2075 is nowhere on the table for 2022. Gold could more or less maintain its range between $1700-$1900, with deeper declines seen below the longer-term support of $1,700.

Valeria Bednarik: Well, we are in a moment of high uncertainty. So I don't dare to discard a rally for 2022. Much depends on what the Fed and other central banks announce this month. Would the ECB remain "patient"? I don't bet on that. Central bankers are losing credibility, much worse than taking wrong decisions.

Dhwani Mehta: Well, for the dollar, the yields differential will remain in favor, as the ECB has been clear of a no-rate hike scenario at least in 2022. But again, it all depends on inflation and if it could move the ECB to act earlier.

Eren Sengezer: The ECB can adjust the PEPP, then the APP and continue to kick the can down the road. The Fed-ECB policy-divergence will remain in play at least in the first half of 2022 in my opinion.

Dhwani Mehta: Lol yeah, the least we can expect is some adjustment in the ECB's emergency stimulus. Yes, agreed. Until we have some clarity on Fed's tightening plans. Central bankers are expecting inflation to moderate in H2 2022.

Eren Sengezer: Well, they have been wrong so many times on inflation, I don't think markets will take their word for it. So, you don't like gold in 2022. Which commodity do you like?

Dhwani Mehta: I think the 2020 Commodities 'Super Cycle' will continue to remain on pause next year.

Valeria Bednarik: I like gold! Which girl doesn't? I just see it going down the hill.

Dhwani Mehta: Haha nice one, Val!

Valeria Bednarik: And would expect other bright metals to follow suit.

Eren Sengezer: I actually like aluminum.

Dhwani Mehta: Amongst the precious metals, it’s time for Platinum to shine... Rather outshine next year.

Valeria Bednarik: Cooper, on the other hand, may soon turn lower. Another sign metals could enter a selling spiral. It's forming a double top clear in the daily chart, and close to the neckline of the figure at 3.95.

Yohay Elam: Technically copper is under pressure, but electric cars need more copper than traditional ones.

Valeria Bednarik: Why aluminum Eren?

Yohay Elam: Silver is also in use in green technologies, but I think silver's price is more influenced by speculation, just like its big brother gold.

Dhwani Mehta: I’m not too optimistic about copper, mainly because China's property sector woes are likely to heavily weigh on the red metal.

Yohay Elam: Good point Dhwani!

Eren Sengezer: That is true. I think the same goes for aluminum. It has a wide variety of use cases. It's used in cars, electronics, and construction.

Dhwani Mehta: For that matter on industrial metals as a whole.

Valeria Bednarik: So bright metals headed lower and industrial ones poised to rally? That's the 2020 scenario?

Yohay Elam: Cobalt is used in electric vehicles and batteries.

Joseph Trevisani: Ok, the Bloomberg Commodity Index (BCOM) is down just over 10% in a month, from 105.84 on October 25 to 94.92 this morning. That would seem to be a response to the changing picture for the global recovery, it coincides with the current Delta incidence in Europe.

Dhwani Mehta: Bright metal will stabilize and industrial ones look not so promising either.

Joseph Trevisani: Hence, industrial resources are the swing on metals. Gold, platinum, and silver have industrial uses as well but they have a large consumer/hedge value also.

Dhwani Mehta: Iron-ore prices have been on a downtrend, exacerbated by China's new restrictions on steel production to cut down emissions.

Joseph Trevisani: I think the reaction to the Delta and Omicron variants will pass and then industrial metals will be in demand. There is plenty of room historically above 100 for commodities to rise.

Dhwani Mehta: I believe the main theme to play out other than central bank decisions next year will be the Chinese policies towards decarbonization. China is the biggest consumer of commodities and the biggest carbon emitter as well.

Valeria Bednarik: Indeed, you have a point there. But do we believe in China?

Yohay Elam: And I would add that it heavily depends on China's overall approach to growth – after years of pushing for high growth, they are now rediscovering their communist origins and talking about "shared prosperity," letting their construction firms linger.

