A complex projection of potency

S2N spotlight

I didn’t plan on writing about this today, and boy did I let my unconscious run with it. Don’t hate the player; hate the game. Enjoy!

Watching the anarchy unfold in LA as if I am watching a dystopian movie of apocalypse with the military being called in to help restore order against the wishes of the state’s governor is just too rich in psychological symbolism for me to keep quiet.

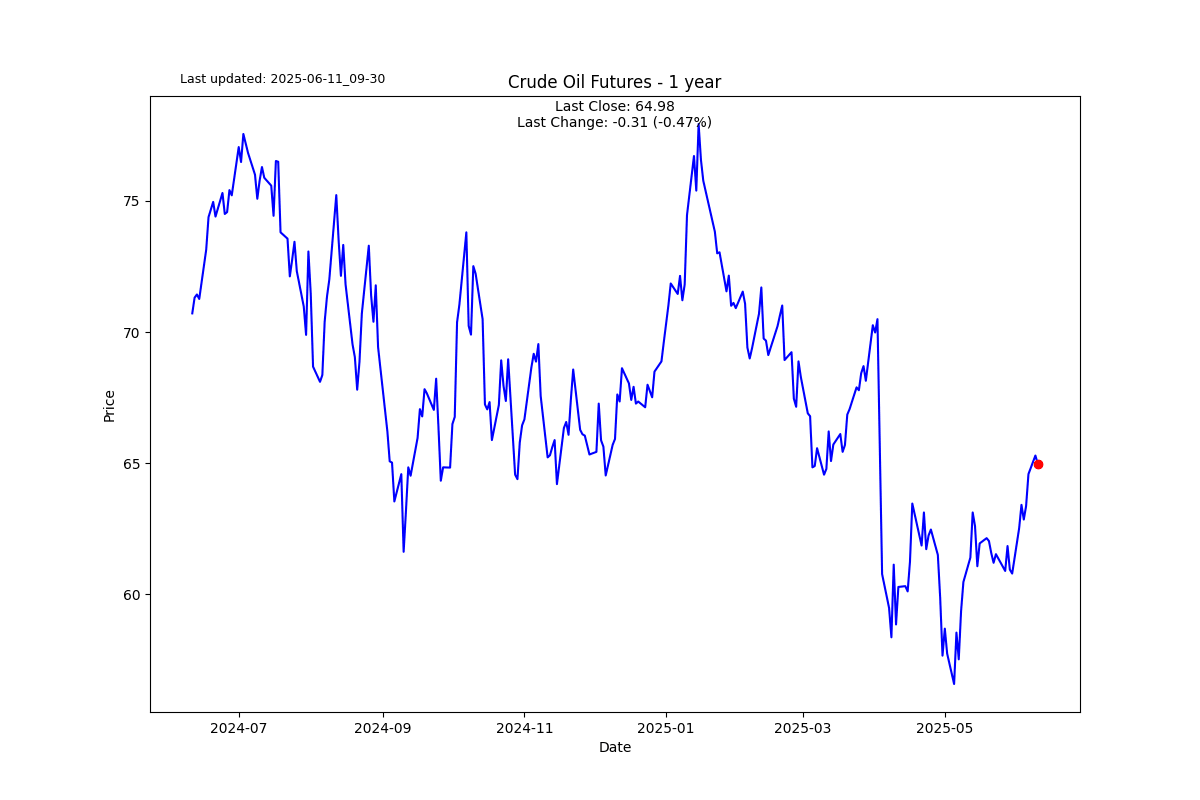

What we are seeing in LA with Trump’s crackdown on illegal immigrants is just part of a series of global tensions where conflict is now commonplace. We have a trade war with the US and almost the entire world through the Trump administration’s tariff policies. The 2 superpowers, the US and China, are at each other's throats. There is a war between Russia and Ukraine, where Russia, the aggressor, has allies in countries that pose a threat to the West. War in the Middle East against Israel and the global anti-Israel protests. Iran flexing its nuclear capability and the West’s desire to remove the threat.

