A great strategy for your pension?

If you have never traded the major indices and would like to here is a great seasonal strategy.

Seasonal patterns are well known in finance and one pattern that turns up over and over again is the superior return of major indices over the winter period. There is a saying in Wall St, ’sell in May, and go away’. Essentially that indices are pretty flat during the summer months. Now looking at the chart below you can see that the return on the FTSE 100 if you bought from May through to October each year since 1984 would have given you very minimal returns. There was little advantage to being exposed to the FTSE 100 during the summer. Look at the red line on the chart – a very flat return.

Winter tells a different story though

However, buying from November through to April would have exceeded the return of the FTSE100. Look at the green line on the chart below.

So, the mantra for the UK FTSE 100 would be to buy in November, but sell in May. So around fireworks night in the UK and exiting at the end of April.

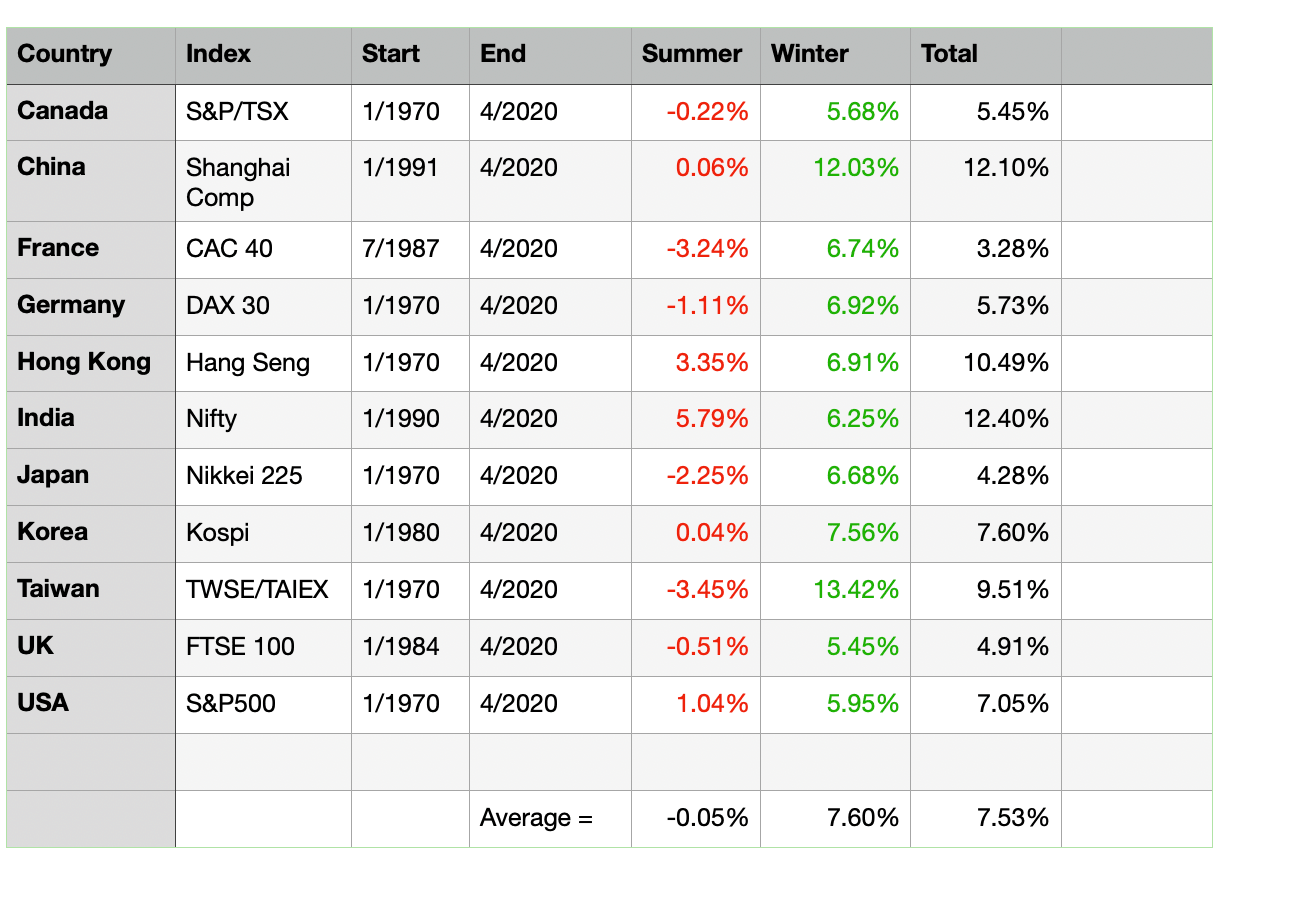

This phenomena is not only unique to the UK. It is reputed across the world. If you take a look at the table below you can see the return of the major indices over winter vs the return over the summer. It shows that over the last 40/50 years the saying has been true. It rarely pays to hold stocks over the summer period. Sell in May and go away.

Author

Giles Coghlan LLB, Lth, MA

Financial Source

Giles is the chief market analyst for Financial Source. His goal is to help you find simple, high-conviction fundamental trade opportunities. He has regular media presentations being featured in National and International Press.