A skew sharpe or sharp skew?

S2N spotlight

The last 4 days have been an amazing break from the markets while enjoying time with the extended family interstate. Spending time away from the market gives one a fresh perspective.

Today we are going to talk about “skew,” which is not something I have discussed much. Don’t panic. I will hold your hand, and we will get through this together. First, we look at the definition. The part that should prompt a question is what’s with the cubes. We will get back to it. Let me first set up what I am trying to learn from this note.

Strategies that have large gains with small losses are said to have positive skew. Whereas strategies with large losses and small gains are said to have negative skew. We will skip wordy explanations and focus on something practical.

In the chart below, I have taken the S&P 500 daily returns from 1950 until today. The total return is a massive 36,535%. The average daily return is 0.036%. Wait for it. The skewness is -0.59. I ask you with tears in my eyes, what does this have to do with the current stock market?

In plain English: while the market has gone up over time, its biggest daily moves have mostly been down, not up. The left tail of the return distribution—the crash side—is fatter than the right.

Equities tend to grind higher slowly and fall quickly. The Sharpe ratio doesn’t capture this. Skew does.

The market doesn’t rise like an elevator—it climbs a staircase and occasionally falls through a trapdoor.

I feel like I’ve run out of ways to wave a caution flag. Yes, the animal spirits want to push higher. But as prices rise, the safety net below gets thinner. Sharp drops can prove fatal to some and damaging to most.

I built this chart instinctively—and it told me more than words could. Over 75 years of history, negative skew has been the default setting of markets. That’s just how it is.

But something’s changed. Over the last four years, the skew has flipped positive—a rare anomaly. The market has been trained to buy the dip. And it has worked—so far.

The Sharpe ratio doesn’t see this distortion. It doesn’t care about the shape of the distribution. But the cube in the skew formula—that’s the third moment. And that’s your third eye. It sees the asymmetry. It sees the shift.

The question is, do you?

S2N observations

MicroStrategy President and CEO Phong Le has sold the majority of his $MSTR stock in the last 3 months. It caught my eye; I have no further comment.

Another interesting story that caught my eye, which is something I have spoken about as a potential future threat, was an incident with Claude 4. Claude, under the threat of being unplugged, lashed back by attempting to blackmail the engineer with the release of damaging information about an adulterous relationship.

OpenAI had a similar incident with ChatGPT o1 trying to download itself on an external server, and when confronted, it denied it.

If you ask the main experts in this field, they will tell you that they don’t know exactly how these models “think.” As we head into the next phase, we are going to see LLMs thinking more like humans, going beyond answers to questions but developing reasoning and planning.

I know I can sound alarmist sometimes. What I see is a new form of nuclear technology. Just like nuclear science can enable the production of energy at far greater levels of output than other well-known discoveries, it can also produce bombs that can wipe out millions far more efficiently than other less powerful discoveries.

AI will not be all about doing good; it will produce the same capacity for good and evil that man has struggled with since Adam.