Dhwani Mehta: Nickel could also see a pick-up demand due to an increased shift towards EVs, as Yohay Elam mentioned earlier.

Eren Sengezer: China is planning to turn "carbon-neutral" by 2060 and their policies are unlikely to have a significant impact on prices of industrial metals in 2022. I agree with Yohay Elam though, the construction sector is the biggest consumer of industrial metals and a significant slowdown in their activity could be a big catalyst.

Joseph Trevisani: China's interests are internal and political. I think the campaign for prosperity is an effort to forestall popular discontent at the vast disparities in wealth, rather a novel situation for an ostensibly Communist country.

Dhwani Mehta: Yes, China's indebted property sector will weigh on the industrial metals at least in the first half of 2022.

Valeria Bednarik: So if we remove the consumer factor, we believe that metals have more chances of rallying than of falling in 2022?

Yohay Elam: If China's construction sector pushes commodities inflation down in H1 and central bankers expect broader inflation to ease in H2, perhaps Powell will unretire the term transitory.

Joseph Trevisani: As for China's commitment to become carbon neutral by 2060, I do not believe it. Beijing's interests, like India's, another prolific user of coal, is to enrich their people. They both tend to view the West's climate concerns as incidental to their own development. I think China's crackdown on the property sector is practical. The sector was used by the government to prop up growth and now it is convenient to blame the sector and its companies for something the government itself promoted.

Dhwani Mehta: Besides, China and central banks, the underlying fundamentals will come into the picture, which could revive the rally in some of the industrial metals in H2. Most of the miners are under-invested after the GFC and its effect could very well begin to show up next year.

Joseph Trevisani: China still needs economic growth, it is the lynchpin for government popularity. Consequently, I lean towards the industrial metals and commodities for price increases. The recent drop in commodities and oil is largely due to changing perceptions of global growth. Sooner or later, and I think sooner, those growth expectations will return.

Valeria Bednarik: Oil prices are also tied to OPEC+ decisions.

Yohay Elam: So, China's "shared prosperity" and letting property developers sink is only transitory? If China returns to pushing forward growth, the outlook is bullish for commodities, and also for global inflation.

Joseph Trevisani: Yes I think so. "Shared prosperity" is a term of social control, economic growth is Beijing's raison d'etre. China has also made substantial and largely successful efforts to gain control of the supply of several scarce industrial resources. Rare earth metals for electronics and batteries is one example. Control initially raises prices, then alternative sources are developed and prices come down. Oil is an excellent example.

Dhwani Mehta: Yes, I agree as well. For commodities, we can loosely say it depends on China's policy measures and economic outlook. But in the face of the recent power crunch, most industry experts have projected China's growth sub-8% The country's manufacturing sector is also struggling once again. So, i think it will definitely take the second half of the next year to see some optimism back on the China front, with regards to the property sector and overall growth.

Joseph Trevisani: Oil depends on US policy, which does not seem flexible at the moment.

Valeria Bednarik: In the end, we are still looking at central banks for direction. And policymakers are still tied to the pandemic developments. Hopefully, we would have a clearer picture after the December announcements, and as long as we keep moving away from this global crisis.

Joseph Trevisani: I hope that the state of crisis does not become permanent. Markets are completely capable of dealing with the economic implications of the pandemic as long as they are permitted to do so.

Yohay Elam: Central banks will continue propping up economies as much as they can. It seems they are forced to be hawkish. When it comes to currencies, CBs rule. But for commodities, there are so many moving parts in large economies but also tiny ones. A mine in the Democratic Republic of Congo may impact cobalt prices and global energy markets. Tensions between Gulf States rock oil. I think we will continue following geopolitics when it comes to commodities.

Joseph Trevisani: Truly. It has been interesting since last Thursday to see US Treasury rates ignore Mr. Powell's comments and join the general market panic over Omicron.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

FXStreet Team

FXStreet