All things being equal

S2N spotlight

I am away on holiday, so today will continue to be brief and will build on yesterday’s post.

Yesterday we highlighted that investing 50% in an equally weighted S&P 500 index (SPXEW) and 50% in the classic market capitalisation-weighted index (SPY) outperforms the classic S&P 500 benchmark.

As this is a long-term strategy, it is more appropriate to look at how performance stacks up when using total return, not just the price, i.e., including dividends.

It turns out that the argument made yesterday is not nearly as compelling when looking at total return.

Over the long term, looking at total returns, the difference is not that impressive. However, I am sticking to my trade idea, as looking at the last 10 years, the ratio of outperformance has gone way above its mean and is due for a correction.

S2N observations

I will keep quiet today.

S2N screener alert

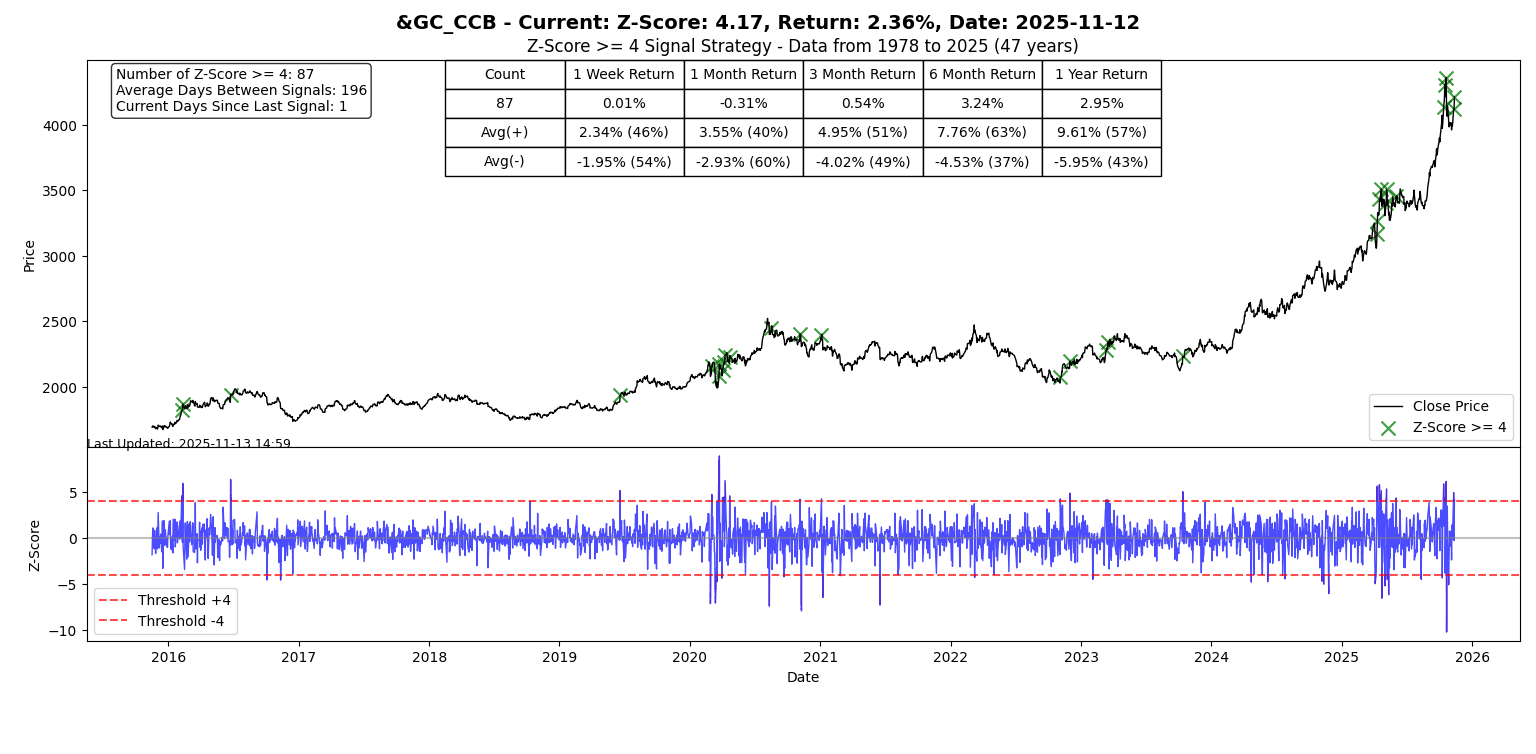

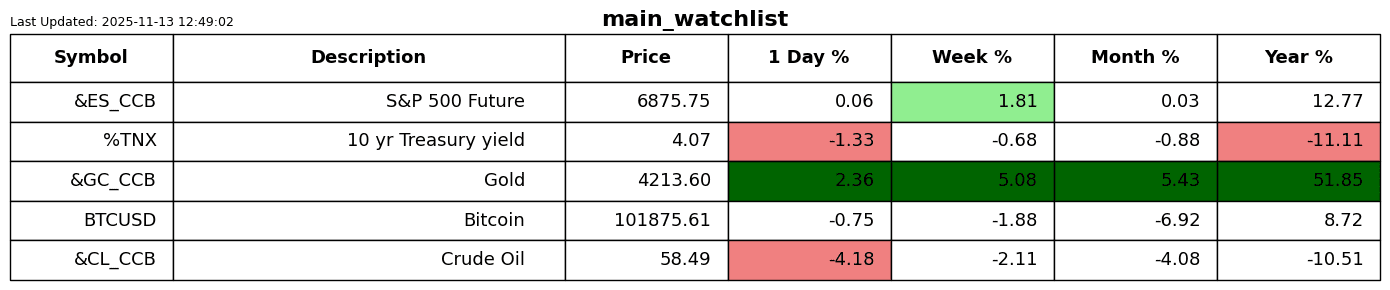

Silver and Gold put on their big boy pants and let it rip with 4 sigma up moves.

S2N performance review

S2N chart gallery

S2N news today

Author

Michael Berman, PhD

Signal2Noise (S2N) News

Michael has decades of experience as a professional trader, hedge fund manager and incubator of emerging traders.