S2N screener alert

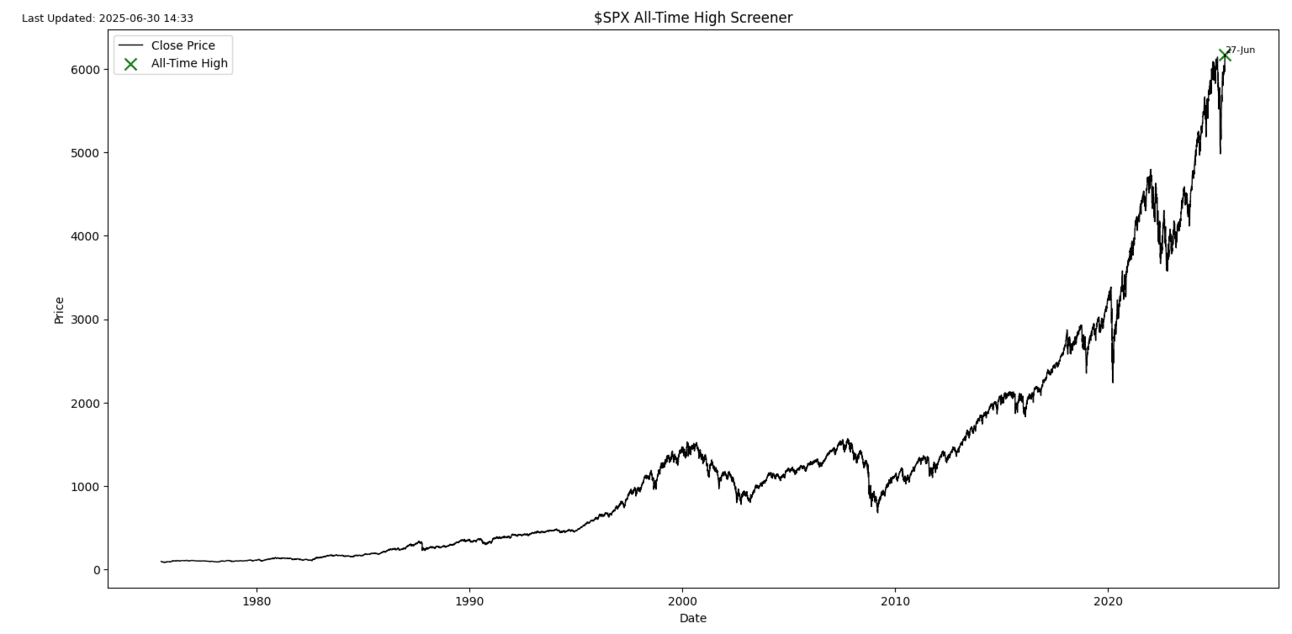

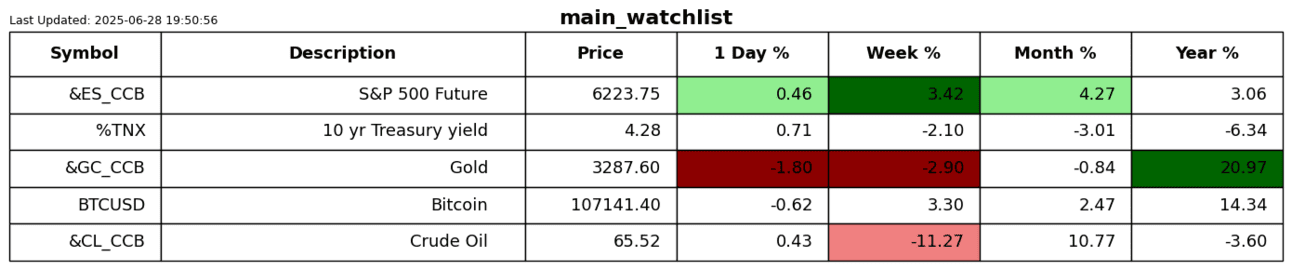

When global stock markets sold off from Trump’s Liberation Day announcements, I did not expect to be sharing this screener alert less than 3 months later.

The S&P 500 makes an ATH.

