Another major milestone

S2N spotlight

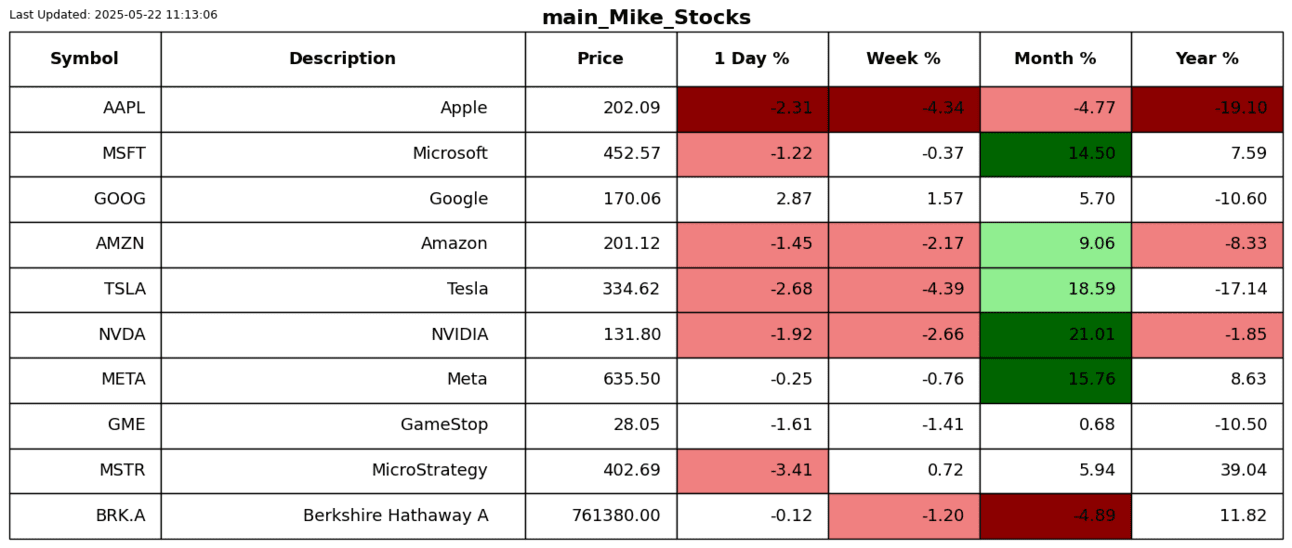

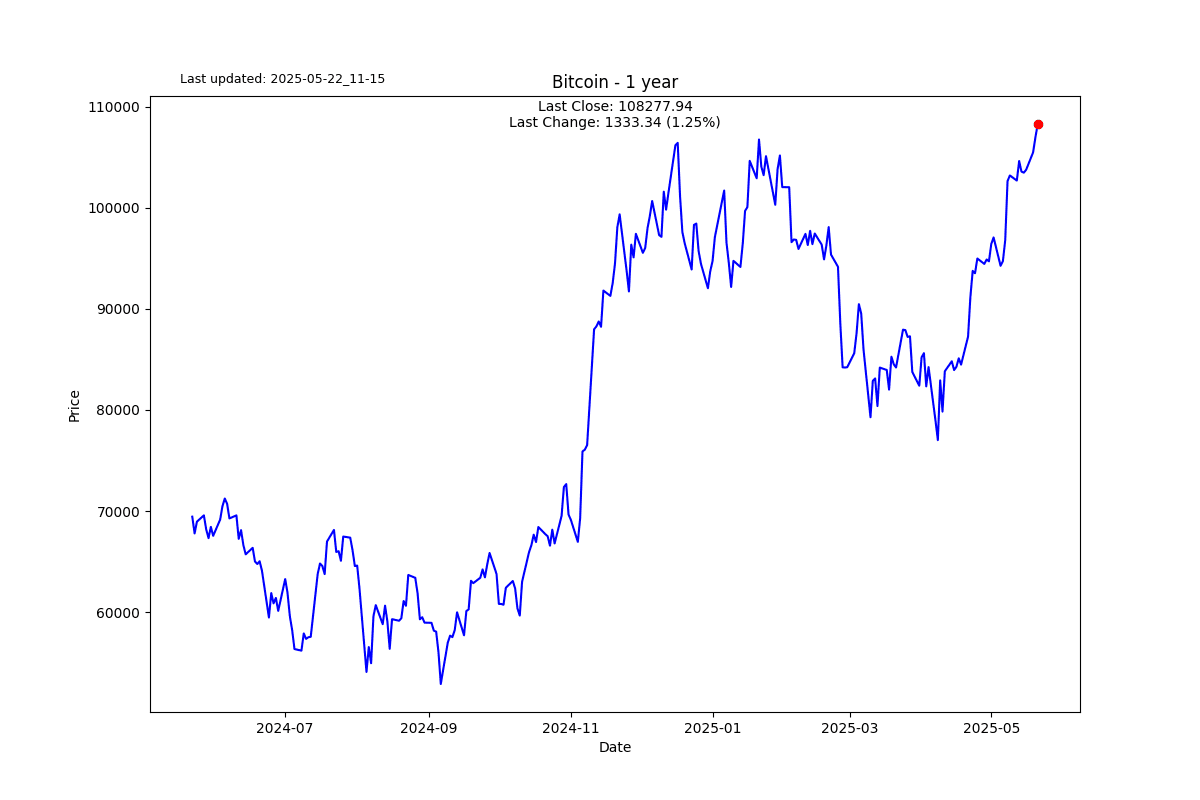

I like it when the chart does most of the talking. I wanted to present a picture that captures the essence of the daily moves of some of the major asset classes traded on the markets. I have presented the Euro/USD Future, Gold Future, S&P 500 Future, and Bitcoin in order of their respective volatilities over the last year.

The only thing to mention is you can see how the volatility of the assets, save for Bitcoin, has been over the last few months.

