Another preposterous free money universal basic income test on the way

Another UBI Test is coming up. This time in Germany.

The UBI Idea

The goal is to provide a "living wage" to everyone as a basic right no matter how productive anyone is.

Under UBI, governments collect taxes and redistribute the money or alternatively just hand out free money.

Under some proposals, everyone gets free (or redistributed) money but in other proposals, free money only goes to the needy.

German Test of UBI Coming Up

Eurointelligence reports Universal Basic Income Now Subject to a Vaccine-Style Test.

A German NGO is funding a unique economic experiment that works like a vaccination test: a group 120 people will be given a universal basic income of €1200 per month for three years. The idea is to study what they will do with the money and how the universal basic income changes their lives.

This reminds us of scientific experiments funded by the pharmaceutical or tobacco industry. If the source of funding has an interest in a particular outcome of a study, chances are that the study will be biased in many subtle and not-so-subtle ways. We would be very surprised if this particular NGO concluded that the universal basic income was a thoroughly bad idea in the unlikely event that the experiment sprang a surprise. Remember: no empirical evidence in economics ever led to the abandonment of an economic theory. They exist in a universe of their own.

Test Cannot Possibly Fail

Even without the built-in bias, the test cannot possibly fail.

If you give a carefully-selected group of 120 people €1200 free money monthly, it is certain all 120 people will have an improved standard of living.

Any UBI test has but one mission: Come up with the wrong answer.

Free money, what can go wrong?

The obvious problem, which is why these tests should never happen in the first place, is the tests do not scale.

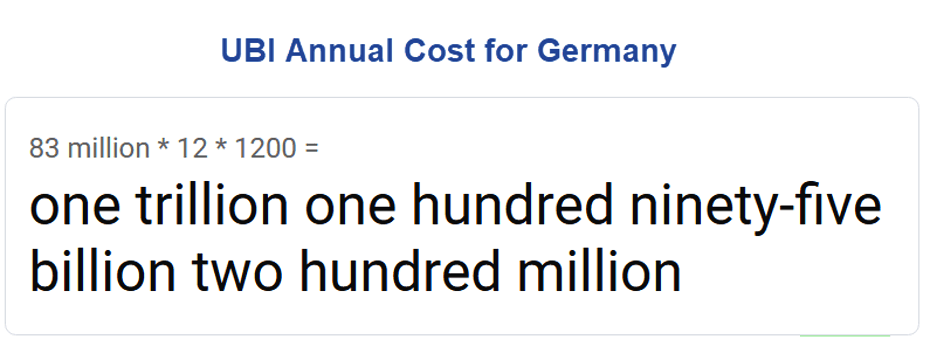

It's relatively easy to come up with €1200 * 12 months for 120 people. That's €1,728,000.

UBI annual cost for Germany

Let's do the math for 83 million people in Germany.

UBI for all of Germany would cost about €1.2 trillion annually.

Where is that money supposed to come from? Unlike the US, Germany does not even have its own printing press.

And right off the bat Germany would face a huge immigration problem. People from all over the EU would move to Germany.

That would cause an instant housing crisis with soaring rent, mandating a bigger monthly UBI to keep up.

I suppose you could pick winners (no immigrants and no wealthy) instead of handing out free money to everybody.

But that creates a huge incentive to not work, especially at the margin.

Previous studies claim that does not happen. But participants know the test will end.

Higher Taxes? How High?

Tax the wealthy enough to pay for this monstrosity and the wealthy will move.

More Studies? Why?

The problems are many, obvious, and insolvable. UBI in any non-trivial amount will never scale.

I show how and why studies are guaranteed less than useless. Unfortunately, ridiculous economic theories never die.

For example, the economic illiterates at YouMatter conclude "more experiments will probably need to be done to assess whether a universal basic income would be a good idea."

The clamoring and studies will continue until the economic fools eventually get approval somewhere.

Will California Be First?

California, like Germany, has no printing press but it is willing to tax anything and everything for the sake of social fairness.

Also note that California's Radical Brainwashing Curriculum Soon To Be Mandatory.

Thus, California may be as good a guess as any.

Author

Mike “Mish” Shedlock's

Sitka Pacific Capital Management,Llc