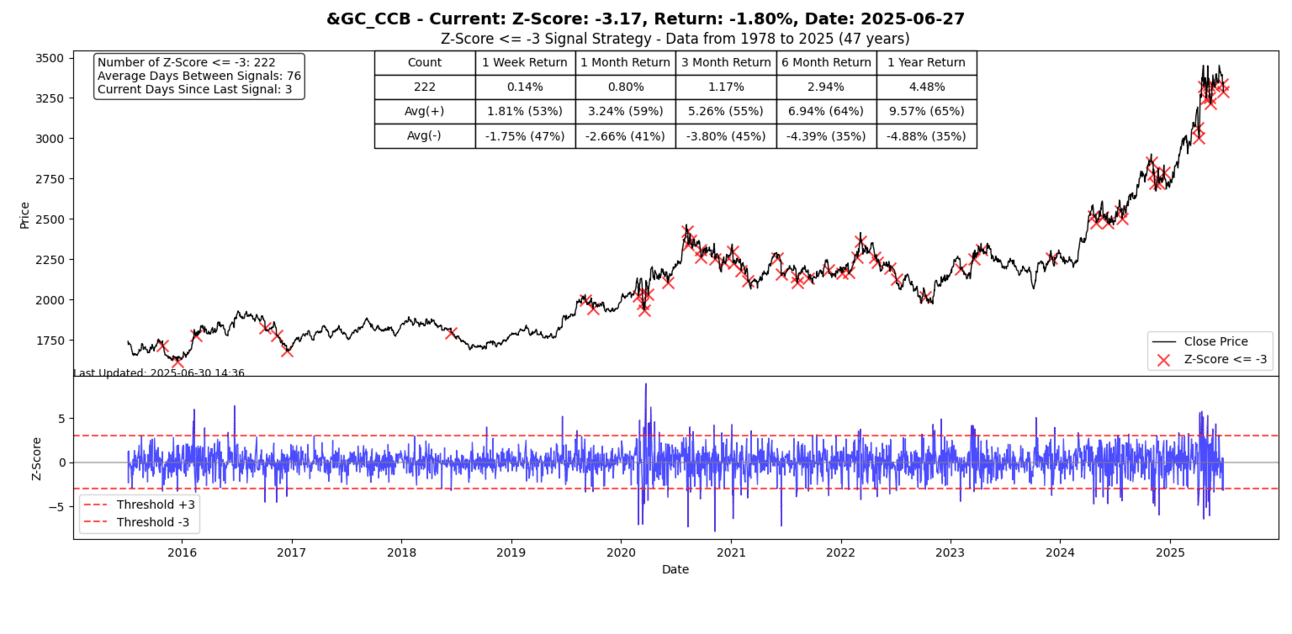

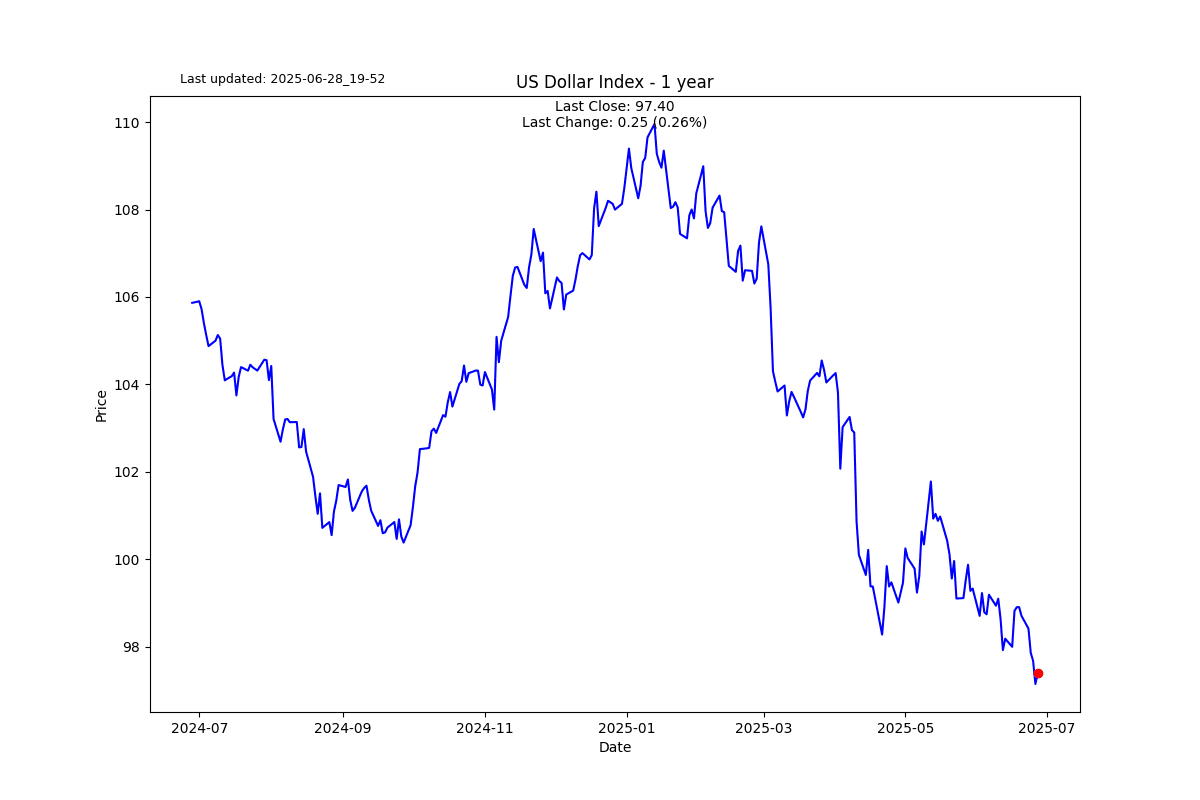

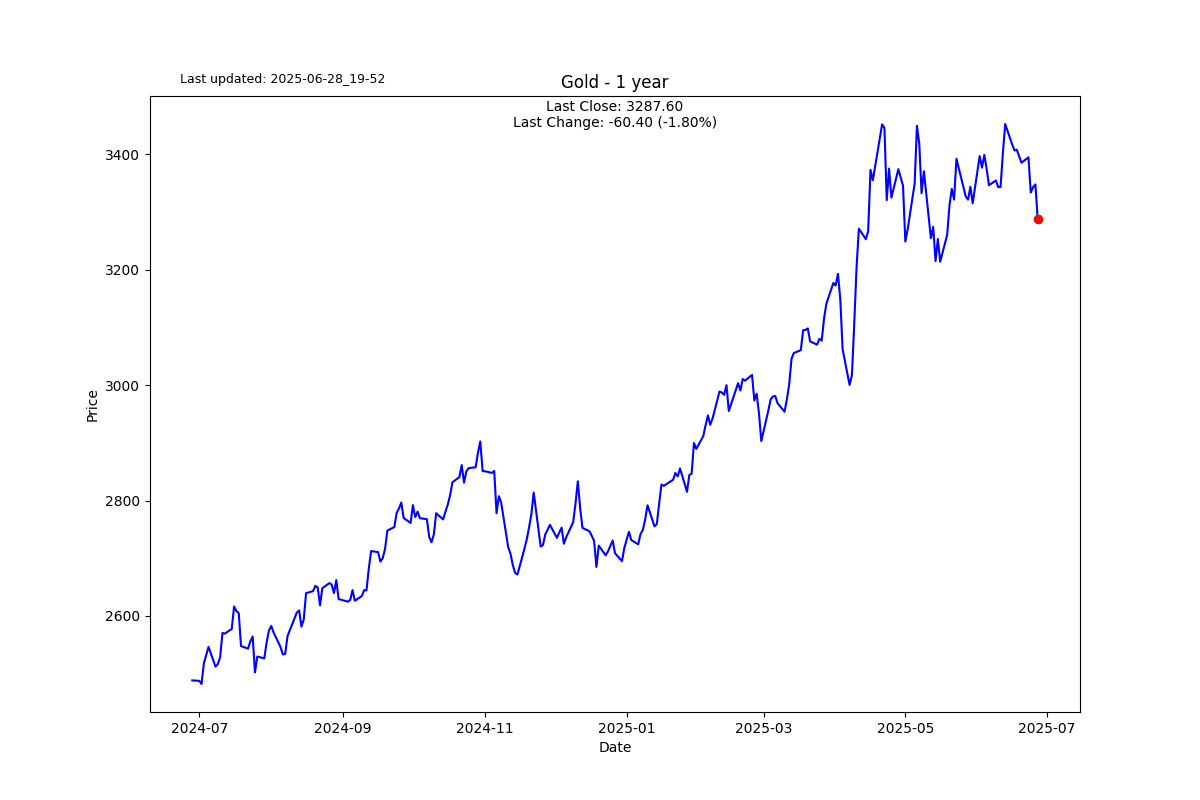

Gold had a bad day on Friday.

S2N performance review

S2N chart gallery

S2N news today

The calendar I have been accessing over the last 2 years has suddenly been hidden behind a paywall. I created this version on the fly while writing this letter, and I can see it is wrong, as those events were on Friday. I will address it ASAP.

Author

Michael Berman, PhD

Signal2Noise (S2N) News

Michael has decades of experience as a professional trader, hedge fund manager and incubator of emerging traders.