S2N observations

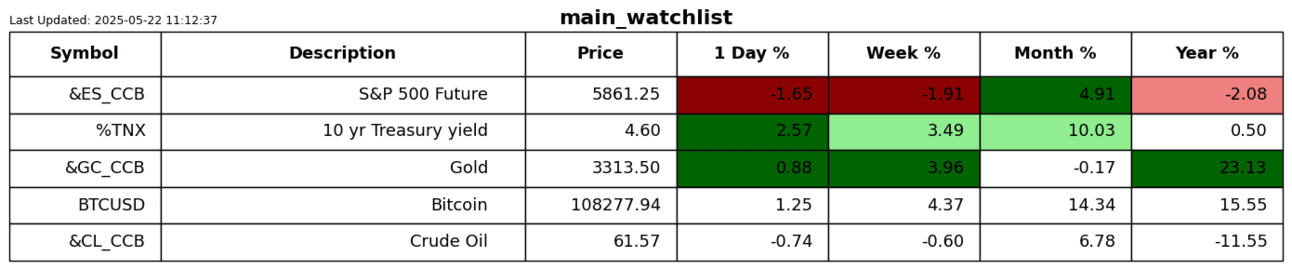

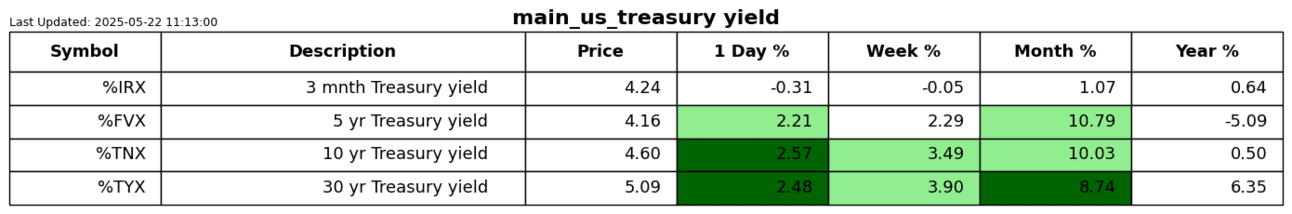

The talk these days is all about the bond market. You will see in the table below the 30-year is trading over 5%. I wanted to share the $TLT (- 1.71% ) ETF, which represents the long end of the Treasury curve, 20 years+.

We are back at levels last seen before the global financial crisis. We are approaching some significant support levels. The red one I drew is not particularly strong. If we break below the black line, Scott Bessent will probably be looking for a new job.

