Another step higher following Wall Street’s impressive gains

After another phenomenal rally on Wall Street, which saw the Nasdaq strike a fresh all time high and the SP come close to wiping out all its losses for the year, Asian markets traded mixed. The lifting of coronavirus lockdown and hopes of a quick recovery are feeding trader optimism, although the lack of fresh catalysts is seeing that optimism start to fade.

European markets are pointing to a quieter start as investors take stock of recent gains, particularly in light of the poor economic conditions, and tread water ahead of tomorrow’s FOMC. There is little doubt that the central bank’s accommodative stance and obliging manners has helped propel stocks to there current levels. Any sense that the Fed could be less accommodative could threaten a repeat performance of 2013’s taper tantrum.

Glass half full

Whilst recent data has shown a stark improvement from April’s bottom, the numbers still paint a grim picture. Yet traders are showing that they are more than prepared to see the economy in a glass half full manner. The jobs report is a good example. Traders focused on the 2.5 million jobs created rather than the 20 million jobs that have been lost.

BRC retail sales improving

BRC retail sales data here in the UK also added to mounting evidence that the economy was on the right track, with sales -5.9% in May compared to a year earlier. This was a vast improvement of April’s -19.1% drop giving optimistic traders reason to cheer. However, it was still the second worst reading since records began in 1995. After 8 straight days of gains the Pound is mildly lower versus the USD. That said it still remains close to three month tops above $1.27.

Eurozone data in focus

A slew of data is due from the Eurozone. German exports were considerably worse than forecast -24% vs -15.6% expected. Imports -16.5% vs -16%. The Dax has barely acknowledged the data whilst the Euro continues to show resilience against the slightly stronger US Dollar.

Eurozone unemployment and GDP figures are also due shortly.

Oil clawing back losses

Oil is attempting to claw back loses after falling sharply in the previous session after Saudi Arabia, Kuwait and United Arab Emirates confirmed that they would not extend an additional 1.18 million bpd in cuts on top of the OPEC+ cuts in July. The disappointment resulted in WTI and Brent shedding over 5%.

Today, oil is back on the rise as easing of coronavirus lockdown measures boost hopes that a recovery in demand will do some of the heavy lifting. Brent is sitting comfortably over $40 and the expectation, particularly now that New York is reopening, is that WTI will be back there soon.

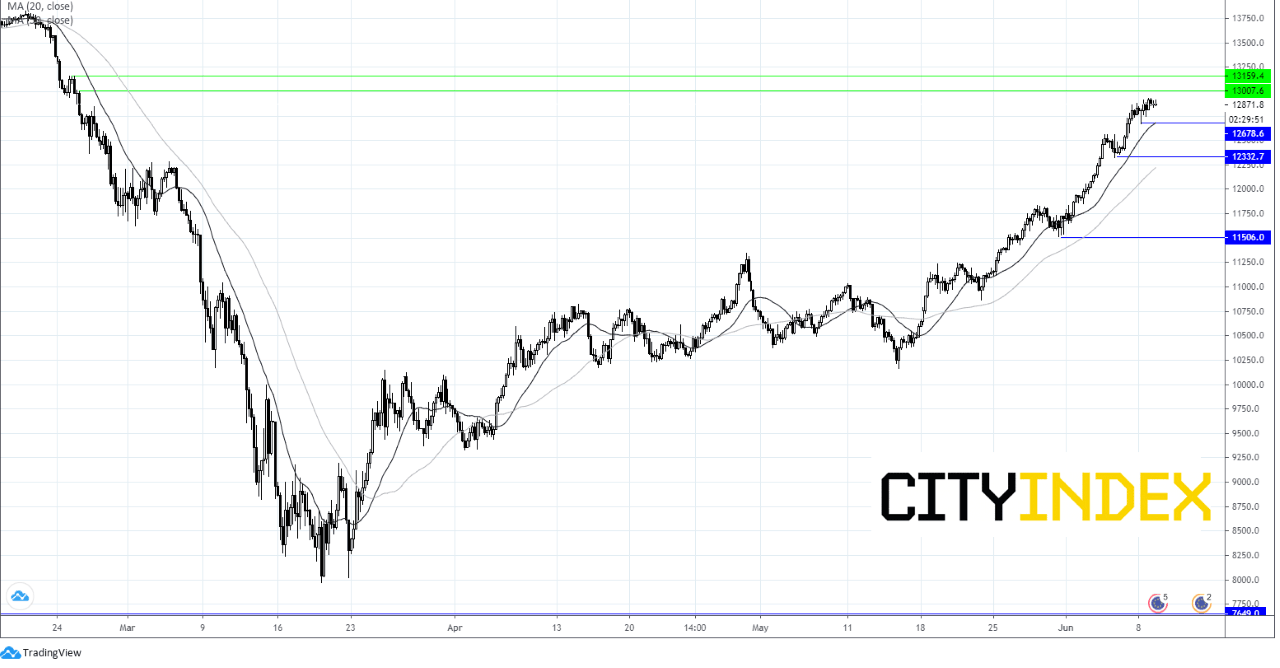

Dax chart

Author

Fiona Cincotta

CityIndex