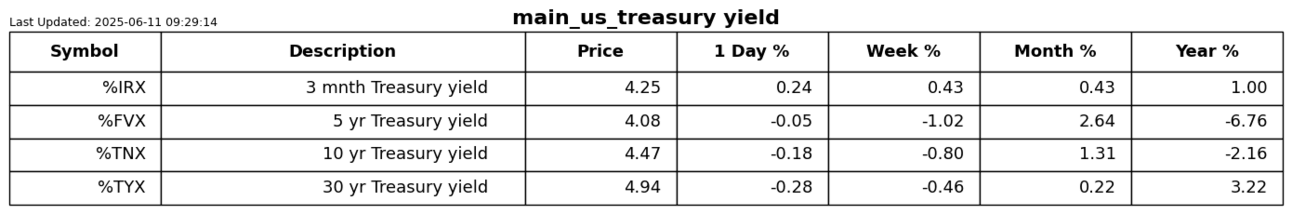

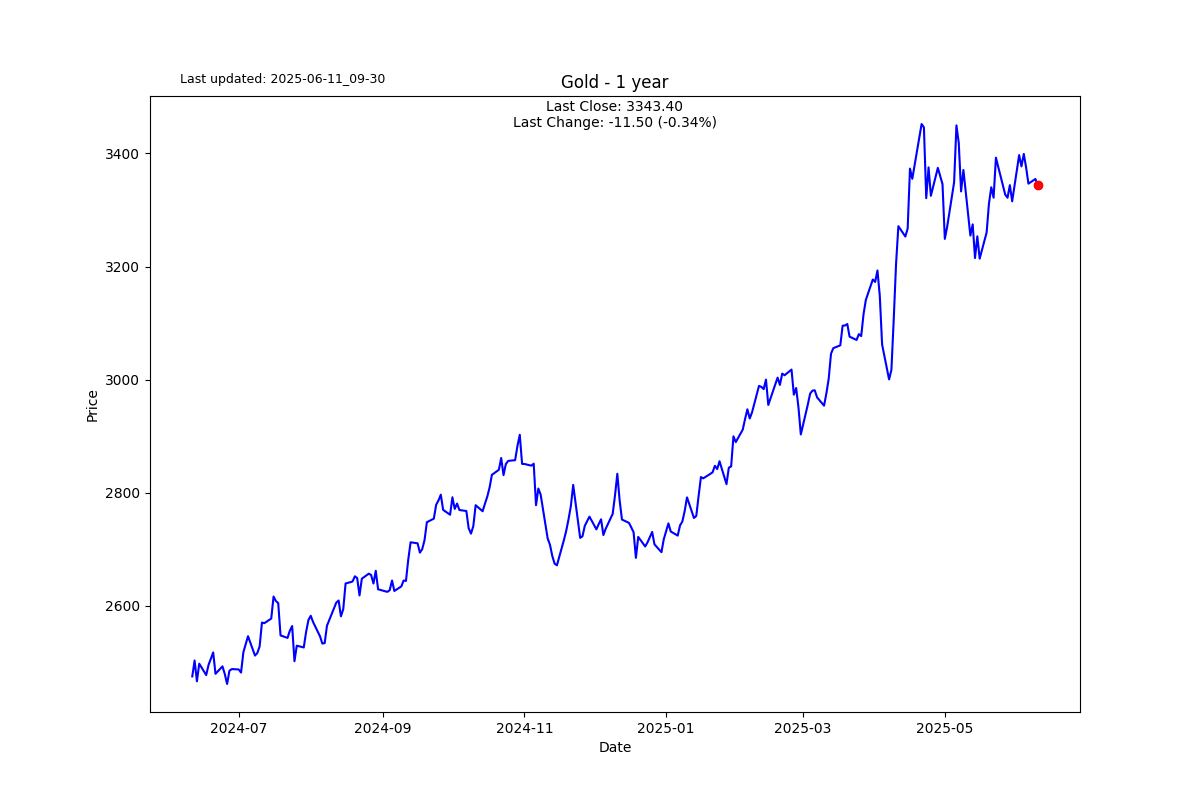

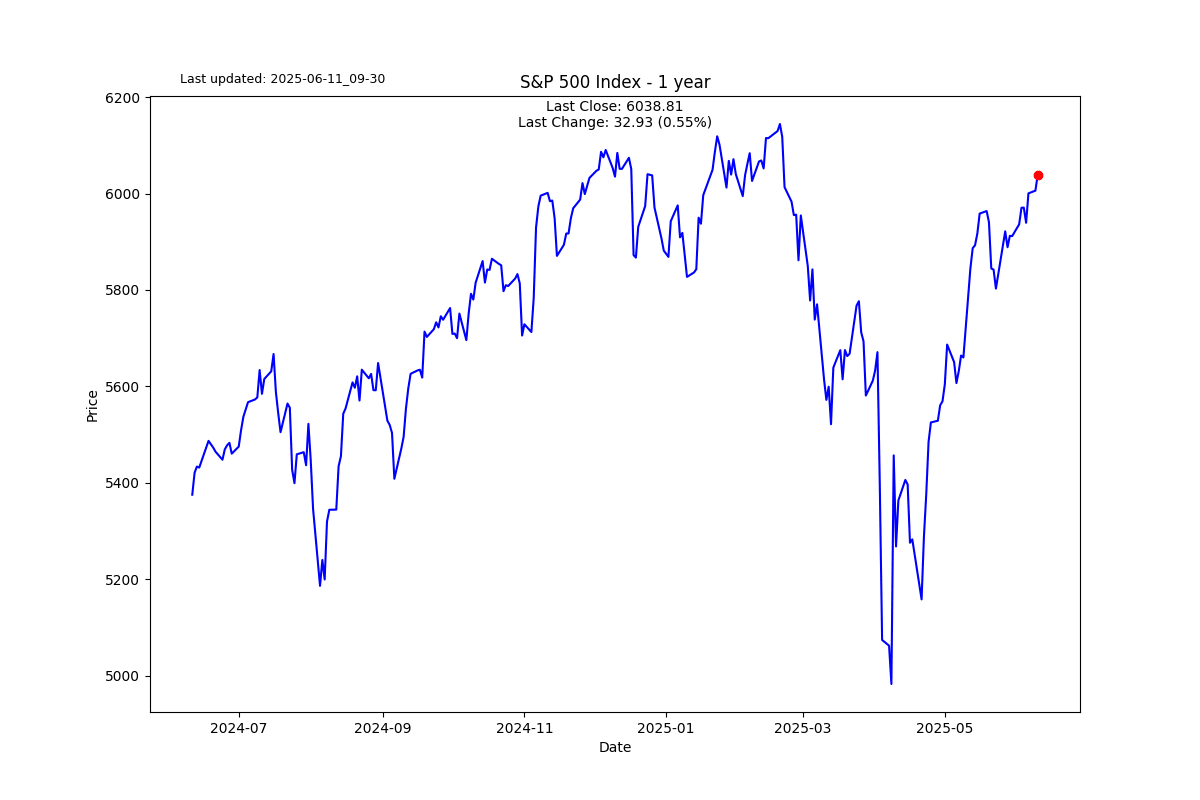

We have tremendous, game-changing progress coming from AI and the threat of job losses. We have the threat of global debt overwhelming economic growth with inflation pulsing a cost-of-living crisis. Yet with all this anxiety, we have global stock markets at all-time highs or thereabouts. Step into my consulting room and make yourself comfortable on my therapist couch.

I mainly see the symbolic world through the lens of Jungian psychology. In no particular order, there is a growing sense of anxiety with Trump evoking the trickster archetype by increasing chaos by failing to honour election promises of swift (in a day) resolution to the Russian-Ukraine and Israel-Gaza conflicts.

Amid this chaos, global stock markets, including the S&P 500 and NASDAQ, hit record highs in early 2025, defying anxieties over trade wars, debt, and conflict. Jung’s concept of projection—attributing internal fears or desires to external objects—offers us some clues. The markets’ exuberance resembles an “erectile complex,” a metaphorical overcompensation for underlying impotence. Investors, driven by optimism over AI advancements and corporate earnings, inflate valuations as if to assert potency against fears of economic collapse. This projection mirrors Jung’s persona, a false mask of confidence worn to conceal the shadow of doubt.

Yes, what I am saying is disturbing, and presented in the language of a therapist, it is depressing, go figure. Aren’t therapists meant to make you less depressed? However, as a market strategist, I see the fragility of the current environment. I believe in understanding the paradox that a projection complex can, in reality, be the complete opposite of what we see. This is my message: we need to look through all the masks projected on us by the media, politicians, and business leaders and rely on our inner wisdom and recognise the reality for what it is; this can save us a lifetime of therapy and a lot of investment dollars.