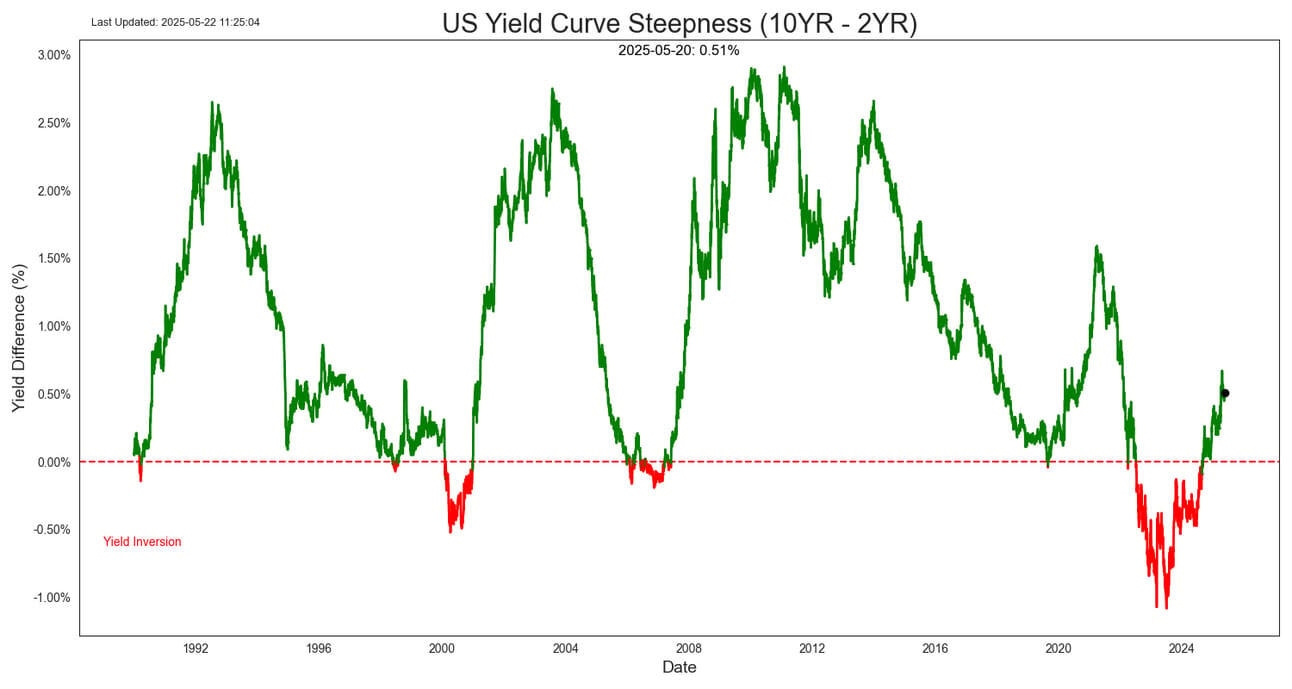

I remain committed to my steepener trade. I am sharing the 30-year as well, which has performed even better.

