All things being equal

S2N spotlight

I am away on holiday, so today will be super brief.

There may not seem like a lot in this chart, but it is extremely powerful with some excellent investment advice.

We keep hearing how the Magnificent 7 currently accounts for 37% of the S&P 500, which is a record. In other words, 7 companies out of 500 are moving the index disproportionately, as the S&P 500 index is weighted according to a company’s market capitalisation. Yes, it is great on the way up but not so good on the way down.

There is a counterbalance to this called SPXEW, which is the S&P 500 equal-weighted index. In this index each stock is weighted 1/500 of the index.

I created a portfolio of exactly 50:50, the classic S&P and the equal-weighted index. What you see is that the equal-weighted index outperforms all over the long term. However, the portfolio does not achieve the best return and risk-adjusted return; it does outperform the classic S&P 500, which was my goal. This is what I would recommend, especially at a time like now when the classic index is at record distortion.

S2N observations

I will keep quiet today.

S2N screener alert

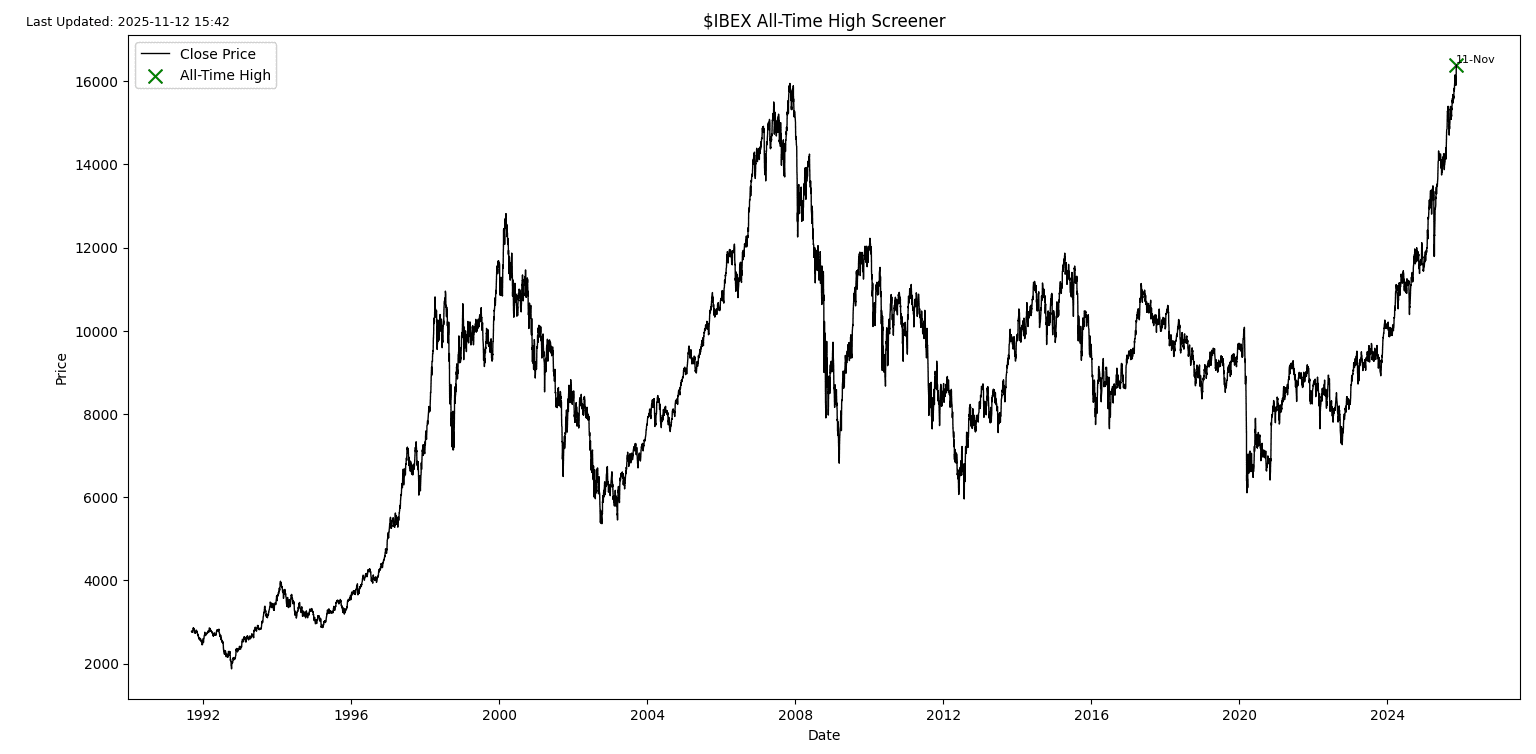

Spain’s IBEX (top 35 stock index) finally makes an all-time high after nearly 17 years.

S2N performance review

S2N chart gallery

S2N news today

Author

Michael Berman, PhD

Signal2Noise (S2N) News

Michael has decades of experience as a professional trader, hedge fund manager and incubator of emerging traders.