At the risk of taking this session one layer too deep, I want to share a further insight. Jacques Lacan, whose work builds on Freud, introduces a more symbolic and linguistic approach to psychoanalysis. My therapist is a Lacanian, so I am familiar with Lacan’s work and his insights around the need to project a seemingly permanent erection to overcome the feeling of lack.

For me, the ultimate expression of this is the central bank’s desire to kill the business cycle, and the government’s promises of endless fiscal support are nothing but projections to a level of omnipotence.

To borrow from Sir Isaac Newton’s Third Law of Motion. What goes up must come down.

S2N observations

While still on my high horse, let me just make the following observation against the virtue-signalling high priests of climate change. Most of the hype around solar has amounted to very little sunshine. The most recent bankruptcy and other notable solar companies seem to be very much in the dark.

SunPower filed for bankruptcy and sold assets to a rebranded SPAC called Complete Solaria in 2024. Investors are about to go bankrupt on the same assets twice.

I could go on. I am no expert on energy, and of course I don’t want to destroy the planet, but this notion of net zero emissions by 2030 is a dream at best. I read in the paper yesterday that all the hydrogen projects are uneconomic and will be 3x more expensive than fossil fuels.

Gee I ripped every band-aid off today. Maybe I need therapy.

One last one for the road to echo one of the biggest erectile projections known to man. Investors poured $651 million into the Direxion Daily TSLA Bull 2X Shares (ticker TSLL), marking the largest weekly inflow since the fund’s 2022 debut, according to data compiled by Bloomberg. The biggest chunks came in Thursday and Friday.

S2N screener alert

Dow Jones Global Index at an all-time high.

S2N performance review

S2N chart gallery

S2N news today

Author

Michael Berman, PhD

Signal2Noise (S2N) News

Michael has decades of experience as a professional trader, hedge fund manager and incubator of emerging traders.

-638852094188993158.jpg&w=1536&q=95)

-638852094375369930.jpg&w=1536&q=95)

-638852094502282850.jpg&w=1536&q=95)

-638852094656610450.jpg&w=1536&q=95)

-638852094899538835.jpg&w=1536&q=95)

-638852095241769010.png&w=1536&q=95)

-638852097213208272.jpg&w=1536&q=95)