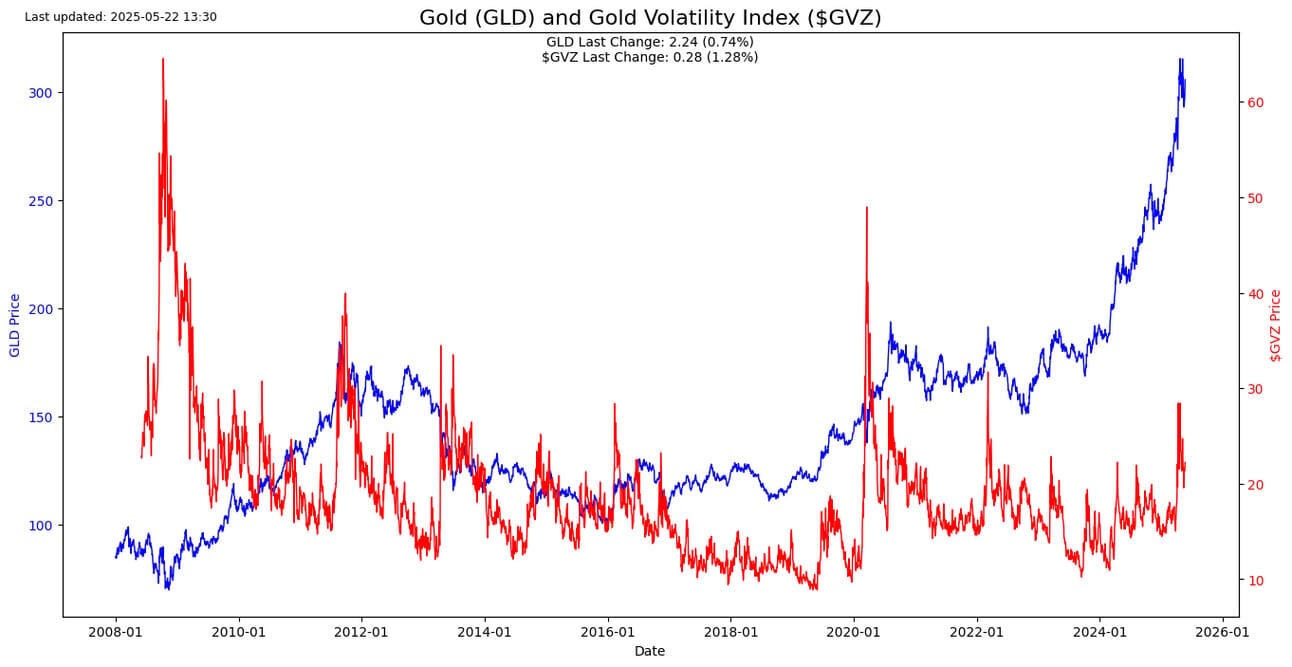

Not many people know about the gold volatility index, similar to the VIX. Despite the new all-time highs with gold, we are very far from previous volatility peaks. My point is that the latest trend has been very persistent. I believe gold is going to continue higher; I just think it is probably going to get more volatile along the way.

S2N screener alert

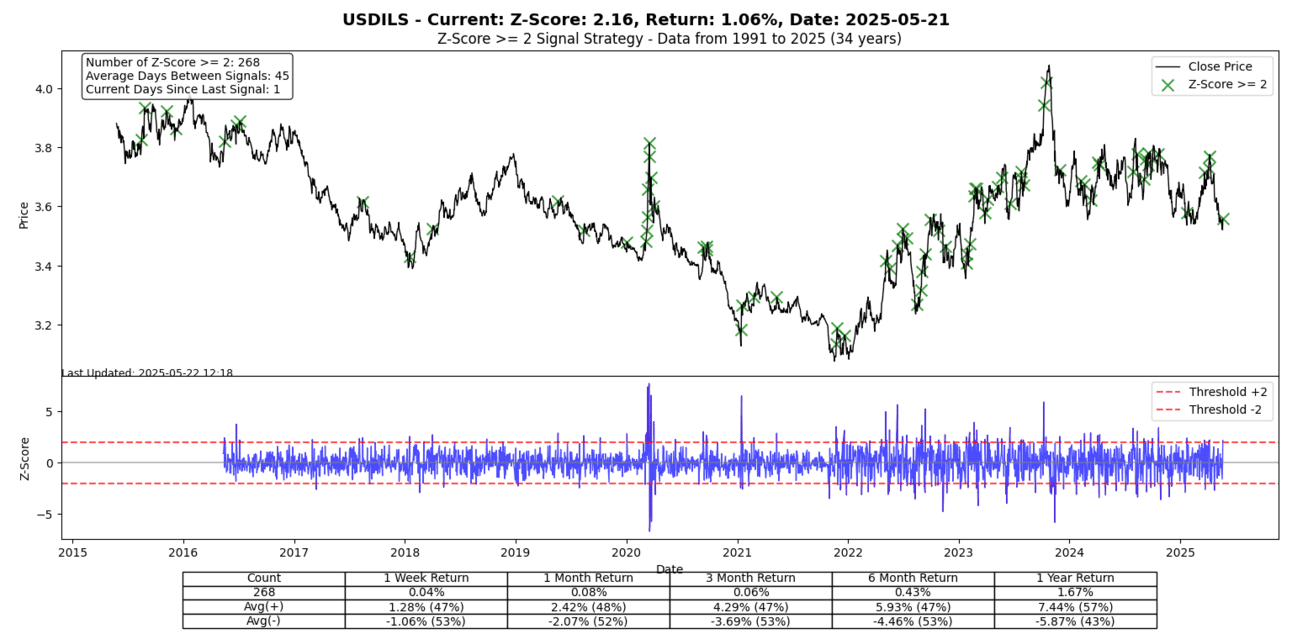

I have a new-look Z-Score screener.

The Israeli shekel strengthened with an up Z-Score above 2 after some recent weakness.

Even the $VIX (-15.37%) got going yesterday. Could this be the start of something?

S2N performance review

S2N chart gallery

S2N news today

Author

Michael Berman, PhD

Signal2Noise (S2N) News

Michael has decades of experience as a professional trader, hedge fund manager and incubator of emerging traders.